Key Points

- Tariffs affect a wide range of industries.

- Consumers will feel when new tariffs are implemented.

- The hope is that tariffs increase domestic production, often at a cost.

- Also: Discover “The Next NVIDIA”

Tariffs are one of the most prominent tools for shaping global trade policy, and they will likely play a central role in the incoming second Trump administration. Whether it’s tariffs on countries like China, Canada, or Mexico, many industries will likely feel the pressure of new tariff policies and pass these costs on to consumers.

Retail, fashion, beauty, electronics, and automobiles are just a few industries likely to suffer as tariffs are implemented. A tax on imported goods, or tariffs, would be applied at the border when a business or person based in the US purchases goods from outside the country, increasing the price of foreign-produced goods and affecting various industries.

15. Big Box Retail

With everyday items expected to increase by 10-15%, retailers like Walmart have already started to lay the groundwork by hinting at price increases. This will lead customers to purchase goods not impacted by tariffs, costing big box retailers billions in lost sales and unsold inventory.

14. Telecommunications Equipment

The impact on telecommunications equipment could be significant for an industry worth around $200 billion. The US relies heavily on international brands like Nokia and Siemens to build network infrastructure and network components, which will raise prices for US telecom companies by as much as 15%. This would accelerate domestic technology development at a higher cost to businesses based in the US.

13. Aerospace

If EU retaliatory tariffs are imposed on the US, it would greatly impact companies like Boeing, raising airline costs. In addition, it would decrease the US’s global competitiveness against brands like Airbus, costing the US tens of billions in lost contracts. The projected cost increase for any tariffs placed on the aerospace industry could be as much as 10% to 15%.

12. Renewable Energy

The renewable energy industry heavily relies on imported solar panels, wind turbines, and other components for products manufactured here. As part of a 200 billion dollar industry, renewable energy equipment costs could go up as much as 16%, which would undoubtedly be passed onto consumers and shift the renewable energy landscape.

11. Plastic and Plastic Products

Given that Canada and Mexico are both responsible for a large amount of plastic materials and products used in packaging, any tariffs could have a big impact. Tariffs would quickly raise costs for any business or consumer industry heavily relying on plastic.

10. Mineral Oils and Fuels

In 2024, Canada continues to be the largest exporter of crude oil and refined petroleum to the United States. If the US follows through on a threat to implement a 25% tariff on Canada, it would dramatically increase fuel costs, which could mean higher costs for home and car owners around gas prices (to the tune of at least several cents per gallon) and the cost of heating a home during the winter months.

