Personal Finance

I'm set to inherit millions but I feel uneasy about it - what if my kids won't work hard enough?

Published:

Last Updated:

It may be true that great power requires great responsibility, but I think that’s a concept that’s true of households that have built significant wealth. Plenty of Reddit posts have put forward the reality of coming to inherit significant sums of money. And if that sounds great to you, it may not be all sunshine and rainbows at the end of the day.

In fact, there are certainly plenty of situations where those receiving significant inheritances feel uneasy about the situations. Whether that’s due to the stress of growing this wealth during their time (and living up to their parents’ expectations) or simply feelings of guilt for having more than others and not knowing what to do with so much money, it’s an intriguing problem to think about.

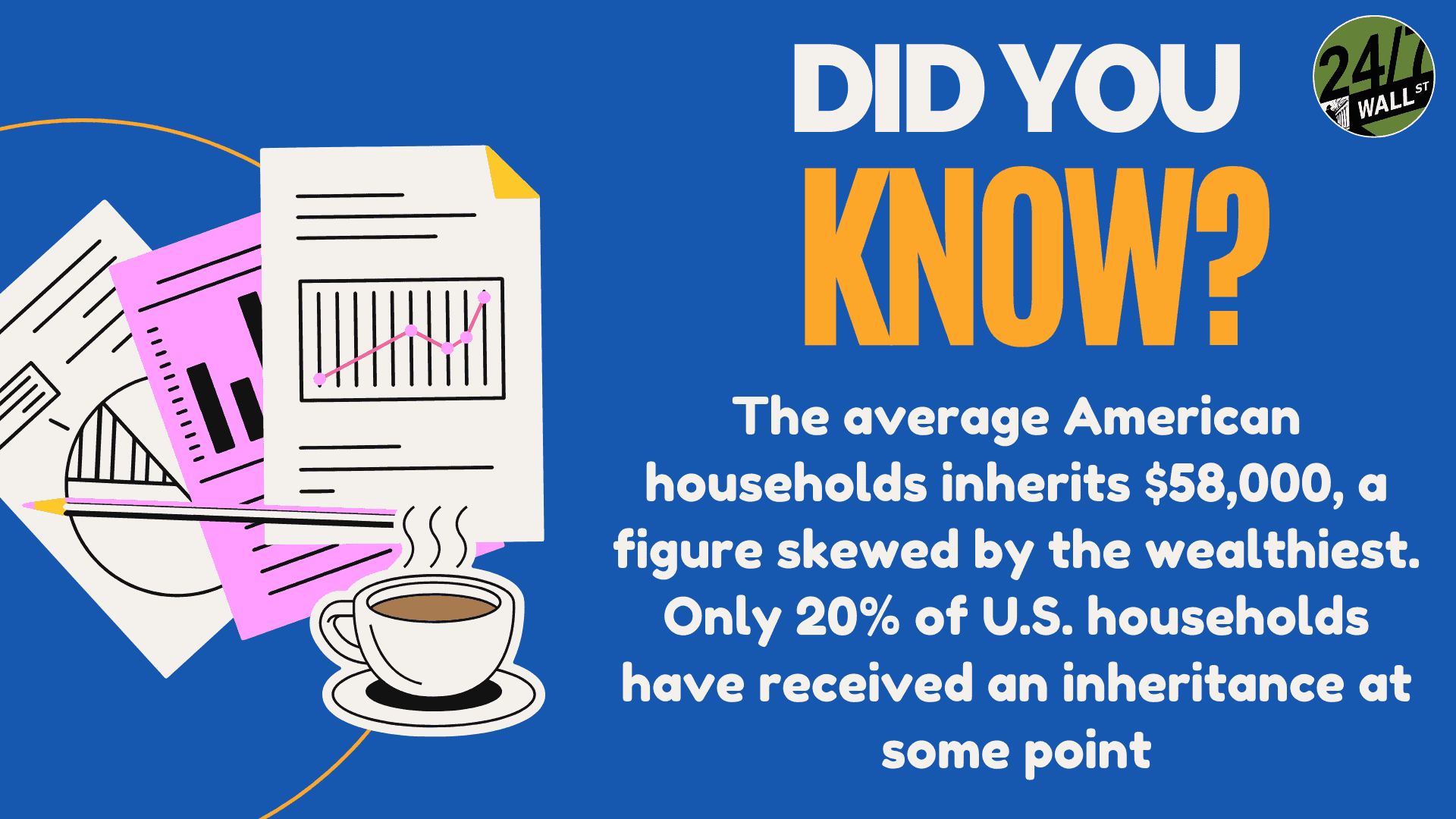

The idea of having a seven or eight-figure portfolio to manage may be one that most readers would be okay with. But I have no doubt that such a large sum would come with some significant stress, and is a situation worth diving into for many households out there. Indeed, in many coastal parts of the country, what would be considered a “median” or middle-class home can fetch millions of dollars. With retirement accounts and other assets, passing down eight figures ($10 million or more) can be more commonplace than many think.

Let’s dive into such a situation, and what parents looking to pass down this wealth, and kids expecting to receive such a sum, may want to think about.

Inheriting a substantial fortune can be a double-edged sword. On the one hand, such a distribution of wealth is obviously positive. Having enough to be able to sleep at night and not worry about finances is great. Being able to take care of your family and future generations as well is an added bonus.

However, it’s also true that large sums of money often come with strings attached. And for many, receiving millions of dollars can come with feelings of guilt and isolation.

The Reddit post mentioned at the beginning of this article highlighted the sorts of someone who felt that possessing wealth that others desperately need led to such feelings of guilt, and an internal conflict which appears to stem from a heightened awareness of societal inequalities. While these sorts of feelings can be overcome by some sort of charitable giving plan, and allow the user to benefit from the positive feelings that can come with giving away wealth, the immediate shock of receiving such a large sum of money ought to be considered.

Additionally, children receiving a large inheritance from their successful parents may feel like a failure if they lose that money or don’t live up to that legacy. Again, these feelings are specific to the individual, but are common among the threads I’ve read of those discussing this phenomenon.

