Personal Finance

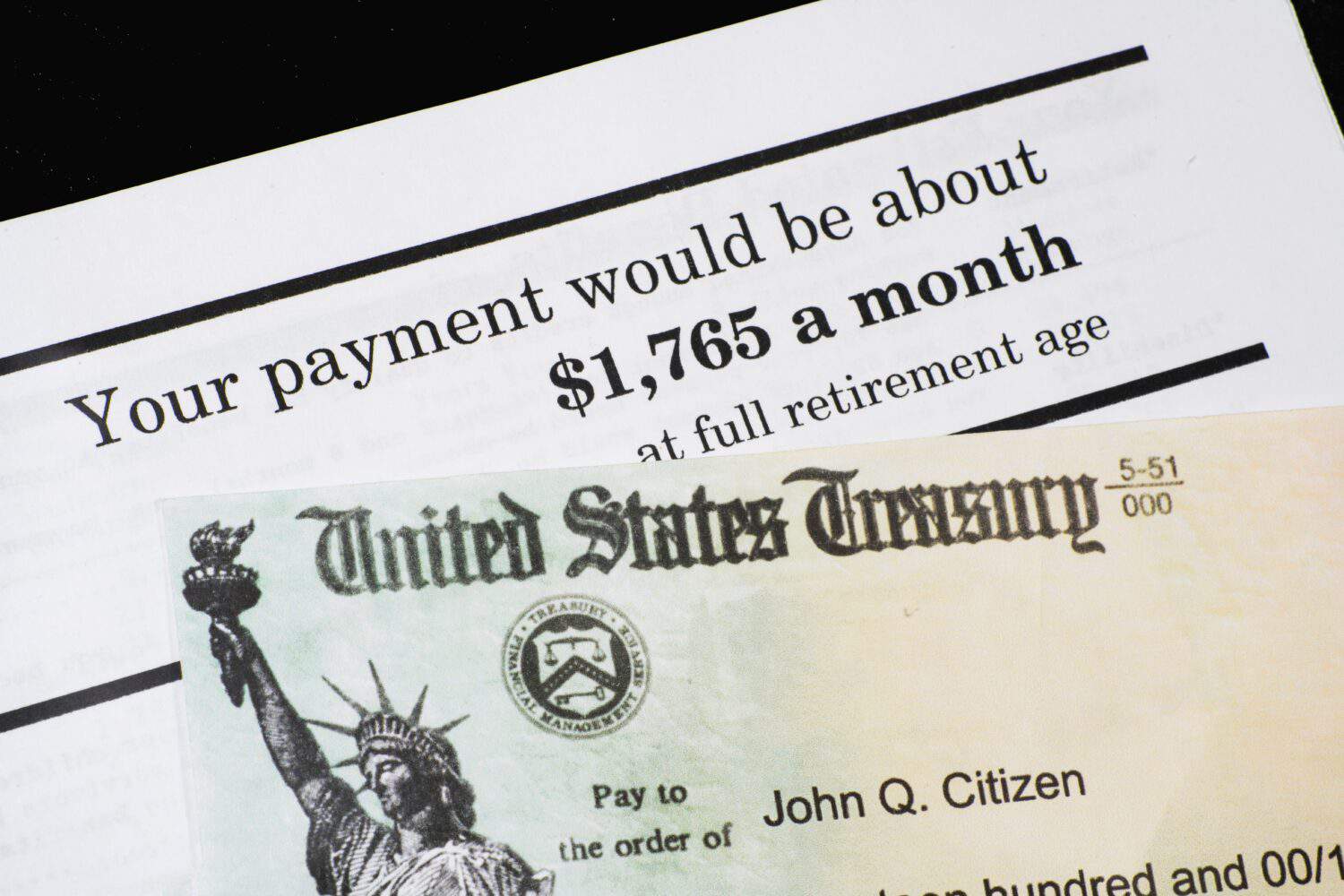

Suze Orman says this 'Social Security norm' is costing Americans thousands of dollars of retirement income

Published:

Last Updated:

Financial guru Suze Orman offers a wealth of helpful, sometimes surprising insights for savings gearing up for retirement. Even if you’re not a big fan of Suze, her views and opinions are worth listening to, especially if you’re unsure as to when the perfect time to start receiving social security benefits.

In a prior piece, I highlighted Dave Ramsey’s view that retirees should opt to take social security at 62, the youngest age one can opt in. Indeed, choosing not to delay gratification may be a rather aggressive move that’s not right for those with a low risk tolerance and a rather limited nest egg for their age. Ramsey’s points were pretty clear: taking social security sooner will allow one greater financial wiggle room and perhaps even a good shot at better returns compared to those who take social security at 70.

Most notably, investing one’s funds received at 62 in a passive investment product — think a mutual fund or index exchange-traded fund (ETF) — may just allow one to stay flexible and on the growth track. Indeed, it does not take any exceptional skill to score a decent return over a timespan longer than four or five years.

An S&P 500 ETF that boasts a low expense ratio is more than enough to help retirees continue building their nest egg as they put their social security benefits to work as soon as possible. Additionally, I noted that skilled contrarian investors would likely be better off with the means to buy stocks on those inevitable market sell-offs that come one’s way.

I’d be more inclined to stick with Ramsey, who’s on the more aggressive extreme (take social security at 62), over Orman’s conservative extreme (who recommends waiting until 70 to receive the maximum benefit).

That said, if you’re a retiree or soon-to-be retiree who’s nervous about market volatility, it may make sense to take all market risk off the table by taking social security later rather than taking it sooner and investing the amount you won’t need in retirement. That’s when Orman’s strategy could be the better course of action.

Of course, the perfect middle ground lies somewhere in the middle of the two extremes. Whether you’re leaning more towards Ramsey or Orman, you should really consult a professional financial advisor who can better know your situation at a more personalized level.

Either way, the “social security norm” for many is to take social security benefits once they’re officially retired. For some, it’s 62; for others, it’s closer to 70. Regardless, one opts into social security once they’re officially retired. Indeed, it’s a simple plan that makes sense for many people, especially since one needs the income supplement once they’re no longer on the job.

Orman argues that subscribing to such a “norm” could cost retirees dearly, especially for those who retire in their earlier 60s and take benefits at 62.

By delaying social security benefits until 70, benefit amounts can rise in the ballpark of 8% annually. That’s a solid return, which Orman points out is risk-free. Sure, a retiree who takes benefits before 65 could score far better than 8% by investing the proceeds in the S&P 500 or individual stocks they deem as undervalued. However, such a return will entail bearing some degree of risk. Further, it would be very hard to land a high single-digit return on a low- to no-risk type of investment, especially in a falling-rate environment.

Though a lengthy investment horizon (let’s say more than five years) can help one mitigate some market risks (you’ll be invested long enough to recover from particular nasty sell-offs), it’s still not free from risk. Sometimes, the smaller risk-free return is better than the superior risky return. And in the case of delaying social security benefits until 70, you’ll maximize your risk-free return.

Arguably, that’s the smart move for retirees who just aren’t comfortable with risk and would rather sleep comfortably at night knowing they’ll maximize their risk-adjusted returns.

Of course, if you retire at 62 and wait until 70 before opting into social security, you’ll be waiting a long time, perhaps too long, depending on your needs. In any case, Orman’s case for taking social security benefits makes a lot of sense when considering just how good a deal a high single-digit percentage risk-free return is.

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.