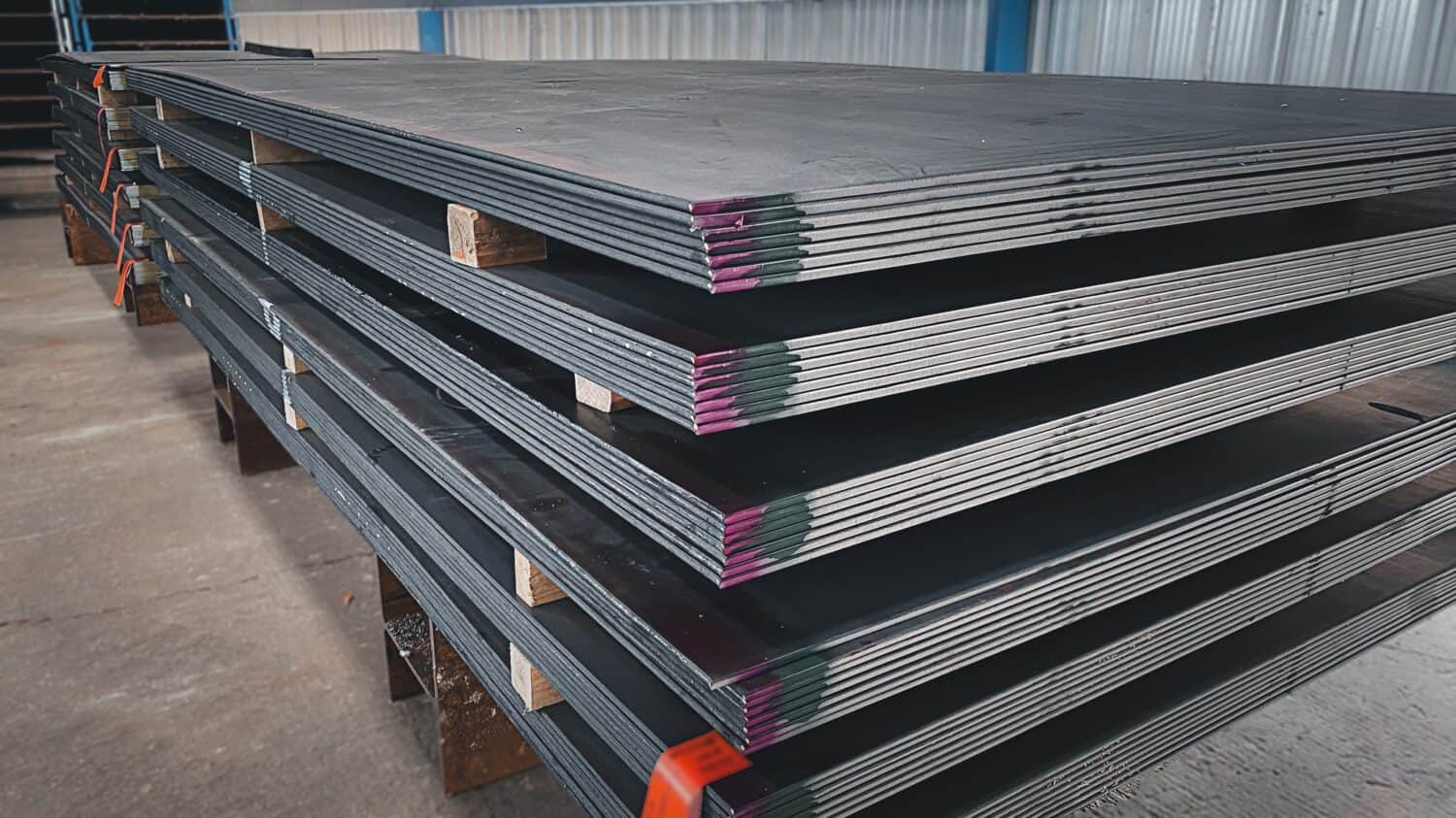

9. Steel and Aluminum

One of the biggest concerns with Chinese tariffs is their impact on the steel and aluminum business. Any impact here would be felt in various industries. While the Trump administration hopes to boost domestic production, automobile companies and those businesses in construction and manufacturing will see a big increase in the cost of raw materials.

8. Industrial Equipment

For an industry worth around $250 billion, heavy industrial machinery, agricultural and farming equipment, and machines used to process could affect local manufacturing. The projected increase in machinery cost reaches as high as 20%, a cost that will no doubt be passed onto buyers in the US.

7. Chemical Industry

With a global trade value of as much as $350 billion, tariffs’ impact on the chemical industry could have widespread implications, affecting industrial chemical compounds and specialty chemicals. The anticipated impact could lead to price increases by as much as 15%, which would be directly passed onto consumers.

6. Electronics Manufacturing

If new tariffs are implemented, electronics manufacturing will suffer ripple effects. According to industry experts, microprocessors, integrated circuit boards, and computer/smartphone parts will experience price increases, leading to higher retail costs for consumers by as much as 10-20%.

5. Pharmaceuticals

Over time, increased tariffs could impact pharmaceuticals. This would be especially true in Canada, where many Americans purchase drugs without insurance for less than in the United States. If health companies saw tariffs as staying power, it would lead to additional production in the US, which could raise costs by at least 8% across the board.

4. Fashion and Apparel

With expectations that tariffs on textiles and apparel will average between 15% and 25%, the fashion and apparel industry will see a big impact. Hundreds of fashion brands rely on China for low-cost production, and any tariffs could immediately raise prices for consumers by at least 10%, if not more, which could have a big impact on overall demand.

