Personal Finance

I’m 45 with almost $5 million and want to quit my job but I can’t pull the trigger

Published:

For most people, having $5 million would be an automatic reason to quit working as hard as they do. In the case of one Redditor on the fatFIRE subreddit, they want to leave their job but can’t bring themselves to say the words. In this instance, the question isn’t about retirement but rather about taking on another job that earns less but offers a far better work/life balance before they turn 50.

The Redditor wonders if quitting his high-income job is the right move and what impact it will have on the wealth he is building for his family and children. Another question causing a bit of strife is what if he needs to take care of ailing parents down the road. There is no right (or wrong) answer, but there are some factors this Redditor should consider.

As someone in his early 40s, I’m very interested in this line of thinking. It’s a great example of where you could be with smart finances and a great job. Of course, I’m not a financial advisor, and this is just my opinion. More importantly, no one answer works every time.

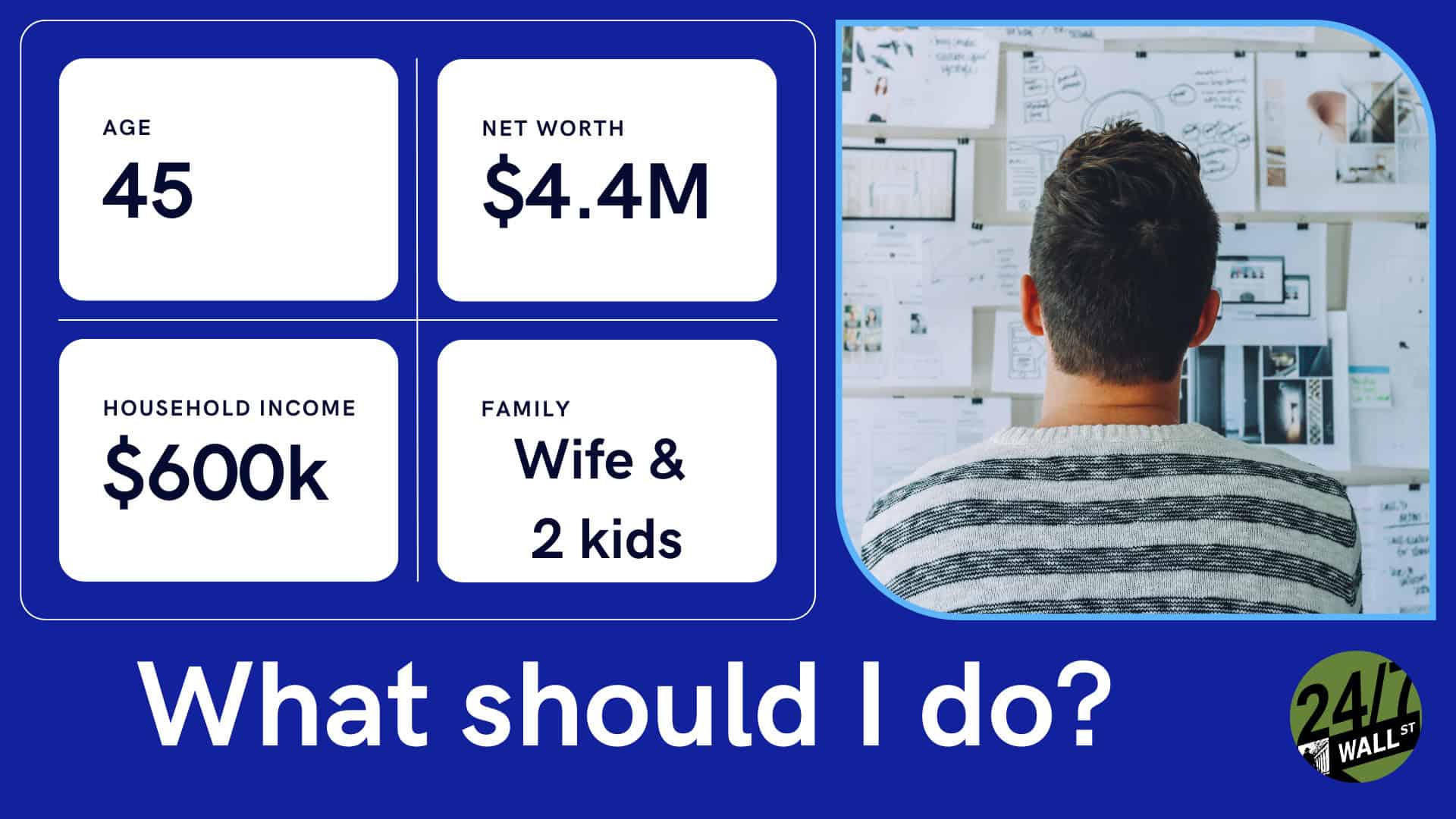

In this case, you have a Redditor with a net worth of approximately $4.4 million, not including potential profits from two homes. You also have two kids who are not yet college-aged, a combined income with a spouse of around $600K, and total family spending of around $210K annually. This Redditor asks if he should take a new job offering remote work but would cut the family net income to $350K.

He also notes that job security wouldn’t be as strong as it is at his current job, so that’s another factor to consider. He is considering staying in his current role for another three years until he adds another million in net worth. This consideration is based on potential spending needs in the future, like big trips, family support for aging parents, and building up generational wealth for his children.

So, let’s talk about the primary concerns, as a few jump out to me immediately. Note that I am not giving anyone financial advice. First and foremost, taking an income hit of $600K to $350K isn’t a small drop. It’s a major one. No matter what your net worth is now, there is no question this will cause a lifestyle change. It’s also mentioned that this new job offers more flexibility but less job security, which seems less than ideal in the current job market.

This means you’re not only taking an income hit but also adding to your stress level, even if you travel less and cook more to offset the drop in income. So far, my reading on this scenario is that the pros of this new opportunity don’t seem to outweigh the cons in any meaningful way.

With the idea that you are not just taking a hit, let’s now talk about the worst-case scenario. If you step down to a lower income, the pressure gets passed to your wife, who now has the additional stress of not being able to lose her “super secure job.” So now you and your wife have potentially more stress about not losing either job.

Stress aside for the moment, what are the positives of this scenario? For starters, less stress in your career without the need to travel as much sounds great. The same can be said for spending more time at home cooking and time with your kids before they head off for college. Adjusting your lifestyle to make everyone happy while still bringing home a significant income could be a win-win.

Ideally, the reality is that this person needs to set a goal with a number and keep working until they hit that number. As it sounds like he isn’t completely sold on the number he is at now, I don’t think anyone is ready to make life-altering changes to their income levels.

The r/fatFIRE subreddit is about trying to retire early and enjoy life, and it doesn’t sound like we’re at that point yet. I’d keep going with my current job and build up some additional income before making any dramatic life changes.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.