Personal Finance

I'm 46 years old and my 401(k) finally hit $1 million - why did it take so long?

Published:

Last Updated:

You graduated college and entered the working world at 21, setting a goal to have $1 million in your 401(k) within a decade. Instead, you hit your target at 46, 15 years later than your original plan.

What went wrong? What drove you so far off course in achieving this significant life goal?

Truthfully, life happened, and perhaps a little naivety about the time required to amass $1 million in savings. By understanding a few financial data points, you’ll see that hitting your goal at 46 is still a significant accomplishment to celebrate.

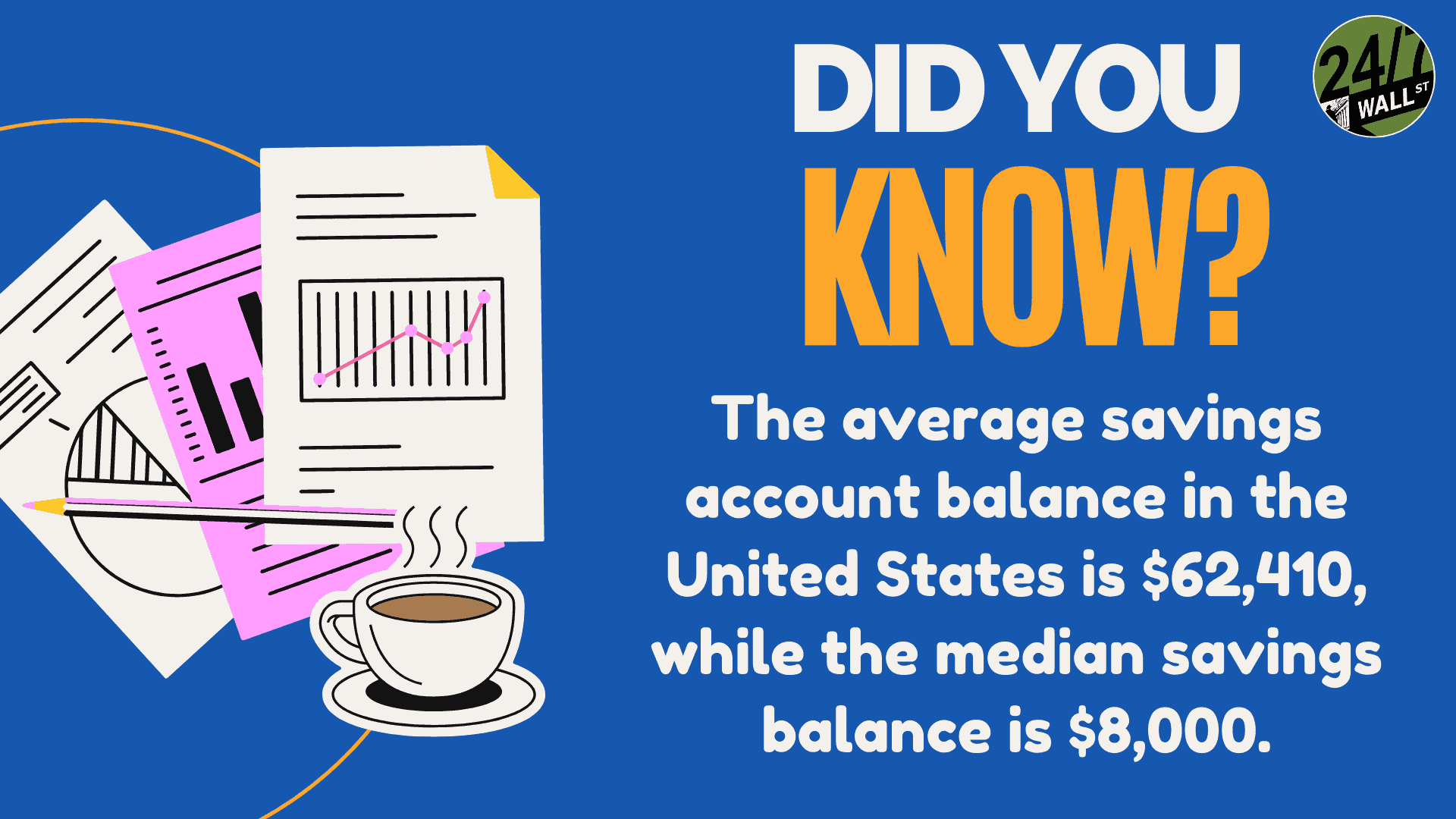

Most Americans could improve their savings and investing, and they often require 30 or more years in the workforce to reach their retirement and savings goals.

Here are three reasons why.

The U.S. Bureau of Labor Statistics says that the median income of American workers peaks between 45 and 54. You hit your $1 million target right at the beginning of those peak earning years. You should commend yourself for your persistence and focus on reaching your goal.

There are many 401(k) retirement calculators online that you can use to estimate the size of your 401(k) account value at retirement. Here are the assumptions for someone looking to hit $1 million by 31:

Based on these assumptions, you would have $111,456 in your 401(k) at 31, which means to reach your $1 million target in a decade, you’ll have to earn and contribute a lot more and take greater risks to accelerate your investment returns.

Let’s raise your starting salary to $60,000, increase your contribution by 20%, increase your salary by 10% annually, and bump your expected rate of return to 10%. Based on these changes to the assumptions, you would have $426,235 by 31, less than halfway to your target.

Now, if you go back to the original assumptions but change the retirement age from 31 to 46, your retirement portfolio would have $1,060,719–right on the button. Not to mention, you’re just entering your highest earning years.

Experts say buying a house is one of the best ways to save because you’re forced to do it, or you could lose your home. The 401(k), however, is on you. No one will knock on your door to remind you that you’ve got 401(k) contributions to make.

Your 401(k) provider would give you some hints that your account needs feeding. Also, your employer might if they have automatic enrollment.

“Automatic contribution arrangements allow employers to ‘enroll’ eligible employees in the retirement plan automatically unless the employee affirmatively elects not to participate. ‘Enroll’ means that the employer contributes part of the employee’s wages to the retirement plan on the employee’s behalf,” states the IRS frequently asked questions page.

Although the 401(k) is an important retirement savings vehicle, the average American’s home is their largest asset. According to the Pew Research Center, 62% of U.S. households owned their primary residence as of 2021, with an average home equity of $174,000. Meanwhile, the average retirement account was valued at $76,000, less than half that amount.

Except for the highest income earners, monthly mortgage payments can impede your ability to make larger contributions to your 401(k). Don’t let this diminish your savings accomplishments.

According to the JPMorgan Chase Institute, 63% of households earning $26,000 less couldn’t cover an unexpected $1,600 expense as of Dec. 31, 2023. However, the percentage falls to 3% for households with incomes over $93,000.

The average American’s everyday unexpected expenses include out-of-pocket medical expenses, car repairs, emergency vet care, and broken furnace and air conditioner repairs.

“The Federal Reserve’s yearly study found that more than one-in-five adults struggle to pay their bills in full each month, and an unexpected cost could lead to ongoing bill disruption. Having backlogged or unpaid bills can lead to other financial issues, like growing debt or credit score issues,” states U.S. Bank’s personal finance webpage.

There will be times in your life that will temporarily reduce your ability to save for retirement through the 401(k). That’s especially true if you own a home and make monthly mortgage payments.

Unless you can make up for the paused savings, unexpected living expenses could affect your ability to meet your $1 million 401(k) target.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.