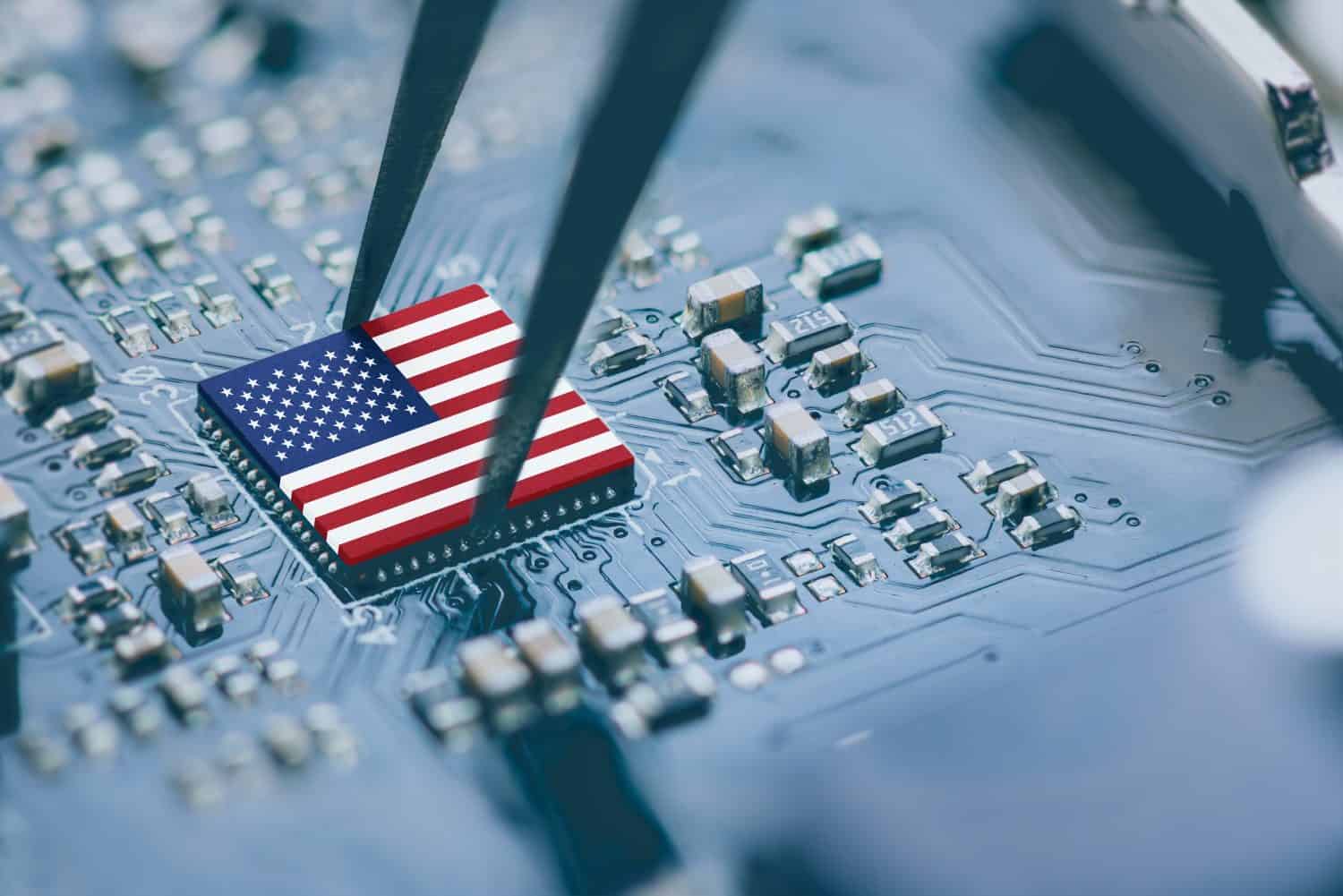

3. Technology

It’s safe to say that the tech industry is heavily reliant on global trade, and increased tariffs for any country will dramatically impact pricing. In addition to products like semiconductors, internal components will feel a pinch, disrupting the supply chain. Experts predict prices could rise 8-15%, costing consumers $300-$500 billion over one year and costing the industry $50 billion by the end of 2025.

