Personal Finance

I thought $10 million was enough money to live a luxurious life - boy, was I wrong

Published:

Last Updated:

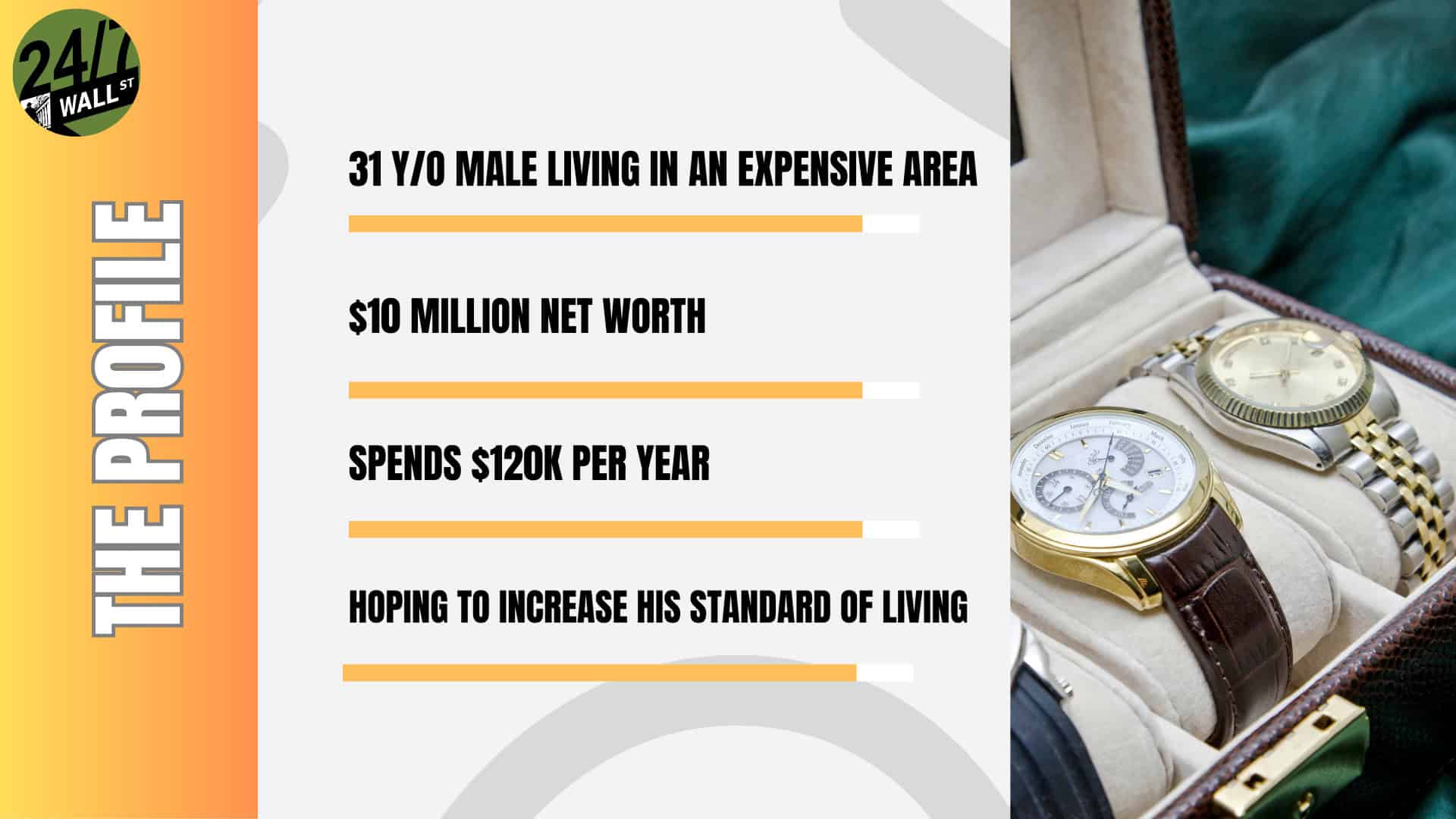

When it comes to money, we all like to think there is a magical number that will set us up for life. At the very least, I think it’s safe to say we believe this number is somewhere in the low millions, if not a little higher. Well, in the case of this 31-year-old Redditor, having a net worth of $10 million may not be enough.

While you might scoff at the idea of anyone saying they can’t live off $10 million, this is precisely what this post in r/fatFIRE indicates. Between hired assistance, hobbies, travel, and everyday living, including children, this Redditor believes he cannot live long-term with this money.

What I love most about these articles is that I not only try to live vicariously through these Redditors but also learn about different financial strategies.

So here’s where we are with this Redditor: We have a 31-year-old male who admittedly has a very high cost of living. After selling a startup he founded, he is set to reach a net worth of $10 million very soon. His net worth was previously $200,000, so this will be a significant bump in wealth almost overnight.

Diving into the crux of the matter is where this whole thread gets super interesting. This individual points out that while $10 million “unlocks security,” it doesn’t unlock “lower-end rich life luxury.” Even though there is an admission that you don’t need to do everything he’s suggesting, the concern is that with hired assistance, various hobbies, private school and daycare, college, travel, a large home, and various entertainment expenses, you’re out of money.

As far as actual living expenses, there is a proposition that with a withdrawal rate of 3.75%, at a $10 million net worth, you’d have around $375 pre-tax and around $260K post-tax in his state. So, what’s a guy to do if he wants to live the high life but can’t quite do so?

While I’m not qualified to give financial advice, I reacted similarly to other Redditors in the comments. At roughly $260,000 after taxes, this Redditor can do much of what he mentions. He can send his kids to private school and take a yearly five-star luxury vacation. He can also afford two luxury cars and have a fun hobby, but he can’t do everything.

The reality is that he can have one luxury home, not two. He can do fine dining every month but not every night. In other words, he can have anything he wants. He just can’t have everything he wants, which doesn’t seem like a bad problem, as the commenters in this post like to point out.

The easiest recommendation here is to pick and choose what’s most important from this Redditor’s list of “luxurious life” expenses. Separately, he’s also 31, so he must decide whether to continue working or retire for good. He also hasn’t considered that he doesn’t have to spend every cent of his interest. He could, potentially, not spend every penny of his annual interest earnings and instead accrue additional money through a high-yield savings account.

While I can only wish we all had a problem of having $10 million and deciding how many luxury cars are essential, this isn’t reality. Instead, v

Instead of worrying about luxury vacations every year, this Redditor should consider what he says and how much of a head start he has at an age where he can still make considerable money. This does appear to be a missing part of the conversation, in that he can still work and bring in income, even if it’s not as involved as creating another startup but taking on a consultant role somewhere.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.