Personal Finance

This Is How Much You Need to Make to Comfortably Afford a $1 Million Home

Published:

After dipping a little bit last month, mortgage rates have started to keep back up in the first half of October – leading many prospective homebuyers to question if now is the right time to make their move—especially for high-end properties.

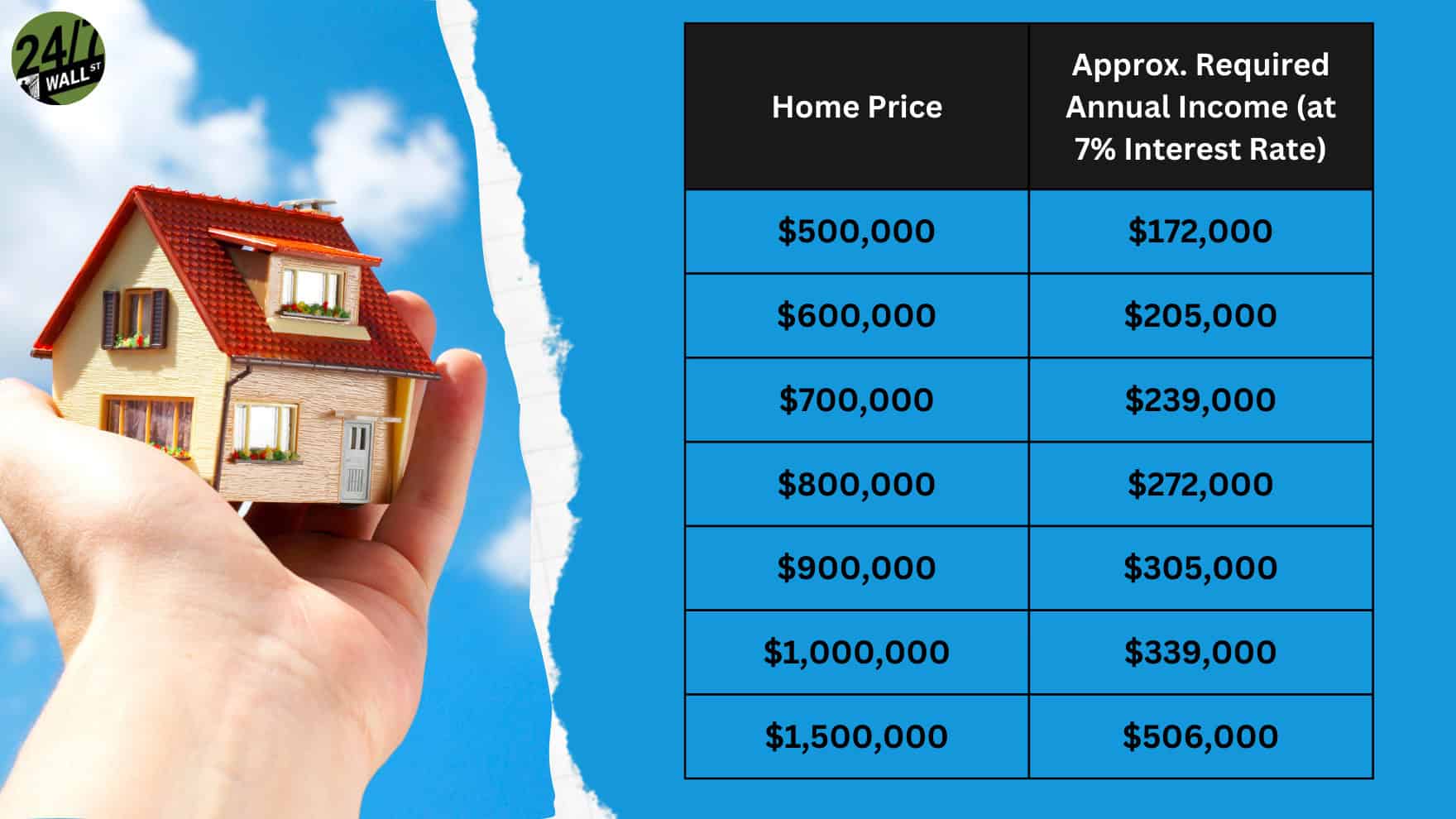

For those eyeing homes priced in the $1 million range, it’s critical to approach such a purchase with a clear understanding of the financial commitment involved. With mortgage rates still in the 6-7% range, you’ll need a high income to afford a home in this price range.

So, just how much do you need to make to afford a $1 million house in today’s market? Let’s break it down.

The “28% rule” is a widely accepted guideline that suggests spending no more than 28% of your gross monthly income on housing costs, including mortgage payments, property taxes, and insurance.

The rationale behind this rule is to ensure you have enough left over for other expenses like debt payments, savings, and life’s other necessities. However, with rising living costs and economic uncertainties, here at 24/7 Wall St., we suggest capping housing expenses at 22%.

By keeping your housing costs lower, you give yourself a larger financial cushion to handle unexpected expenses, invest more in savings or retirement, and avoid feeling “house-poor.”

For the purpose of this scenario, let’s assume you want to buy a house in Nashville, TN and your mortgage broker is able to lock you in at a 7% 30-year mortgage rate.

We also need to factor in Nashville’s typical property tax rate of 0.95% and homeowners insurance of approximately $1,200 per year.

Using our more conservative figure of 22%, a total monthly payment, including mortgage, taxes, and insurance, would be about $6,212, meaning someone would need to bring in an annual income of roughly $339,000 to comfortably afford this home without overextending their budget.

While we still have a long way to go before we get to 4% mortgage rates again, it’s possible it happens again. If that does happen, the total monthly payment for the $1 million home (including mortgage, property taxes, and insurance) would decrease. In this case, you would only need to earn approximately $250,000 annually to afford the home while keeping housing costs with that 22% guideline.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.