Personal Finance

The typical soon-to-be retiree in America has $250k in their 401(k) - how do you compare?

Published:

Last Updated:

For the soon-to-be-retired, there’s one last stretch to sprint before you break the finish line. Undoubtedly, the last part of a race can be the toughest, with the end in sight and you’re running on empty. While it’s tempting to just head into cruise mode as you move closer to retirement, I’d argue that it may make more sense to give the one last push you’re all so that you’re set for an unforgettable and rather comfortable retirement.

According to a piece published by Business Insider, the average 401k balance currently sits at just north of $134,000. For soon-to-be retirees (think those in the 55-64 age group), the average 401k balance is hovering at just shy of $245,000.

If you’re nowhere close to this range, though, no worries, as the median balance for the age group is closer to $87,500. Indeed, there’s quite a striking difference between the average and the median. The good news is that if you’re closer to the median, you still have plenty of capital to work with as you look to make that one last push before retirement.

Even if you’re close to $250,000 and in your 50s, you’re not quite close enough to fund a retirement income stream to support you in your golden years. Of course, this ultimately depends on your other passive income sources, which we won’t cover in this piece. Notably, social security and work pensions can also be relied upon by the time you’re ready to quit the workforce and live your best life.

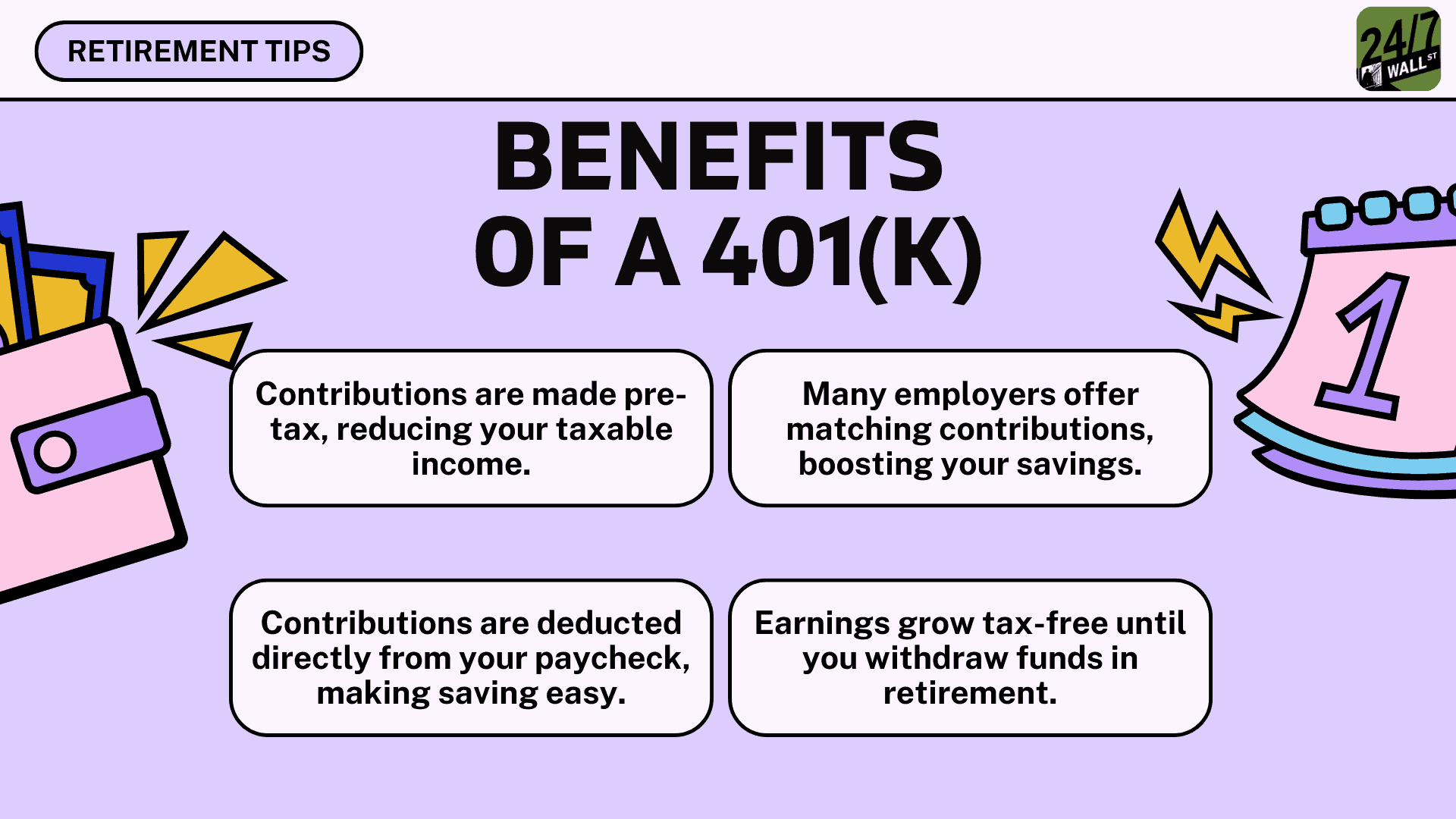

Either way, your 401k is an invaluable nest egg that can be transformed into a rather potent passive income machine once you’re ready to flip the switch after retirement.

So, if you’re 5-10 years away from your hopeful retirement date, you’ll have a chance to add to your 401k in a big way. But, for now, I’d argue it makes sense to prioritize its growth rather than its ability to produce yield.

Right now, your 401k nest egg is like a growing tree that still needs water, fresh soil, and fertilizer added consistently before it can yield fruit. If you’re fortunate enough to have an employee match plan with your 401k, you may have what it takes to make one last massive sprint that helps you reach financial freedom a tad sooner than expected.

In any case, I believe you should be more focused on achieving greater financial freedom than having a concrete retirement date set in stone, especially if you’re not yet at the average 401k balance for your age group.

In many ways, a 401k match is like getting some free cash from your employer. If you’ve got enough funds to cover the day-to-day living expenses (as well as the occasional splurge), maximizing your match makes the most sense as you put the finishing touches on your retirement roadmap.

If you’ve been contributing a smaller amount, it makes sense to talk to your work’s benefits representative so that you can supercharge your retirement’s growth.

As for the proceeds, index funds (one that replicates the performance of the S&P 500 or Nasdaq 100) can be solid options. However, do be mindful of the fees you’ll need to pay. Additionally, it can be wise to mitigate single-stock risk, whether it’s due to a stock that’s doubled up many times over in recent years or if you have too much company stock that’s built up over the years.

Indeed, hanging onto shares of your company can pay off big time. However, I’d argue that overconcentration is often not worth the risk. Further, you are bound to have your biases when it comes to the company you’re employed by! As such, accumulating company stock without selling and diversifying can be a huge mistake.

Bill Gates continues to make a fortune with his Microsoft (NASDAQ:MSFT) stock. Yet, he understands the value of diversification, having spread his bets across a wide range of firms and industries.

Given Microsoft’s market-beating track record under CEO Satya Nadella as he embraced the cloud, selling MSFT stock for other names has proven a losing move. However, if the technology sector blows up, MSFT shares will feel the pinch. And Gates’ wealth would have taken a massive hit that may have taken away from philanthropic efforts.

As the great Warren Buffett once put it, “You only have to get rich once.” And while there’s an upside to being overweight in just one company, the risk of overconcentration may be too great, especially if you don’t want to risk not retiring until your 70s.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.