Personal Finance

I'm in my late 40s and have already hit my retirement goal - I want to sell my business but I don't think my business partner will want to

Published:

24/7 Wall St. Key Takeaways:

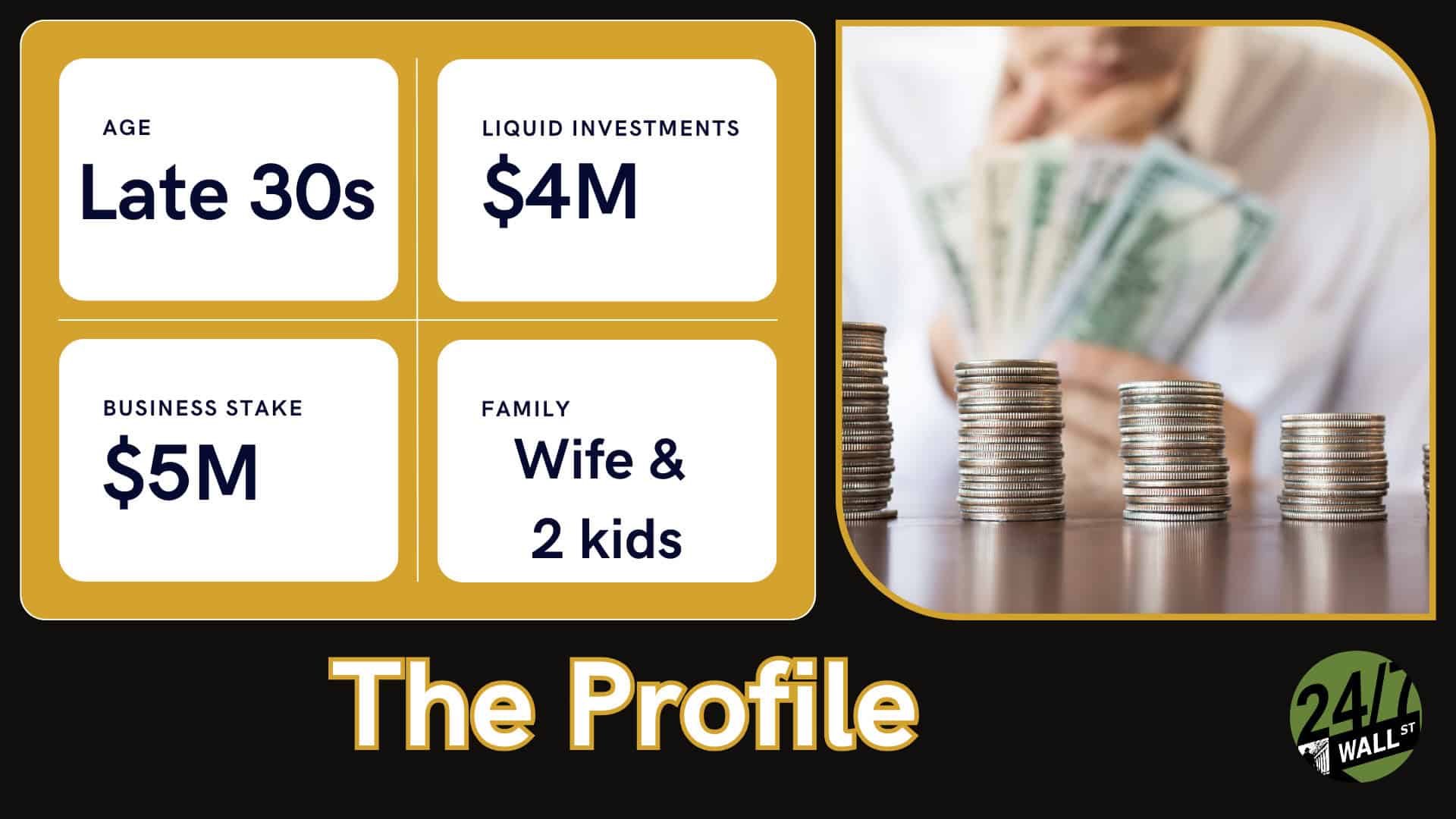

I recently came across a Reddit post with an interesting dilemma. A man in his 30s shared that he had hit his financial independence goal but faced a key problem: he still owns half of a business he no longer wants to be a part of. The company currently pays him between $800K and $1.2M each year, and his half of the company is valued at $5 million. But he feels burnt out and wishes to step away.

That said, selling and leaving are complicated by several factors, including his business partner’s resistance.

This post shows how complicated becoming financially independent is, even after you’ve hit your goal number in the bank. It isn’t just about numbers.

Here’s a breakdown of his situation and my advice. Remember, this is just my opinion, not financial advice:

Let’s take a minute to appreciate that this Redditor has reached a huge milestone. He has $4 million in investments on top of $1 million in other assets. His $10k/month spending needs are fully covered! He looks like he’s in a great position to retire. But…

Despite hitting his goals, most of his investment is tied up in company stock. He owns 50% of a business that has been highly lucrative but is now draining him emotionally. The business is still going well, but he wants to sell his shares. There are several problems in his way, though:

Given his situation, here are a few different paths I recommend:

Instead of walking away entirely, a gradual reduction in hours or responsibilities could help manage burnout while keeping the business’s financial benefit. He could consider hiring more employees to delegate tasks to, potentially lowering his salary to pay for these new employees. This transition can provide some relief from burnout while still maintaining some income and avoiding the complicated path of selling his business shares.

Though his business partner may not want to sell the company, there could be an opportunity to negotiate an internal buyout. If the business is successful, the partner might eventually be interested in purchasing his stake. This is often easier than bringing in an outside investor to fund the buyout.

This path could even be done gradually, as well. The business partner could purchase the poster’s shares in chunks, instead of all at the same time.

If the Redditor is set on selling his shares, I would recommend professional mediation. Often, it’s much easier to sell if professional relationships aren’t soured before mediation is sought. Early is better than too late.

Before any major decisions are made, I would recommend a sabbatical. It sounds like the poster is experiencing some difficult burnout, and it is very hard to make good decisions when your brain is already fried. Taking a few months off can give the poster the space he needs to recover and take a fresh look at the situation.

This reminds me of a similar Reddit post I discussed where burnout played a huge role.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.