Personal Finance

Here's Where Both Parties Really Stand on Social Security Right Now

Published:

It’s becoming clear to many retirees, and those nearing retirement, that the social security benefits once considered to be iron-clad and a certainty may be more at risk than many previously thought. Indeed, millions of Americans face potential Social Security cuts within a decade, unless Congress intervenes. There are a range of estimates on how long it will take for the SSA trust that manages the funds that are paid to to retirees to be depleted. But one recent estimate suggests that, based on current law, it can be expected that the Trust Funds will be depleted by 2041. That’s really not a long time, particularly for those who have yet to start taking their benefits.

Accordingly, it should be no surprise that polls have largely revealed strong opposition to benefits reductions, with many looking to tap this trust fund while there’s still capital to go around. Overall, it’s likely we’re going to see much less opposition to budget cuts elsewhere, but social security support is something that most voters across the political spectrum are in favor of right now.

That’s not to say that Democrats and Republicans have the same view of how to fund these liabilities over time. And while both parties have very definitively pledged to support protecting social security, it’s unclear to many how the path forward via various administrations may vary.

Let’s dive into where both parties really stand on social security right now.

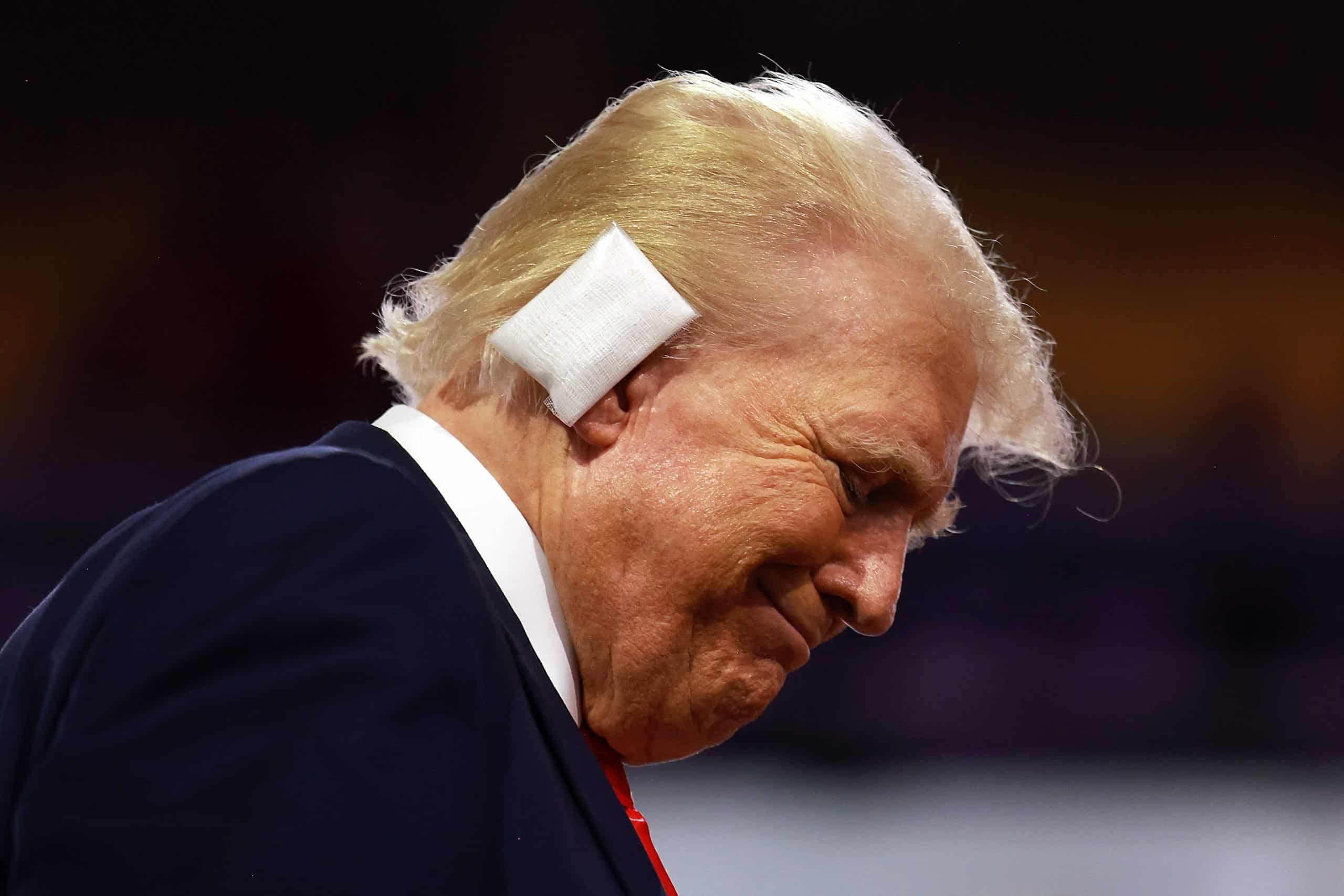

At the Democratic National Convention, democrats planned to criticize former President Trump’s stance on Social Security and Medicare. Now, Trump has previously vowed no cuts. However, his proposals could deplete funds faster, and that’s a take Democrats appear to want to emphasize. Republicans have repeatedly promised to protect both programs without reducing benefits or raising the retirement age, so there’s little near-term risk of funds being depleted at a much faster rate. But how Republicans plan on replenishing the fund remains an open question.

Many within the Democratic Party have highlighted Trump’s March comments suggesting openness to Social Security and Medicare cuts. His campaign has since clarified he referred to cutting waste, not entitlements. Trump also proposed removing taxes on Social Security benefits for seniors, a move that could be a key benefit to seniors currently taking social security payments.

Trump’s proposed Social Security tax cut is projected to have minimal benefits for middle-class Americans, saving them around $90 per year. Unsurprisingly, higher earners would benefit more, while lower-income recipients, many of whom are already untaxed, would see no change. JD Vance, Trump’s running mate, has called for funding Social Security by boosting workforce participation, wages, and tariffs. While Trump proposed raising tariffs, experts doubted it would generate significant revenue, as higher prices might reduce imports.

On this social security policy stance, many experts remain mixed in their view. Some have warned that this plan could worsen the federal budget deficit by $1.6 to $1.8 trillion by 2035. That’s according to the Committee for a Responsible Federal Budget. However, other analysts have focused on the fact that Trump’s plan could accelerate social security insolvency, speeding up the time frame when funds are depleted to as soon as 2033 – and that’s a bit too close for many to be comfortable with.

