Personal Finance

I made a huge mistake with my 401(k) and incurred a $300k tax bill - am I totally stuck?

Published:

On another episode of, “problems out of my tax bracket that I have no business having an opinion on and do anyway,” I stumbled upon a post from the subreddit r/Bogleheads. According to the subreddit description, Bogleheads are “passive investors who follow Jack Bogle’s simple but powerful message to diversity with low-cost index funds and let compounding grow wealth. Jack founded Vanguard and pioneered index mutual funds.”

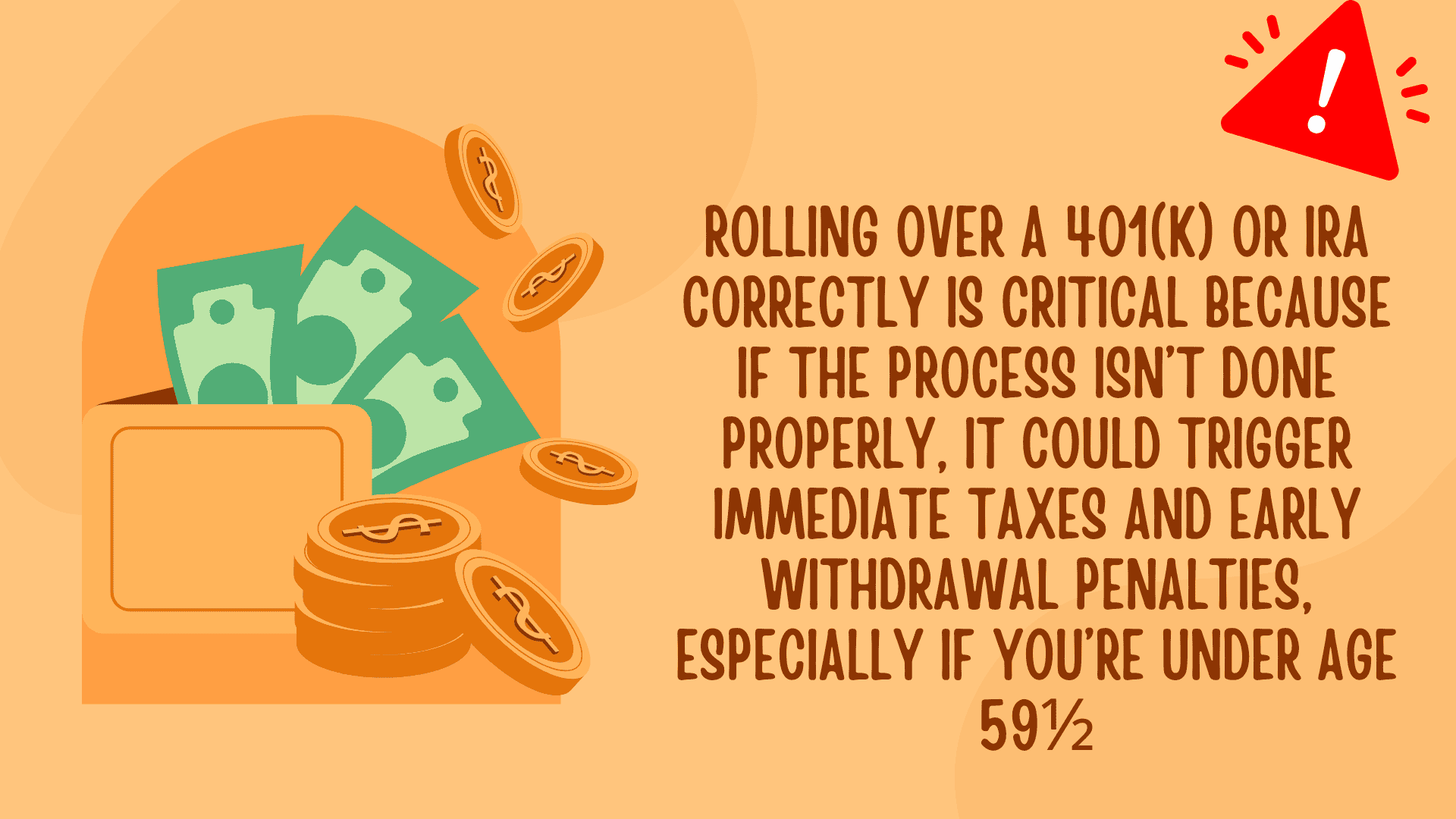

The Original Poster (OP) Oriolefan443, made a post entitled, “401K conversion to Roth IRA—I think I made a BIG MISTAKE.” In the post OP (no description of age or gender) states that they recently called their 401-K company with their former employer and requested it be converted to their Roth IRA at a different bank. The transaction was completed in five minutes and the rollover was equal to $740,000.

OP quickly learned that they accidentally incurred a tax bill of $300,000, because they transferred it into their Roth IRA instead of their traditional IRA. OP was anticipating the tax penalty would only be 20%. OP states that they cannot pay this tax bill, and he’s called both companies to try to fix the error, but both parties said they cannot. OP has been agonizing over this mistake for almost a week.

The top comment suggests that the only thing OP can do at this point is to contact the IRS. Because of a law change in 2018, conversions can no longer be re-categorized. The commenter, mygirltien, suggests that the only thing to do is to call the IRS and politely plead your case and see what can be done. They could hopefully set OP up with a penalty-free payment plan, and OP will just have to pay it. A responder to this comment suggests that it would be better to hire a CPA to contact the IRS on OP’s behalf and not, under any circumstances, should anyone contact the IRS as an uninformed citizen.

Most commenters are simply confused by what OP was trying to do in the first place by converting such a large amount of money into a Roth IRA, as the tax margin on a $750,000 conversion is 37% for all filers with no penalties. Almost every comment is telling OP to stop trying to do DIY finances and hire a CPA ASAP.

Sometimes, professionals really are the best choice for a reason.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.