Personal Finance

I'm divorced and have a net worth of $4.5 million - I have to pay alimony for another 7 years. Can I quit my job?

Published:

Last Updated:

24/7 Wall St. Key Points:

Recently, I was scrolling through Reddit when I came across an interesting post from a 46-year-old woman who was sharing a dilemma many high-income earners face: Is it financially safe to quit a high-paying job, even when you’re burnt out?

Despite making $500,000 to $600,000 a year and having a net worth of $4.5 million, this user is grappling with the emotional toll of being a single parent and the financial struggles of supporting her lifestyle.

The question she’s asking reveals an important truth: No matter how wealthy someone is, there are always challenges involved.

Here’s a deeper look at her situation and why making the hasty decision to quit could jeopardize her long-term financial security, even with her very high net worth. Before making any major decisions, consulting with a financial professional who can analyze the situation in detail is important.

The Redditor gave us lots of information about her finances. While her net worth is impressive, it isn’t everything. Here’s where her money is tied up:

Her monthly expenses are quite high, too:

She has seven years left to pay alimony and must wait before her son graduates to sell her house.

The big question here is whether or not she can coast on what she’s saved up. Let’s take a look at some numbers:

Now, let’s look at how long her $4 million in investments and $150,000 in cash will last based on these expenses. Assuming a modest investment return of 4% annually, we can project how long these savings will sustain her.

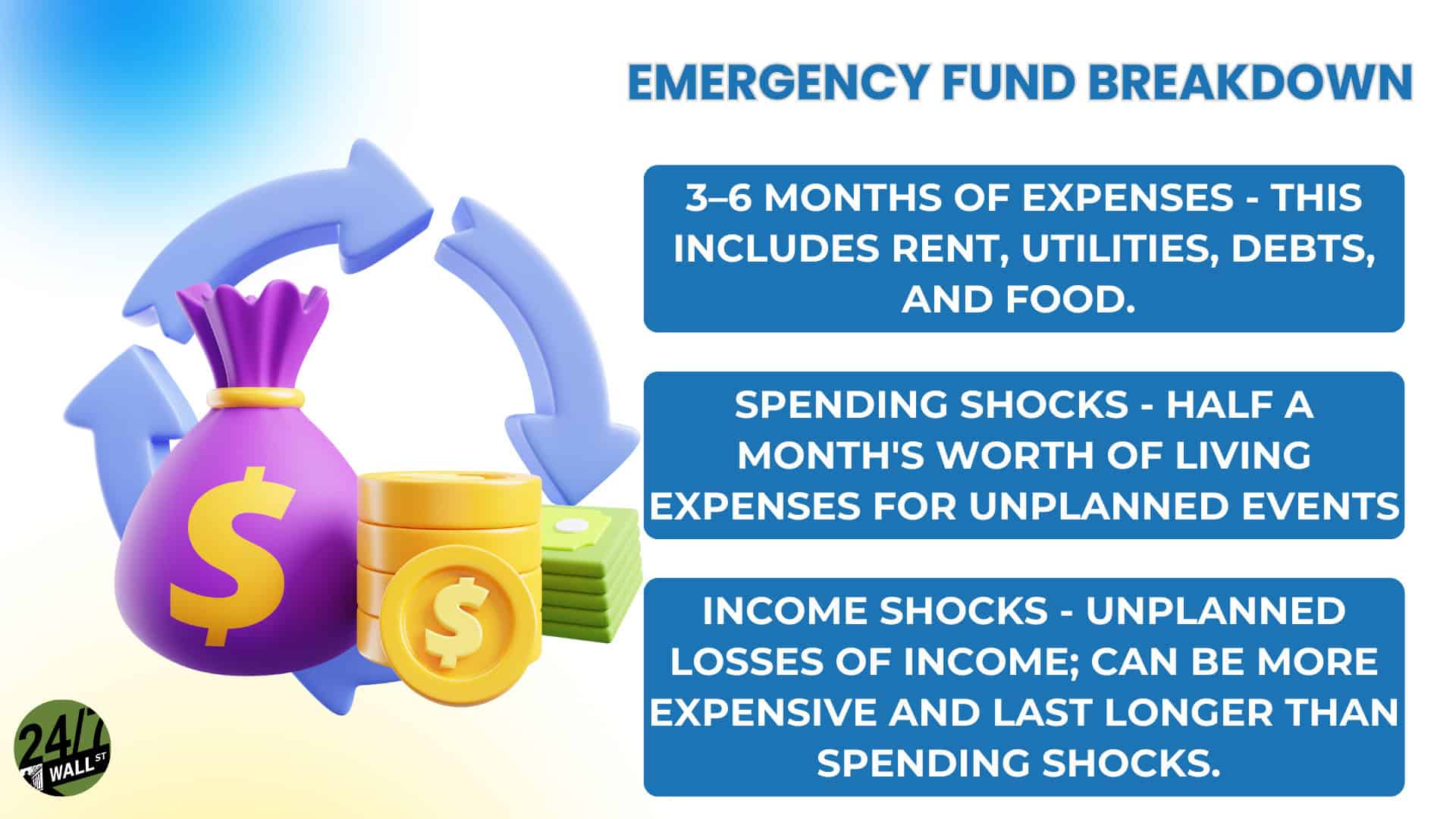

With her current savings and investments, at a safe withdrawal rate of 4%, she could draw around $160,000 annually, which almost covers her $168,000. However, that leaves very little margin for error, emergencies, lifestyle upgrades, or unforeseen expenses, especially over a 50-year period.

Her expenses also won’t drop for another seven years, making this a very tight budget. Furthermore, she may want to have an even lower withdrawal rate, as I recommended previously.

Luckily, she can tap into a consulting gig that makes $100,000 per year, which can help close the gap. However, she would be relying heavily on her savings to maintain her current lifestyle.

Based on these facts, here are a few options she could consider:

The reality is that, even with $4.5 million, quitting a job too early could have long-term financial consequences. Burnout is real and should be taken seriously. However, there are several alternatives to quitting outright that may allow the Redditor to enjoy some more financial security.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.