Personal Finance

If You Have Over $500K, It's Time to Start Asking These Questions

Published:

For those who have amassed over $500,000 in 401(k)s, IRAs, and taxable brokerage accounts, managing wealth effectively becomes even more important to ensure long-term financial security. Reaching this milestone signals that you’ve been diligent in saving and investing, but simply accumulating wealth isn’t enough. Strategic management is crucial to protecting, growing, and maximizing your assets over time.

Here are five key strategies that individuals with over half a million in their retirement and investment accounts should be aware of to optimize their long-term wealth.

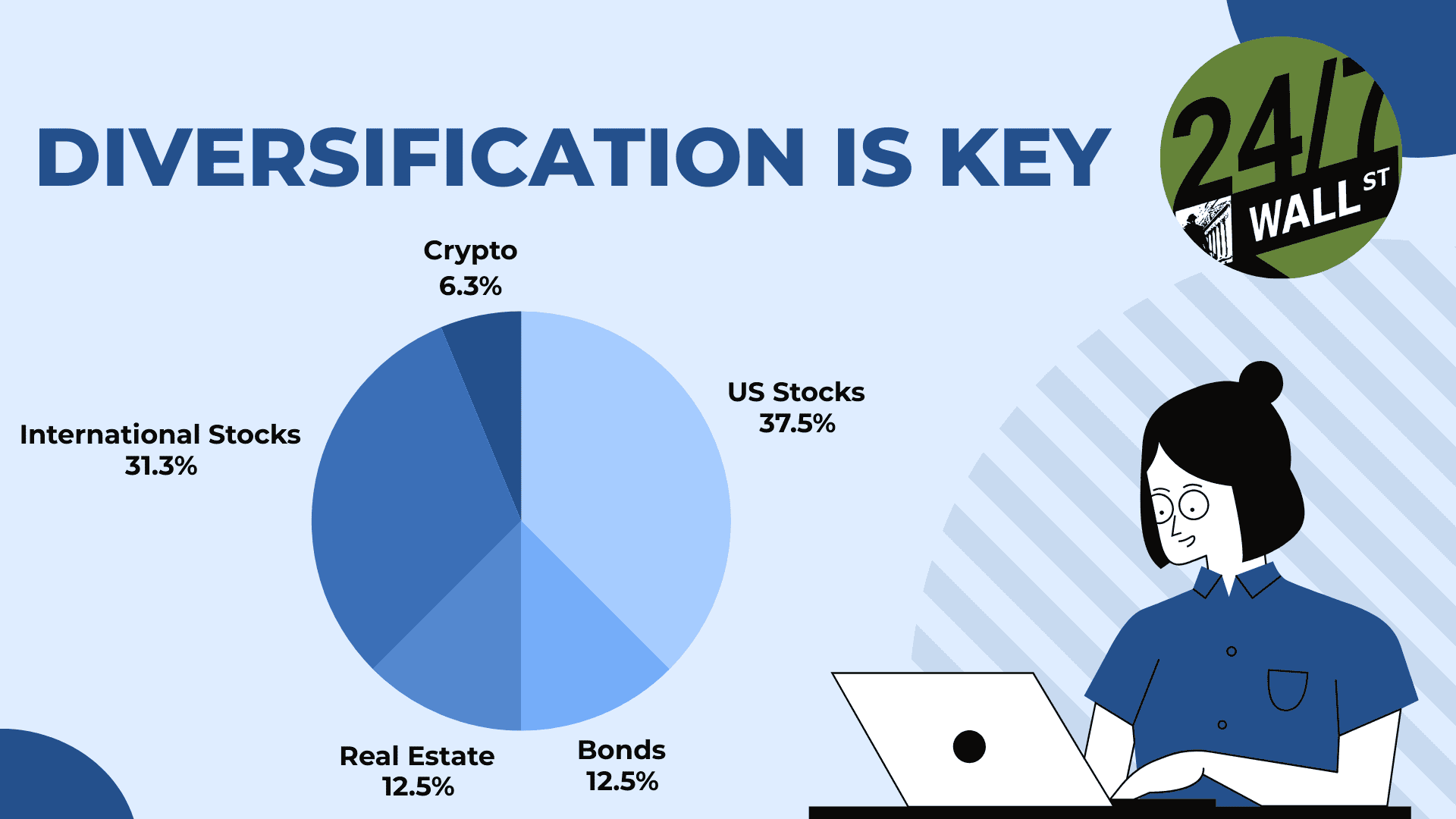

As your wealth grows, so does the importance of having a well-diversified portfolio that aligns with your risk tolerance and long-term goals. Diversification is about spreading your investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, to reduce risk.

For individuals with over $500,000 in assets, periodic rebalancing becomes crucial. Over time, certain investments may grow faster than others, leaving your portfolio unbalanced and possibly riskier than intended. Rebalancing at least once a year or after significant market movements will help keep your portfolio aligned with your financial objectives.

With over $500,000 in taxable and tax-deferred accounts, tax efficiency should be a top priority. Taxes can erode your wealth if you’re not careful, particularly when it comes to withdrawals and investment strategies in taxable accounts. Are you taking full advantage of tax-deferred accounts like 401(k)s and IRAs? Have you considered strategies like Roth conversions or tax-loss harvesting to minimize the tax impact on your investments?

A well-thought-out tax strategy can protect your portfolio from unnecessary tax drag and preserve your wealth over time.

Even with $500,000 or more in assets, high investment fees can eat away at your returns over time. That’s why paying attention to the fees associated with mutual funds, ETFs, and other investment vehicles is critical to optimizing long-term wealth.

Are you reviewing your investment selections for low-cost options? Index funds and ETFs typically offer lower expense ratios than actively managed funds. Reducing fees could significantly boost your portfolio’s long-term growth.

As your assets grow, it’s time to consider estate planning and gifting strategies. Without proper planning, a large portion of your wealth could be lost to taxes and legal fees upon your passing. Have you established a will or a trust to ensure your wealth is transferred according to your wishes? Are you taking advantage of annual gifting limits to reduce your taxable estate?

Estate planning is key to protecting your legacy and ensuring that your wealth benefits your loved ones or the causes you care about most.

As your portfolio grows, the need for expert financial and tax advice becomes more critical. Are you working with a fiduciary financial advisor who is legally obligated to act in your best interest? Are you leveraging the expertise of a tax advisor or CPA to minimize your tax liability?

Hiring the right professionals can ensure you’re making the most of your wealth, while avoiding costly mistakes and missed opportunities.

If you’ve built over $500,000 in retirement accounts and brokerage accounts, congratulations—you’ve taken significant steps toward securing your financial future. Now is the time to shift your focus from accumulating wealth to optimizing it. Regularly rebalancing your portfolio, managing taxes efficiently, minimizing investment fees, planning for your estate, and working with qualified professionals will help ensure that your wealth continues to grow and support your long-term goals.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.