Military

What Boeing Has to Explain at Wednesday's Investor Day

Published:

Last Updated:

For most of 2017, Boeing Co. (NYSE: BA) had the best-performing stock among the 30 equities that comprise the Dow Jones industrial average Index. In 2018, the stock made a brief visit to the top, but it has dropped to eighth as of last Friday with a year-to-date gain of 16.2%. Not bad, but a steep drop compared with the 89% rise the aerospace giant posted in 2017.

A $200 billion company cannot nearly double its market cap every year, and a 16% share price increase is not something investors can ignore. But Boeing has a serious issue that it has not said much about, and one that could have a significant impact on the company’s cash flow, the metric Boeing harps on as being most indicative of its performance.

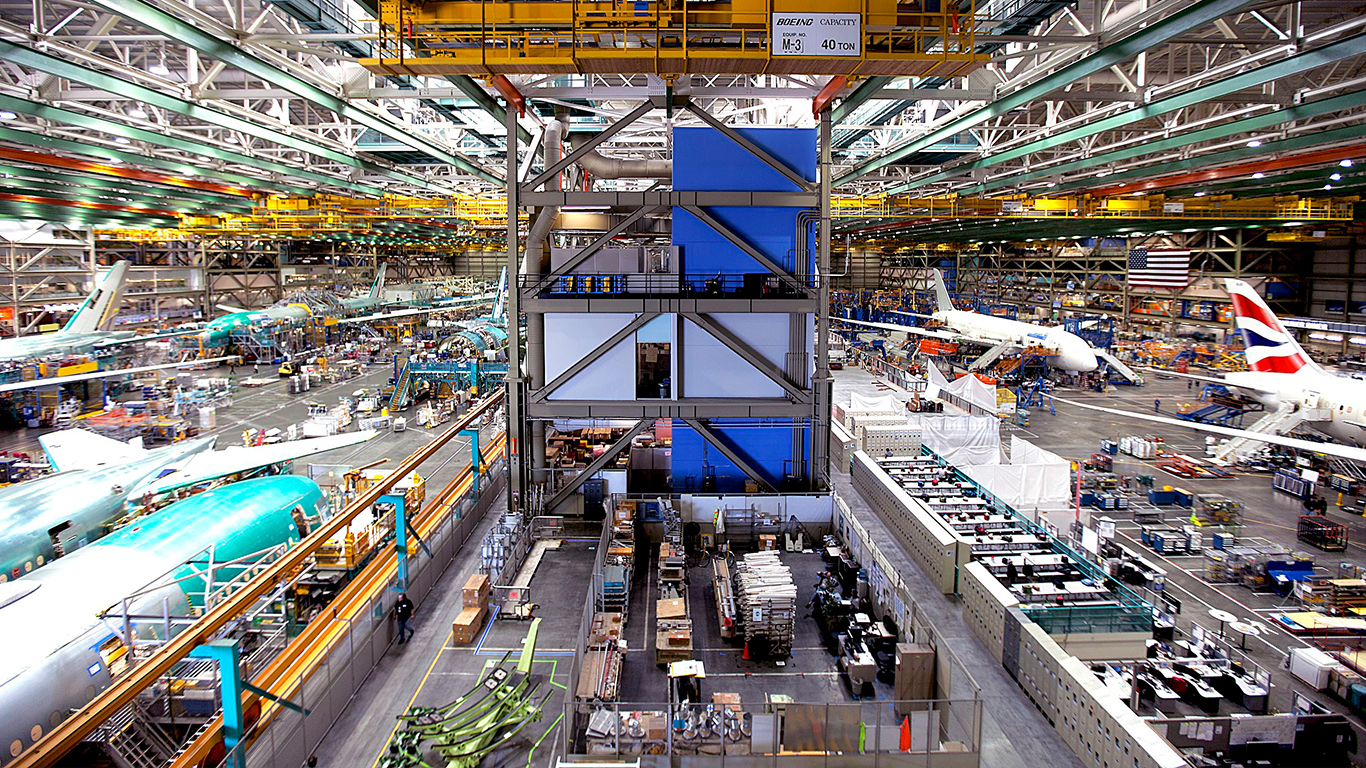

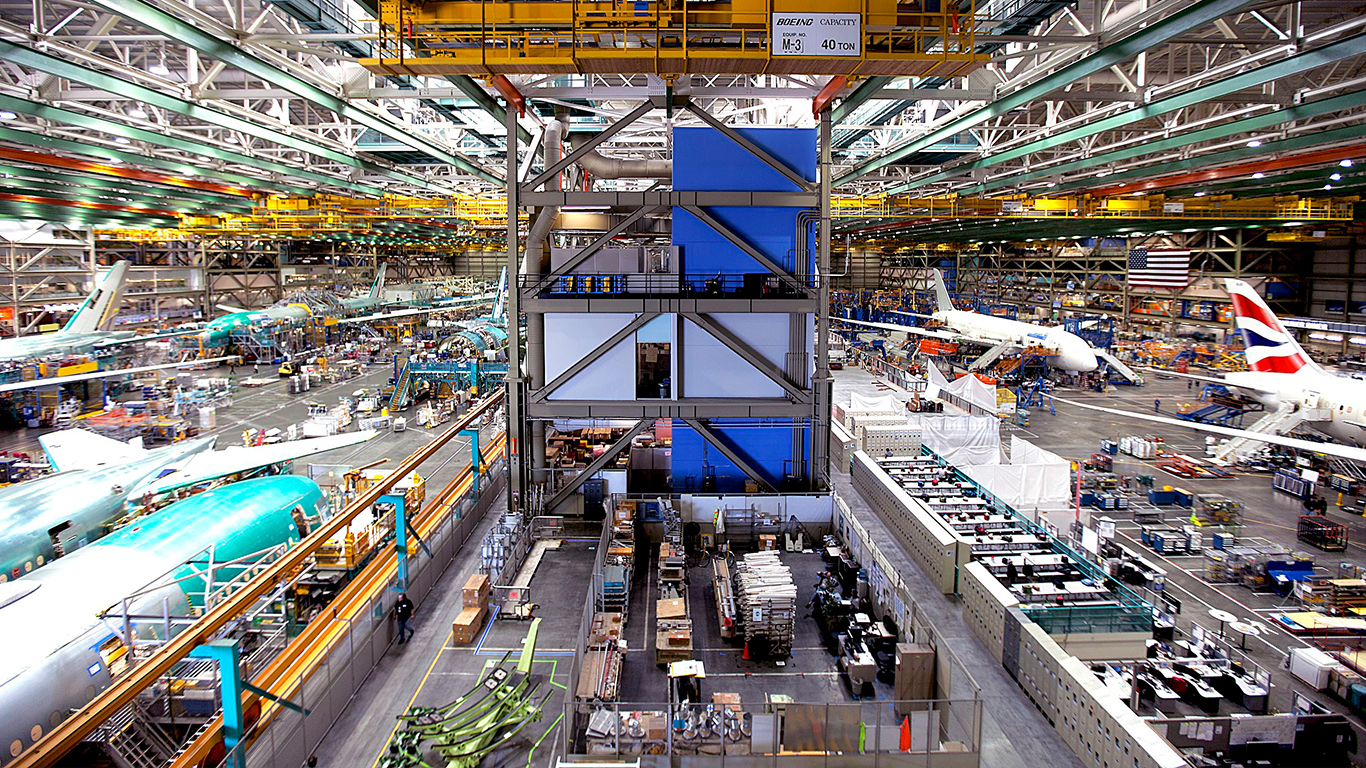

Analysts on Wednesday are going to get a chance to ask Boeing when all those airplanes parked outside its Everett, Washington, and North Charleston, South Carolina, plants are going to get the parts they need so that the planes can be delivered to customers. Until the aircraft are delivered, Boeing won’t receive the final payments from customers, and the cash may not flow as expected.

According to a report at Leeham News, there were 49 Boeing 737s parted at the Renton, Washington, airport. Of that total, 17 are waiting for engines (the technical term for these planes is “gliders”) and the rest are waiting for other parts. The new 737 MAXs accounted for 35 of the total and 14 are the current (NG) generation of 737s.

According to the All Things 787 blog, supplier delays have stalled deliveries of six 787s currently parked on the tarmac in North Charleston, and another two planes have not been delivered because customers have asked for a delay. Here’s the tally:

The aircraft that are affected by supplier delays include Shanghai Airlines (seats), United Airlines (seats), Eva Air (seats), and ANA (engines). Hainan Airlines has requested a delay to delivery for an unknown reason, they have four 787s in Charleston waiting delivery with another 2 at Everett which I assume may also be delayed.

