Jerome Powell and the Federal Reserve did as expected on Sept. 18, cutting the benchmark interest rate by 50 basis points to 4.75% to 5%. This is a sign that inflation has mostly been tamed.

It also suggests that mortgage rates will follow suit, continuing their downward trend that began in earnest last October, when a 30-year fixed-rate mortgage in the U.S. averaged 7.79%. As of Sept. 12, the most recent rate is 159 basis points lower at 6.2%. That will surely drop in the coming days and weeks.

“The Fed’s 50bp rate cut likely adds downward momentum for mortgage rates, which have already come down materially since May as treasuries have rallied,” HousingWire reported comments from Eric Orenstein, senior director at Fitch Ratings.

“While not enough for a full scale refi boom, an average 30-year rate approaching 6% does open up a meaningful slice of the market for refinancing. Mortgage originators stand to benefit, and will likely find the toughest times already behind them.”

While states with lower mortgage rates have already benefited from the fall in rates, some states’ rates remain stubbornly high.

Here are the five states with the highest mortgage rates.

Vermont

According to Zillow data, the average home price in Burlington is $521,337.

Based on the average home price, a 30-year fixed rate mortgage with 20% down and a $417,070 mortgage has a 6.125% interest rate and 6.355% APR (annual percentage rate), according to Bank of America’s website.

It’s important to remember that this rate is based on a person with a credit score of 740 or higher. Every situation will be different when applying for a mortgage, so be sure to keep that in mind when buying a home.

According to Investopedia, the national average 30-year fixed mortgage rate as of Sept. 11 was 6.08% for new purchases and 6.29% for refinancing. For those eligible for FHA (Federal Housing Administration) mortgages, the national average 30-year, fixed mortgage rate as of Sept. 11 was 5.81% for new purchases and 6.20% for refinancing.

Using Zillow’s mortgage calculator, a 30-year fixed mortgage of $417,070, including property tax, homeowner’s insurance, and mortgage insurance — after 20% down on an average home price of $521,337 — has an estimated monthly payment of $3,079.

The total principal and interest payments over the life of the mortgage are $417,070 and $495,229, respectively.

West Virginia

According to Zillow data, the average home price in Morgantown is $268,994.

Based on the average home price, according to Bank of America’s website, a 30-year fixed rate mortgage with 20% down and a $215,195 mortgage has a 6.125% interest rate and 6.308% APR (annual percentage rate.

Using Zillow’s mortgage calculator, a 30-year fixed mortgage of $215,195, including property tax, homeowner’s insurance, and mortgage insurance—after 20% down on an average home price of $268,994—has an estimated monthly payment of $1,560.

The total principal and interest payments over the life of the mortgage are $215,195 and $255,520, respectively.

Wyoming

According to Zillow data, the average home price in Laramie is $372,474.

Based on the average home price, a 30-year fixed rate mortgage with 20% down and a $297,979 mortgage has a 6.125% interest rate and 6.258% APR (annual percentage rate), according to Bank of America’s website.

Using Zillow’s mortgage calculator, a 30-year fixed mortgage of $297,979, including property tax, homeowner’s insurance, and mortgage insurance—after 20% down on an average home price of $372,774—has an estimated monthly payment of $2,120.

The total principal and interest payments over the life of the mortgage are $297,979 and $294,585, respectively.

Iowa

According to Zillow data, the average home price in Iowa City is $291,941.

Based on the average home price, a 30-year fixed rate mortgage with 20% down and a $233,553 mortgage has a 6.125% interest rate and 6.323% APR (annual percentage rate), according to Bank of America’s website.

Using Zillow’s mortgage calculator, a 30-year fixed mortgage of $233,553, including property tax, homeowner’s insurance, and mortgage insurance—after 20% down on an average home price of $291,941—has an estimated monthly payment of $1,770.

The total principal and interest payments over the life of the mortgage are $233,553 and $277,322, respectively.

