Personal Finance

I’m 52 with $7.8 million saved – can I retire and send my kids to college?

Published:

For all intents and purposes, our primary function in life is to work long enough as to build up enough worth to retire comfortably. In the case of one Redditor, this post shows that sometimes the decision to retire isn’t so easy. Of course, everyone has a different number in mind for when they might be ready to call it quits.

For this post in r/fatFIRE, this Redditor has a comfortable net worth of $7.8 million and is considering whether it’s enough to send his kids to college. Additionally, he desires to reduce the amount of work, which we can all agree on. As someone who is also saving for two kids to go to college, I’m right here with the same concerns about the cost of school, minus the whole “I have millions” part.

To the Redditor in this situation, please note that this isn’t financial advice but my opinion on your situation. To lay this out, we should start with the basics: you have approximately $7.8 million spread across bonds, stocks, and retirement accounts. You’re also faced with deciding whether to work another four years and cross the $10 million, which obviously would put off retirement.

Another potential scenario you floated is that you can cut your work hours down from full-time but with a significant drop in income. This said, we all hear you are concerned about burnout, and it’s definitely something to consider, especially when you have a comfortable cushion that allows you to step away from a full-time role.

While sending your kids to college might be a primary focus, you must also consider your living expenses. What’s not mentioned here is something I found interesting, and that is around the home. There is no mention of a house, a desire to travel, or anything else you might want to do in retirement. In addition, while there is a mention of car insurance, we don’t get any info about the type of cars being driven or what they might cost. As your kids are just about to go to college, do they also have a vehicle, and if so, what does that do to your monthly car expenses and additional insurance costs? All of these extra factors can add up to significantly more monthly expenses.

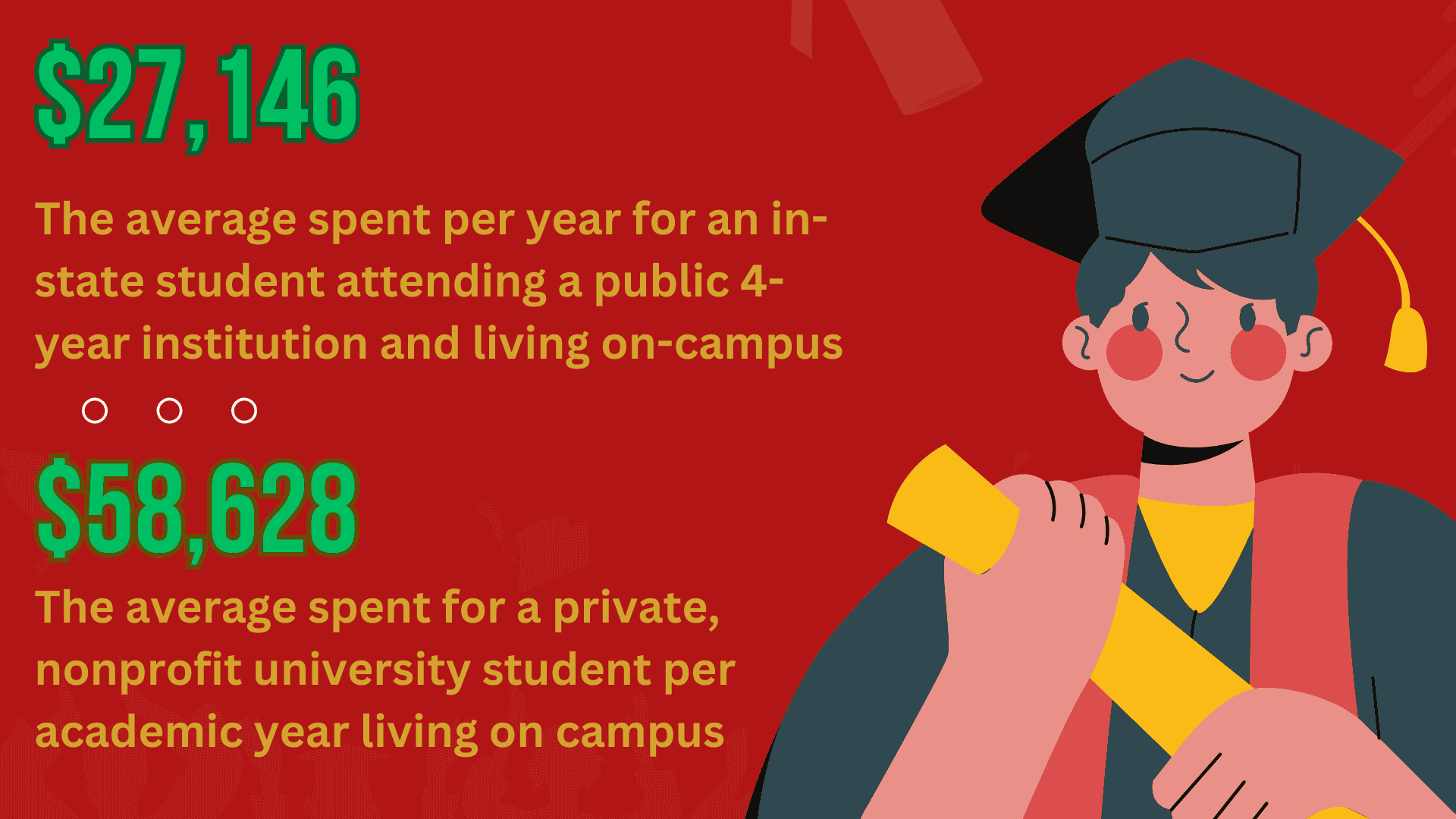

Regarding college costs, I’m also wondering if your $300,000 per child also accounts for living expenses, or is it just tuition? I know full well that college costs can vary wildly depending on whether we discuss a public or private institution. This makes me wonder if this $600,000 accounts for room and board.

The average cost of attending a private school in the U.S. is approaching the $50,000 mark per year, which isn’t likely to drop. While we all hope inflation goes down over the next several years, the cost of a four-year private education could easily exceed $300,000 per child when his children are ready to leave for school. Having a 529 college plan is going to help, but it’s not a solve for the Redditor’s question.

Last but not least, how you are structuring your investment planning will answer the question of whether you can comfortably downsize your job now and begin to enjoy life a little more. He is building a retirement model that assumes an 8% return at 3% inflation, but inflation costs around college are hovering around 5-6% right now, which speaks to where your $300,000 per child figure might be off. In other words, you might need to take another swing at your investment structure.

While the Redditor’s post is arguably mostly about college, there’s also a note about his parents passing away at 69 and 72. As a 52-year-old, this Redditor is concerned about outliving them and knows he wants more time. In this case, I would again argue that he should crunch the numbers and make as much as possible over the next four years to maximize the financial situation and then retire altogether. Right now, if you want to “coast,” that’s fine. However, if the plan is about getting to the $10 million mark, stopping working, and living off your investment strategy, you must push as hard as possible.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.