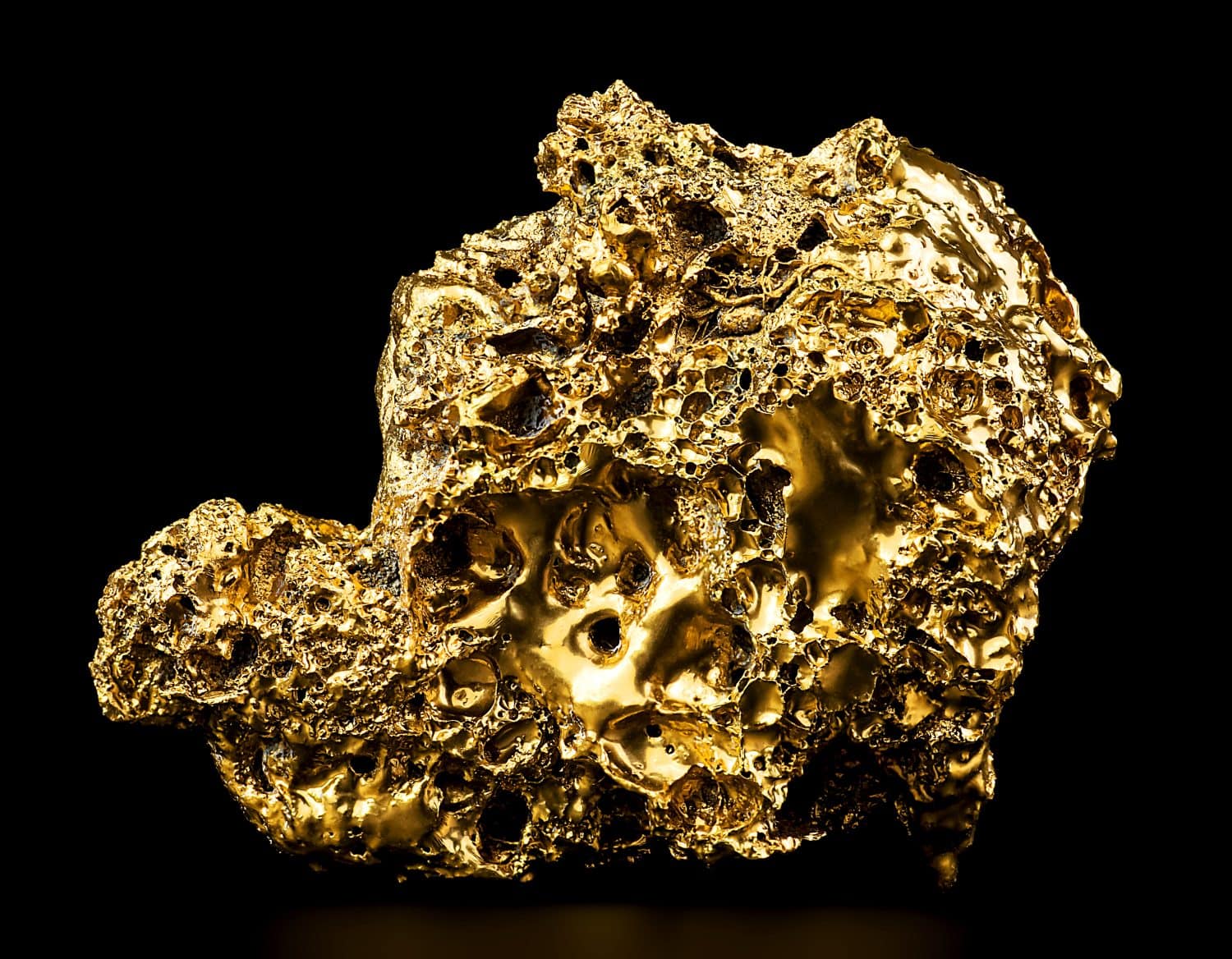

Costco (NASDAQ:COST) has been selling hundreds of millions of dollars worth of gold bars since it offered them in store. Undoubtedly, the Costco gold rush has swept through its stores as soaring gold prices powered unprecedented demand for the shining yellow metal. With gold prices flirting with $2,600 per ounce, it’s not hard to imagine that robust demand has continued going strong.

Indeed, gold has a good rep as an inflation and recession hedge. Though inflation is backing down after this week’s tame (and rather unsurprising) U.S. inflation report (consumer prices rose 0.2% as annual inflation fell to 2.5%), there’s still some stubborn stickiness when it comes to certain goods that comprise the basket known as the consumer price index (CPI).

Notably, housing costs have remained quite heated despite the ongoing inflation downtrend. Either way, lower rates could be the next gold price driver as inflation worries settle and investors seek alternative assets to secure their portfolios against a potential economic slip.

Of course, there are always those speculators just itching to get into gold because everybody else is doing it. In a way, there’s this sense of FOMO (fear of missing out) that can be felt at the gold section of your local Costco.

Key Points About This Article

- Costco gold bars have been selling well this year amid the golden rally.

- There are better, more liquid ways to invest in the precious metal than Costco bars.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Forget Costco Gold Bars. There are Smarter Ways to Buy Gold

Though it may be tempting to scoop up the great deals on physical bullion at Costco (that is, if you can find it in stock!), I think there are far better ways to play the golden run than with bullion. Even though Costco offers competitive pricing on gold, as it does virtually all goods in its warehouses, there are cheaper and more convenient ways to expose yourself to gold. In this piece, we’ll look at two arguably superior ways to bet on gold.

So, if you’re looking to bet on gold more economically or if you just want to save yourself a drive to Costco, consider the following:

Gold Bullion ETFs

Costco gold bars may offer some of the lowest premiums to gold’s spot price. That said, you’ll still have to pay a premium to spot. And you’ll probably have to pay for some secure storage (think safety deposit box at your local bank) to ensure the secure storage of your investment.

Indeed, gold prices have been really heating up of late. But prices could easily melt down as much as they can melt up further from here. Arguably, gold prices could drag for the rest of the year and still be up markedly for 2024. If you’re paying for a safety deposit box and you’re in the red on your gold investment, it’s like taking a double hit to the chin.

With gold bullion ETFs, like the SPDR Gold Shares (NYSEARCA:GLD) ETF, you’ll get all of the appreciation to have in gold minus the storage fees. The catch is you’ll need to pay a gross expense ratio of 0.4% and a small commission to buy the shares. However, you’re getting next-level peace of mind and liquidity (you can easily buy and sell GLD on any given day at pretty close to its worth), which is simply not possible with physical bullion.

The Gold Miner Stocks

If you’re a pound-the-table gold bull and are willing to take on more risk for a shot at more reward, the gold miners, like Newmont Corporation (NYSE:NEM) are worth a look. The company is in the business of unearthing gold across its wide range of high-grade gold mines. Undoubtedly, the miners benefit from higher gold prices, but at the end of the day, they need to focus on what they can control: driving production and improving operating economics.

Newmont has done a great job of improving its operating efficiencies over the years. With gold sales volumes pinned at 6.9 million ounces for 2024, NEM stock stands out as one of the better miners to go with at today’s prices. At writing, the stock trades at 10.45 times forward price-to-earnings alongside a nice 1.97% dividend yield.

Perhaps the biggest plus of a gold miner stock like NEM is that it’ll pay you a nearly 2% yield while you let the stock appreciate. Of course, you’ll have to deal with much bigger price swings relative to gold bullion, but if you have a strong stomach, the trade-off could be well worth it.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.