Personal Finance

I make $240k more than my spouse and we keep finances separate - why do some people combine?

Published:

Last Updated:

Relationships can be tricky, especially if you live with your partner. Who pays for what? Is it fair to even keep track? These kinds of questions can be hard for couples to answer. I found a Reddit post entitled, “Why Do Married Couples Combine Finances?” on the subreddit r/HENRYfinance (High Earners, Not Rich Yet).

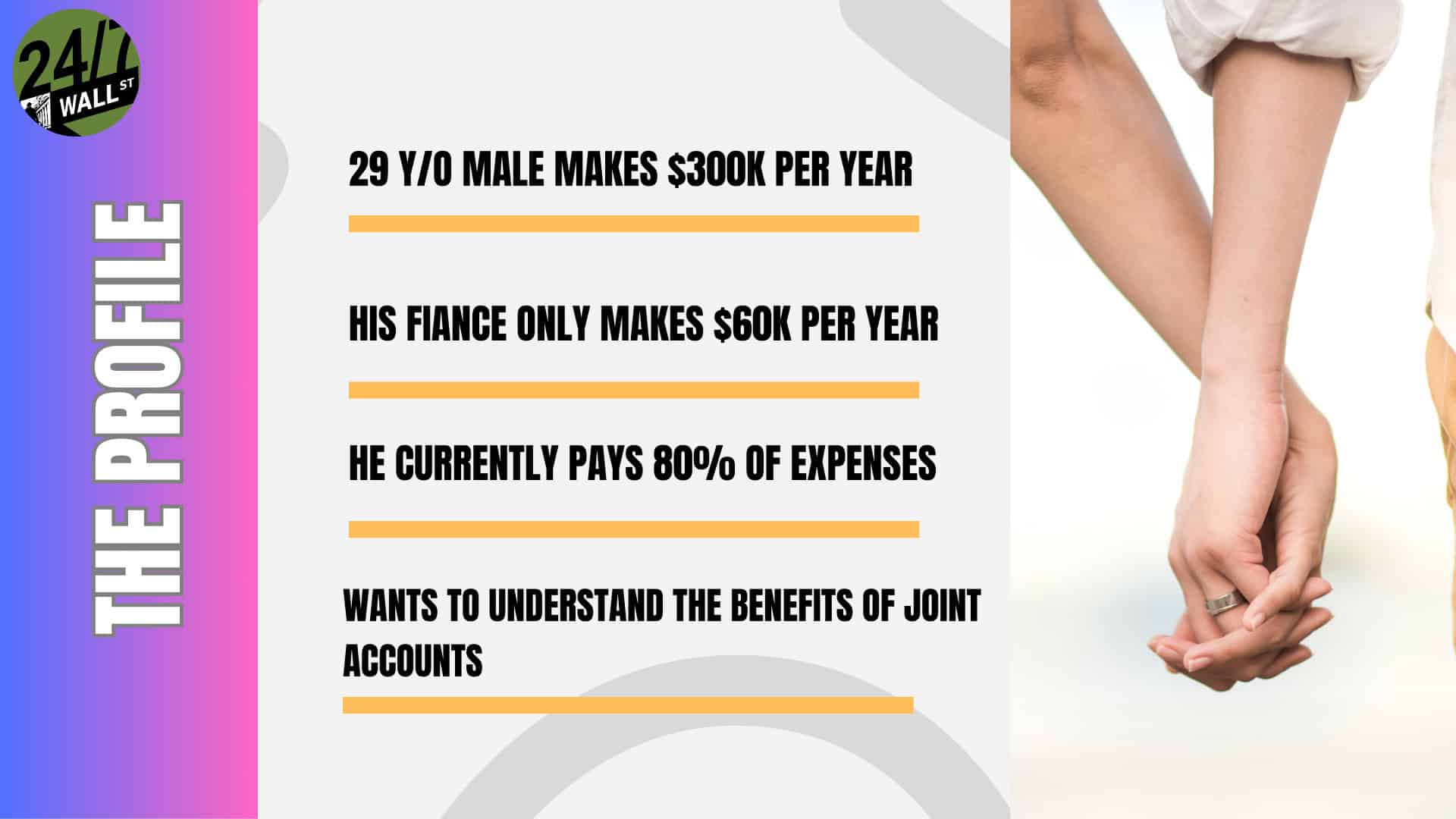

The Original Poster (OP), Ben-E-Fitz is a 29-year-old male engaged to a 27-year-old female. They currently keep their finances separate (his choice), OP makes $300,000 a year and his fiancé makes $60,000. OP pays 80% of the fixed bills, as well as the majority of activities, and car payments. Fiancé pays 20%. This arrangement leaves them both with “fun” money that stays in separate bank accounts. OP is confused about what the benefits would be of combining, and why it seems everyone combines when they get married. Op speculates that it would probably cause more tension in a relationship in regard to individual purchases.

My initial reaction was confusion at the large gap in earnings and percentage division. The bill-splitting percentage seems so unequal to me that it is almost like they are combining finances anyway. I do like that their contributions are proportionate to their earnings. That seems equitable. I am wondering what that looks like in regard to things like food, clothes, makeup, apparel, household items, toiletries, cleaning supplies, furniture, etc. How are they going to split the expenses associated with children in the future? He doesn’t explain those details in the original post.

Another reaction that I had was curiosity. It seems that OP doesn’t quite trust his partner, and the fact that he makes so much more than her but won’t give her access to his money makes it seem like there might be some superior attitude happening in this relationship. This is an assumption, but would this ever cause him to hold her salary against her?

Most of the commenters on this page talk about how adding reimbursements and discussions over splitting costs that might be vague is overcomplicating something that doesn’t need to be complicated. If they are separating finances but sharing resources, how does that make any more sense than just contributing to a shared account? Many commenters also point out that her salary might stop altogether if they have kids. Then, how will this dynamic work? Will OP pay her a salary? Some commenters wonder if there is some kind of trust issue happening in the relationship. Why wouldn’t OP be comfortable knowing what his discretionary fund looks like? Is he hiding something? Is she hiding something? Some commenters question whether OP is ready for such a big commitment as marriage if he is baffled by the concept of combining finances.

A small minority say that splitting finances works for their relationship, but it takes a lot of trust and communication. The top comment says it best, “Combined or Separate Finances + Good Communication = No Problems.”

A number of commenters have both a joint account and separate accounts. The consensus is that around 80%-90% of each salary gets transferred into the joint account and the remainder stays in each individual account. The individual accounts are strictly “fun money” for most of this group of commenters. That way there aren’t any allocation disputes, but each still feels some financial freedom and privacy.

Another group of commenters questions why he isn’t just doing a prenup if he is worried about combining finances. That way, in the event of a divorce, both parties have already decided what is fair leaving a marriage and during the relationship, money isn’t an issue. Some posters point out that his partner might end up making much more than him. A disability-causing illness or accident could happen to either OP or Fiancé. So, a prenup will protect both of them.

Most commenters agree that trust, transparency, communication, and teamwork are what make finances in a marriage a nonissue. Whether joint or separate finances, partners need to be partners in all areas of their lives.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.