Personal Finance

Millions of Americans Not Receiving Social Security Benefits

Published:

Last Updated:

Many Americans sacrifice a piece of their paycheck to ensure they’ll have at least some income in retirement. Social Security monthly checks range between roughly $1,000 on the low side and just over $4,500 on the high side. In an economy where inflation has increased prices, and high interest rates have yet to budge in a big way, retirees could use these funds more than ever.

Yet while 64 million Americans will receive Social Security checks in 2024, another 3.3% of seniors fall into the unfortunate category of what the Social Security Administration (SSA) calls “never beneficiaries,” or those who will never collect on their Social Security benefits.

Both employers and employees are directing an average of 6.2% of wages into Social Security this year. While many retirees also look to 401(k) accounts, pensions, dividends, and more for passive income, Social Security often comprises up to 33% of a person’s income in retirement for seniors over the age of 65. In many cases, there’s a fine line between poverty and retirement, a gap that Social Security benefits help to bridge.

Most of those individuals who forego Social Security benefits comprise immigrants who came to the U.S. later in life. But there are also Americans who are entitled to payments yet for one reason or another, including filing mistakes, never collect.

Of the 3.3% of Americans who are at least 60 years old who do not receive Social Security benefits, 88% are “late arriving immigrants and infrequent workers,” according to the SSA. Late arriving immigrants include those individuals who came to the U.S. at 50 years old or older and whose earnings are not high enough to qualify them for benefits.

Americans may also fall into the “infrequent worker” bucket, as they’ve not had enough consistent employment to qualify them for Social Security Benefits. Non-covered workers are those Americans whose earnings are high enough but who work in non-covered sectors of the economy, like government (some may be entitled to pensions, etc.) Some people who are eligible for Social Security benefits will pass away before getting them.

Not surprisingly, “never beneficiaries” are also more prone to living in poverty vs. Social Security recipients, at 54.3% and 5.8%, respectively.

While Americans work their whole lives to make retirement easier, they may not realize that Social Security is anything but simple. There are thousands of rules, and overlooking the wrong ones could cost you when it comes time to collect payments.

Another reason why Americans never receive what’s owed them in their golden years is because of filing mistakes, a pricey faux pas that could be prevented. According to Forbes cited by Newsweek, Americans miss out on at least $100,000 in Social Security benefits as a consequence of filing mishaps.

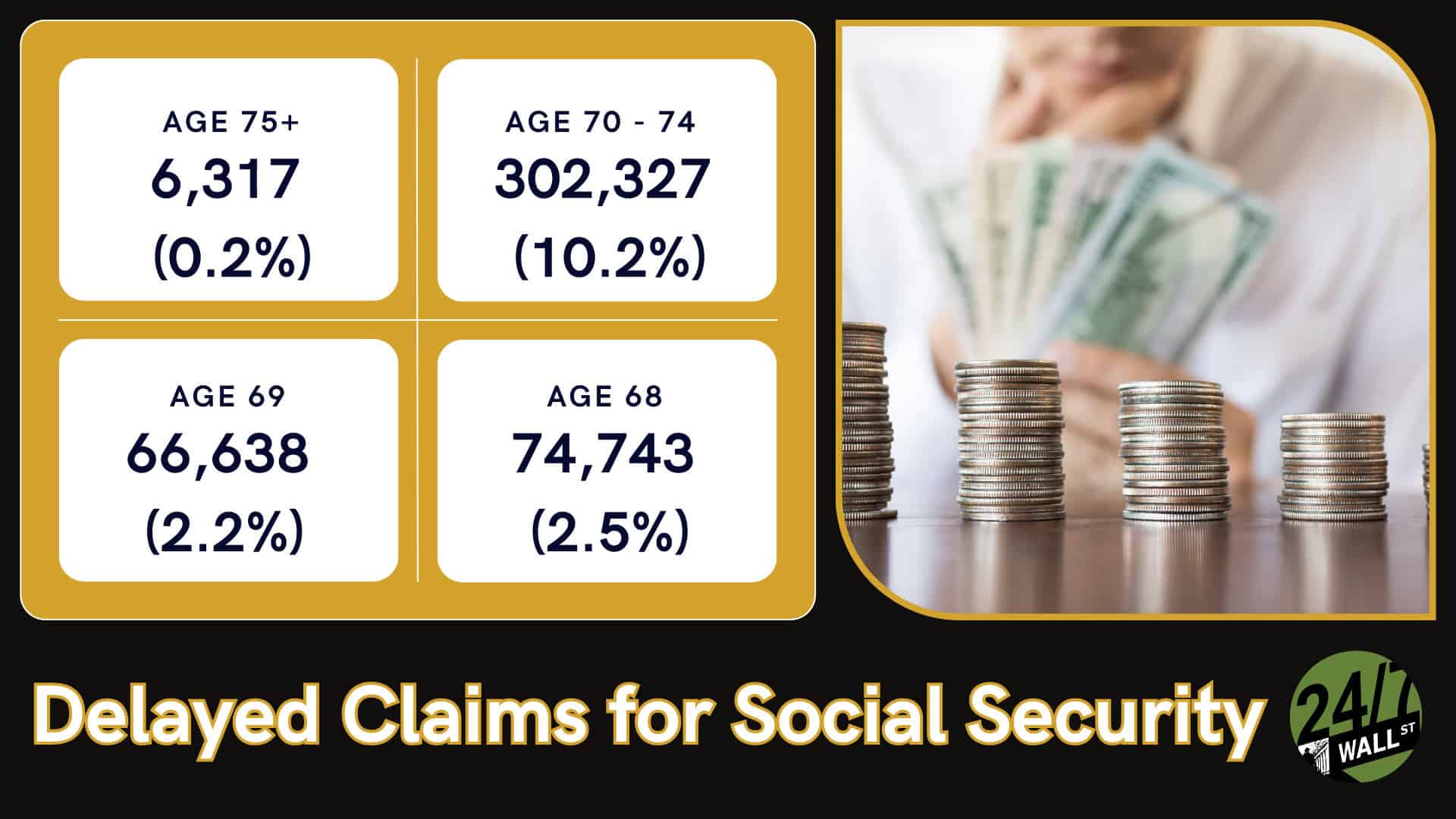

A debatable strategy is postponing Social Security in an attempt to maximize payments. But with the Social Security pool dwindling, this is an approach that could backfire later. Additionally, when postponed, benefits grow at 8% annually, but depending on the lifespan of a person, it could ultimately cost them more in the way of taxes and benefits.

One way to avoid surprises during retirement is to calculate Social Security benefits ahead of time. This can be accomplished by visiting SSA.gov for an estimate of benefits, a formula based on past earnings, prior to filing for the real deal. Experts suggest completing this exercise at least once annually.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.