A 787-9 for Air China is sitting in storage for an unknown reason. The aircraft was assembled over 5 months ago but hasn’t had it engines installed.

Boeing already has said that its 737 monthly production rate is going to rise from 48 to 52 this year and jump to 57 next year; 787 production is going to increase to 14 new planes per month next year as well.

But will there be engines? What about other parts? One of Boeing’s primary raw materials and parts suppliers, Germany’s Thyssenkrupp, is having trouble meeting delivery schedules and the company is facing a revolt from some major shareholders. Engine makers CFM and Rolls-Royce are both ironing out problems with their newest engines.

Not only are current delivery schedules (and Boeing’s cash flow) being affected, but there exists a real threat that the production increases planned for next year won’t happen. Or if they do happen all that will mean is that more planes will roll off the assembly lines and get parked wherever there is space for them until engines or other parts arrive.

Scott Hamilton at Leeham News summarizes Boeing’s issues this way:

Based on my own conversations with suppliers, the problems for Boeing are anything but resolved.

Parts shortages from engines to the proverbial widgets are growing, not shrinking, based on what I’m told. …

I stress that this is an issue across the entire production system. The airframe and engine OEMs share many of the same suppliers. If one has trouble, sooner or later all are likely to have trouble.

From what I am hearing from suppliers, the meltdown has yet to hit bottom.

Analysts need to be merciless during Wednesday’s Q&A with Boeing executives. Boeing has a history of saying that everything is going swimmingly until one day when it isn’t.

Boeing stock closed Friday at $342.79, in a 52-week trading range of $234.29 to $374.48. The stock’s consensus price target is $410.83, and the forward price-to-earnings ratio is 19.59. Boeing’s dividend yield is barely 2%.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.