Personal Finance

Personal Finance Articles

Buying a house is a big financial commitment, and making a career change can also impact your money in profound ways. One Reddit user is considering doing both of those things at the same time, but...

Published:

Retiring early is a dream for many, but taking the plunge and giving up work in your 40s can actually be pretty scary. One Reddit user recently posted about his own fears about finally quitting work...

Published:

It won’t come as a surprise to learn that the gig economy is growing in importance as millennials and Gen Xers, in particular, look for ways to boost their income. As a result, millions of young...

Published:

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. Once you reach the age of 73, you’re legally required...

Published:

Investing just a few grand for a child at or around their time of birth could amount to a profound sum by the time they’re ready to go off to college. Undoubtedly, it’s easy to overlook the power...

Published:

If you stop and think about what life would be like if you had more than enough money, it’s okay to believe life would be much easier. While the reality is that more money can mean more problems,...

Published:

As someone who’s reported on the economy for 30 years, I rarely read anything famous financial gurus have to say about personal finances. My reason for this is simple: so much of it is...

Published:

Politicians who unabashedly call for raising taxes “only on the rich” by claiming that “the rich don’t pay their fair share” are being disingenuous with that rhetoric. They are fully aware...

Published:

We've stashed over $2 million in our 401(k) accounts - should we switch to a Roth to hedge our bets?

Getting caught up in a financial Reddit thread is surprisingly easy. After all, where else can you learn the financial secrets of total strangers and respond to them as though you’ve met? A recent...

Published:

If you get most or all of your retirement income from Social Security, money might be perpetually tight. In fact, workers are advised to save for retirement because it’s a known thing that Social...

Published:

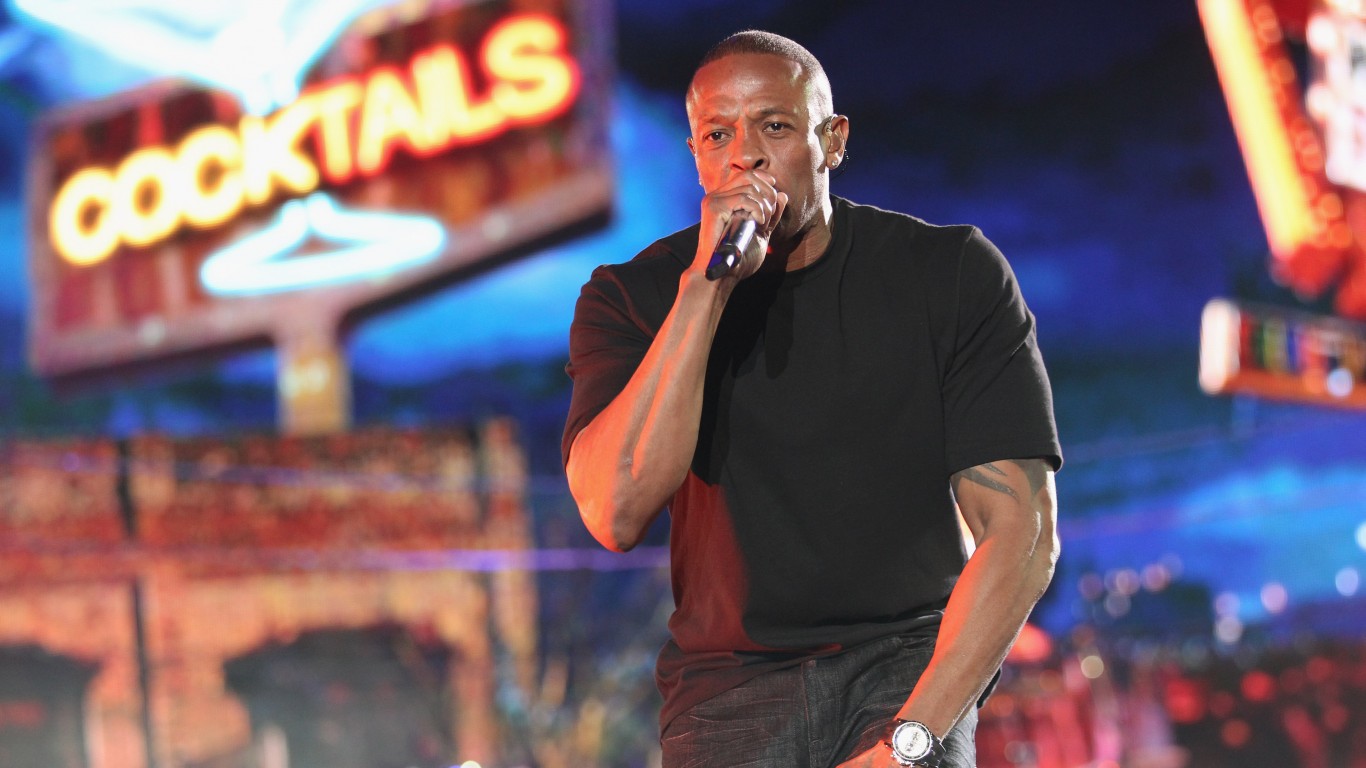

When one thinks of hip-hop and rap music, there are few people whose influence on the development of rap as a commercial art form that is as significant as Dr. Dre. Born as Andre Young in Compton,...

Published:

Once you’re on the cusp of retirement, it’s important to assess your investment portfolio and make changes as necessary. And one thing it generally pays to do is reduce your exposure to the...

Published:

Given the number of guides, tutorials, books, and videos available online about how to minimize your taxes or avoid them altogether, it’s normal to feel apprehensive about paying taxes at all....

Published:

It’s a big achievement to save up $1 million. Not only does it give you plenty of financial options, but you can also grow that $1 million into more fortunes. Many banks are willing to give you...

Published:

One of the biggest concerns facing every American is the rise of insurance costs and premiums. Whether it’s auto, home, or health insurance, costs only seem to be going in one direction and these...

Published:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.