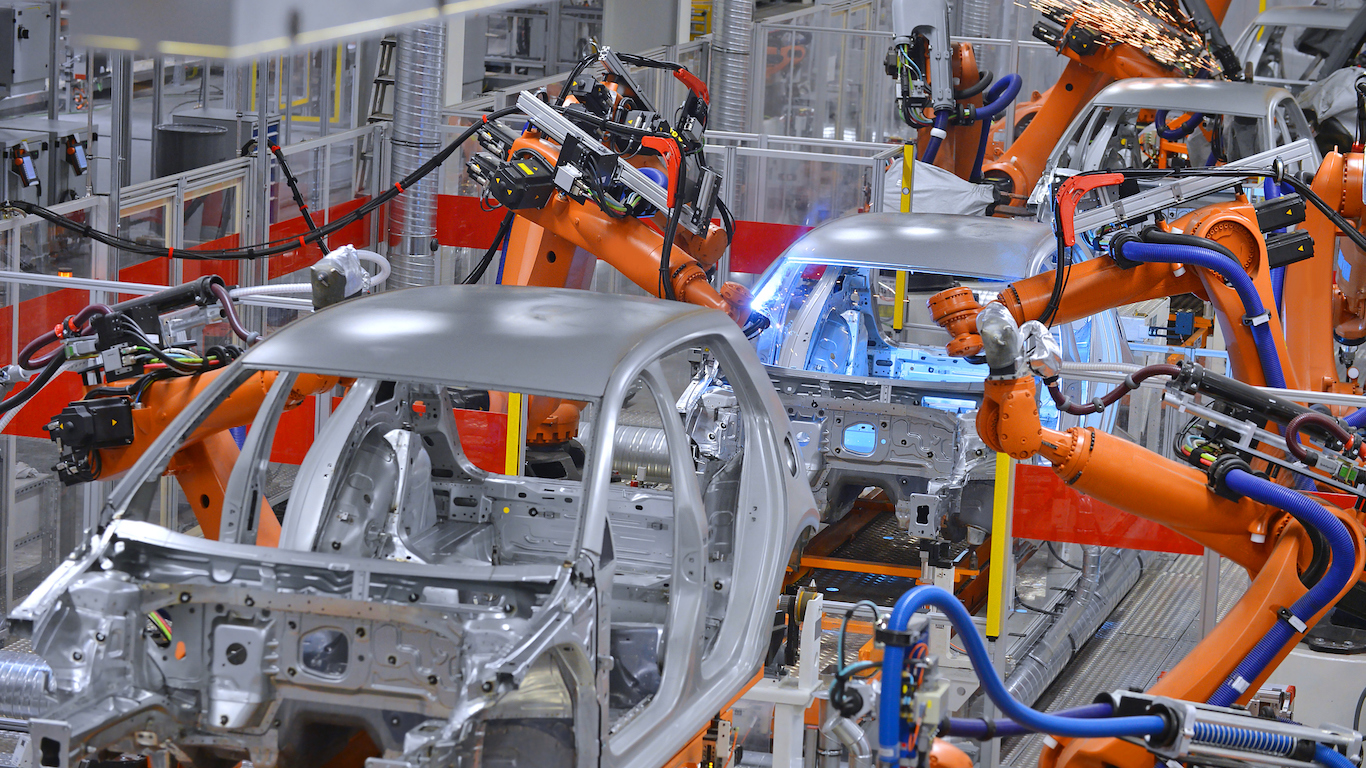

2. Automotive

The automobile industry is highly integrated into global supply chains, with engine components imported from other countries for production in the US. Tariffs will unquestionably lead to higher vehicle prices overall, with some experts predicting as much as a $4,000 to $7,000 increase if tariffs are implemented in China.

1. Agriculture

Agriculture relies heavily on foreign trade, so tariffs likely increase pricing on machinery, pesticides, and fertilizers, leading to higher pricing on specialty fruits and vegetables. Potential impacts include Brazil gaining international market share and US farm exports dropping by as much as 20%. Soybean farms rely heavily on exports to China, and any retaliatory tariffs could put a big dent in the wallet of these farms.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.