Setting up a trust fund can feel like something only rich people do. But we’re now living in a time where a few million may not actually be that much after all, particularly for those planning on retiring and living a few decades. So, for those looking to pass down a few million, or even $10 million plus, setting up a trust can be a great way to have one’s wishes respected when they’re gone.

Estate planning is crucial for many families, and trusts can be in an integral piece of this process. Trusts provide a structured way for wealth to be transferred across generations, potentially offering tax advantages and asset protection (which can vary by jurisdiction).

I’m thinking about setting up a revocable trust, which is a format that can be altered (or revoked) during the grantor’s lifetime. Such a trust is very flexible, and has advantages over revocable trusts which cannot be changed once set up. Another option is a discretionary trust, which allows the trustees to decide when and how much to receive at certain intervals, allowing for more tailored support over time based on individual needs (but requiring a lot more trust).

The goal of setting up a trust should be to encourage the personal growth of the trustees and responsible stewardship. That said, certain provisions can assist heirs in providing the guardrails that may be necessary to allows for this wealth to last.

Perhaps the greatest gift any parent looking to pass down wealth to their children can provide is financial education. Involving one’s kids in the entire wealth-building process can create an understanding of financial principles that can help guide one’s descendants to make the best decisions for their own sake when they’re older as well.

I think financial literacy is an increasingly important concept in today’s asset economy. We’re moving from an economy which has allowed folks to earn with their hands and their back, and buy assets over time. Now, assets can generate far more than one’s income over very long periods of time, and managing these assets can be a much more important job in many respects than receiving a raise at one’s job.

The fact that we’re in an investor-led economy should benefit those receiving large inheritances. However, it’s really no help if those investing the money have no idea what they’re doing, or why. For those who don’t have the time to teach their kids everything they need to know, having a team in place which can help their kids once they pass (a trusted financial advisor, for example) can be a great option.

Inheriting and managing significant wealth is a journey I wish for many readers. The common themes of creating autonomy, discipline and responsibility with money really permeate this piece, and diving into some personal stories of those who expect to receive large inheritances can shed some light on how wealthy (or upper-middle class folks) looking to pass down a few million dollars to their kids may want to think about the process.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.