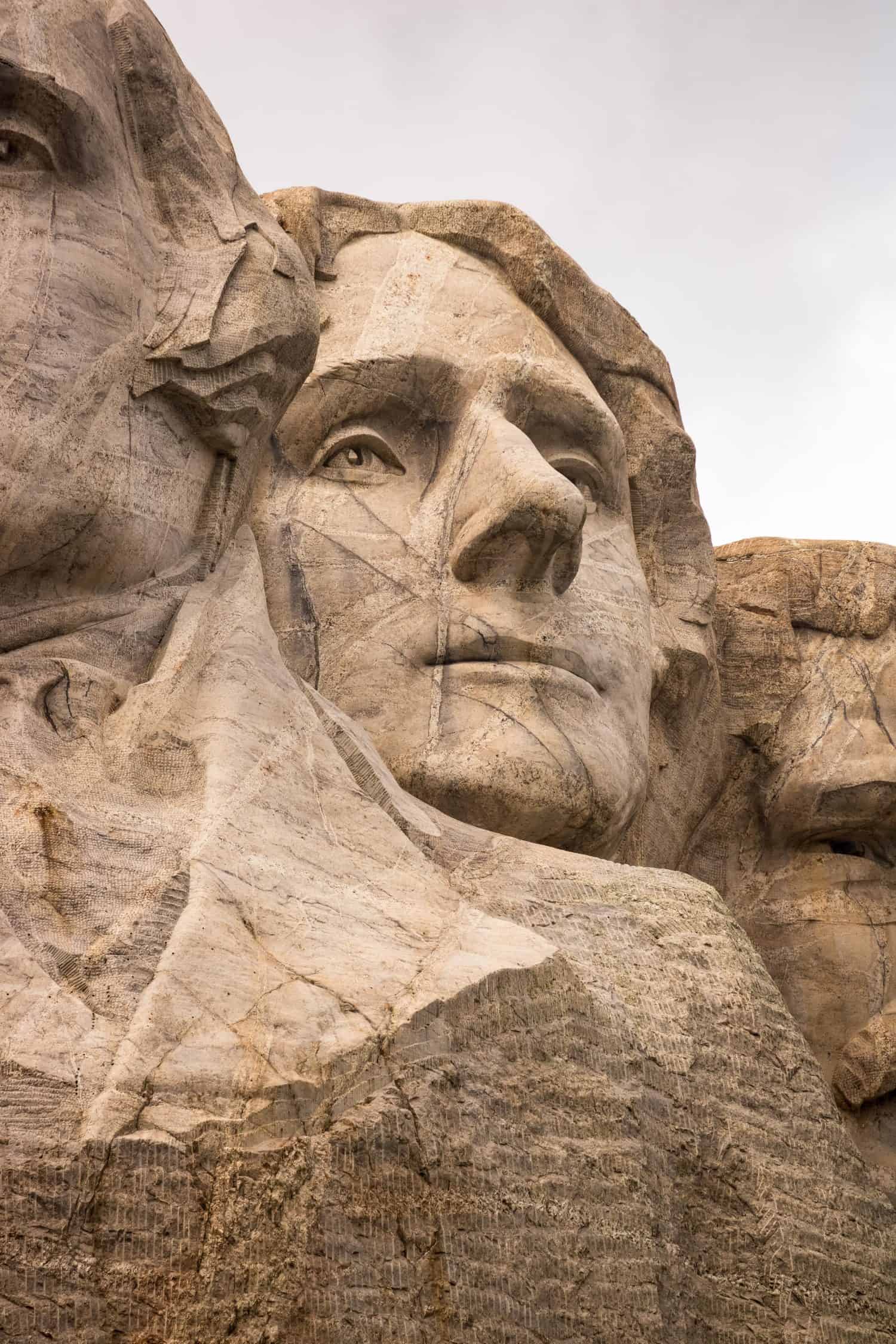

South Dakota

According to Zillow data, the average home price in Vermillion is $252,065.

Based on the average home price, a 30-year fixed rate mortgage with 20% down and a $201,652 mortgage has a 6.125% interest rate and 6.291% APR (annual percentage rate), according to Bank of America’s website.

Using Zillow’s mortgage calculator, a 30-year fixed mortgage of $201,652, including property tax, homeowner’s insurance, and mortgage insurance — after 20% down on an average home price of $252,065 — has an estimated monthly payment of $1,442.

The total principal and interest payments over the life of the mortgage are $201,652 and $229,629, respectively.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.