We’ll have to see if additional details are put forward from the Trump campaign with respect to how this higher Trust utilization could be plugged via economic growth, as many aren’t necessarily clear on how tariffs would make up the difference. Both parties are still building out their economic plans, and I do expect we’ll hear more from former president Trump in the coming weeks on this topic.

Vice President Harris has not yet released formal Social Security proposals, but like her opponent, firmly opposes benefit cuts to seniors. She has repeatedly reiterated her commitments to protecting and expanding the program, criticizing Trump as a threat to social security for all Americans.

It will be interesting to see how the voting public vies this stance. During the Sept. 10 debate, Harris highlighted her long-standing efforts to protect Social Security and Medicare. She emphasized the Biden administration’s achievement of allowing Medicare to negotiate drug prices, contrasting it with Trump’s unfulfilled promises. Harris also vowed to ensure Americans receive earned benefits, but shifted focus from her earlier “Medicare For All” stance to building on Biden’s Medicare policies, especially addressing drug pricing and pharmaceutical companies.

The Harris campaign has been relatively clear in their message – that increased spending will be funded at least in part by taxing millionaires and billionaires at a higher rate. That’s a message that some young voters can get behind. But many wealthy donors have since called on the Harris campaign to consider making some of these proposals more palatable, which the campaign seems to be willing to do.

There’s a clear funding gap for key programs such as social security, and Harris’ team appears to be clearly focused on raising taxes to meet the higher spending needs of the future. One indication this will likely be the case was Harris’ co-sponsoring of the Bernie Sanders’ Social Security Expansion Act, which aims to extend payroll taxes to incomes over $250,000.

Harris distanced herself from part of the Social Security Expansion Act, aligning with Biden’s pledge not to raise taxes on those earning $400,000 or less. While the DNC platform supports taxing the wealthy, it lacks specifics on how this plan will be rolled out. With Social Security and Medicare crucial to millions and 63% of voters prioritizing these programs, Harris is expected to outline her plan soon.

Social Security and Medicare are vital for millions of Americans. That fact won’t change anytime soon. And as more baby boomers age into retirement each day, this issue will become increasingly important for voters looking to gauge where their specific party stands on these issues.

For now, both candidates appear to have holes they’ll need to plug, and specifics they’ll need to provide, for more voters to grow comfortable with not only the vision, but the how of the underlying plans of both candidates. And it’s also worth pointing out that Congress (not the president) holds the power to reform these programs. So, barring a sweep by either party, we may be in for more gridlock on this key issue than not come November.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.