According to a 2024 MassMutual survey, the average American worker retires at 62, up from 57 in 1991. Given that the average life expectancy of Americans in 2024 is 79.25, which is nearly four years higher than in 1991, the push higher makes sense.

Let’s assume you’re average in every way and plan to retire at 62, 20 years from now.

It’s not just about saving diligently; it also means investing with a longer time horizon while controlling expenses wherever possible without diminishing your quality of life.

Author and syndicated radio host Dave Ramsey has been helping people stay on track financially for over 30 years. He believes the most significant thing you can do is get on a budget.

“If you’re not budgeting, you’re basically just winging it every month, just hoping there’s enough money to keep the lights on and food on the table. Believe me, that doesn’t fly very long!,” Yahoo Finance reported in June.

Just as it’s wise to have a budget when planning for your retirement in 20 years, these three money tips will help you get there.

Work Backwards to Find Your Target

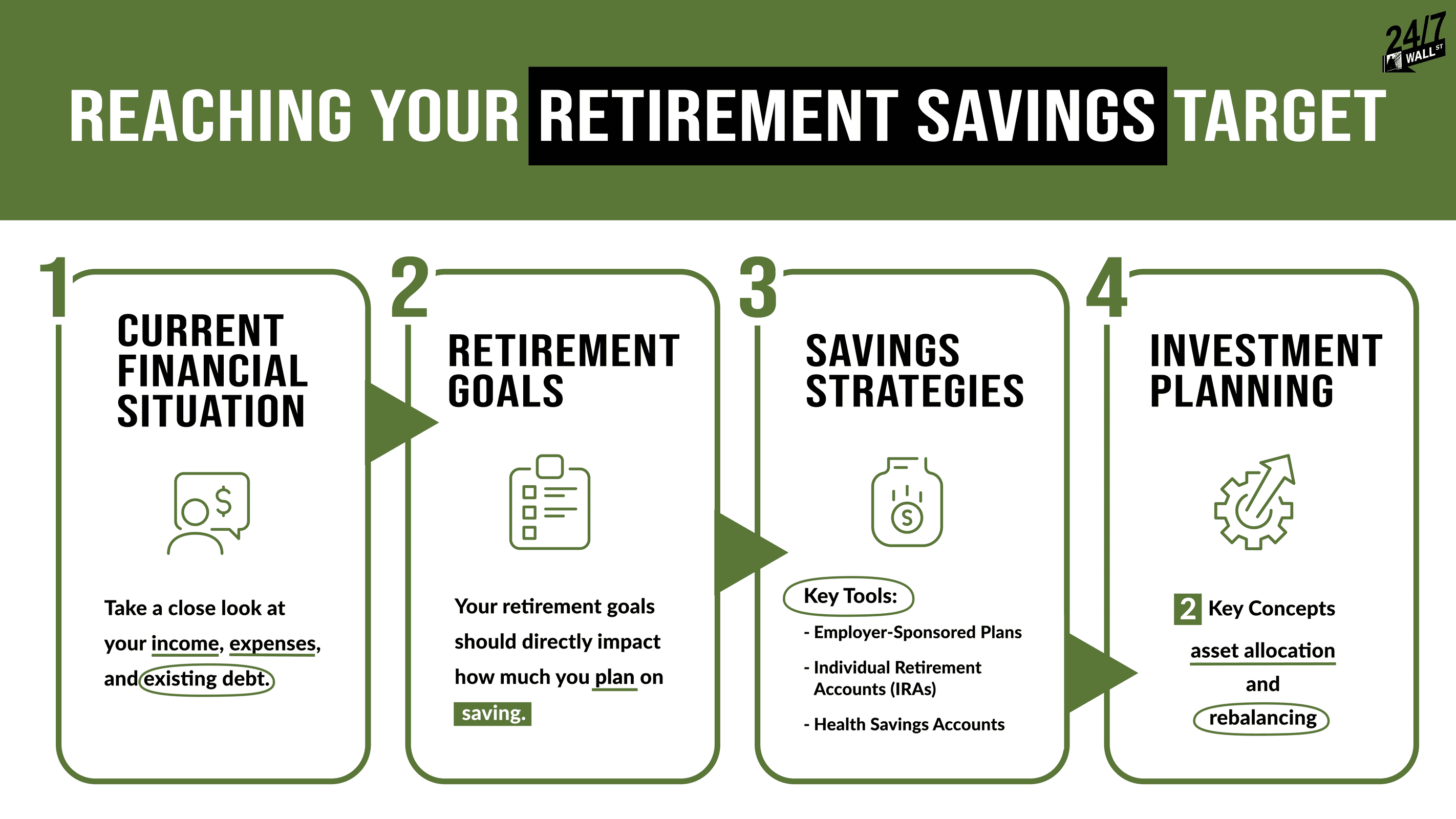

Before you figure out what you need to do today to help you meet your 20-year retirement target, it’s essential to understand how much money you’ll need to live once you get there.

Fidelity Investments estimates that you will need between 55% and 80% of your annual income earned in the year before you retire. It suggests that the more active you are, the higher the percentage will be.

Further, you will likely spend more in the earlier years of your retirement on travel and other fun activities. Later on, healthcare costs become a more significant part of your living expenses. You will spend, on average, about 15% of your annual living expenses on health care.

There are retirement calculators to help you estimate the dollar amount you’ll need in savings at age 62 to meet your annual income in retirement.

Using Vanguard’s retirement income calculator, you’ll get a general idea. Everyone’s situation will be different.

Here are six assumptions:

| Assumption | Details |

|---|---|

| Age | 42 years old |

| Current Annual Income | $100,000 |

| Retirement Savings | $100,000 |

| Annual Savings Rate | 10% of annual income |

| Retirement Income Goal | 80% of current income |

| Estimated Annual Return | 8.2% |

Based on these six assumptions, your estimated monthly expenses of $6,667 would exceed your monthly income by 69%. Adjusting the amount saved each year to 20% reduces the deficit to 52%.

It’s important to note that the assumptions used are conservative. Further, it doesn’t consider any tax savings from registered investment accounts, marital status, etc.

The critical thing to remember is that the earlier you begin working toward your retirement target, the more likely you are to achieve it.

Pay Yourself First

This personal finance strategy recommends that individuals and families take a percentage or dollar amount of every paycheck and allocate that to savings before they use the funds for anything else, including debt repayment and other monthly bills and obligations.

Essentially, it becomes another expense you’re prepared for and can pay as part of your monthly household expenses. In addition, it helps you reduce unnecessary spending on things that will have little or no appreciative value in the future.

As you look to reach your retirement goals, this strategy helps you develop disciplined savings habits that will translate into hitting your targets. This will allow you to retire in 20 years at age 62 with a comfortable lifestyle.

Maximize Your 401(k) and Other Tax-Advantaged Accounts

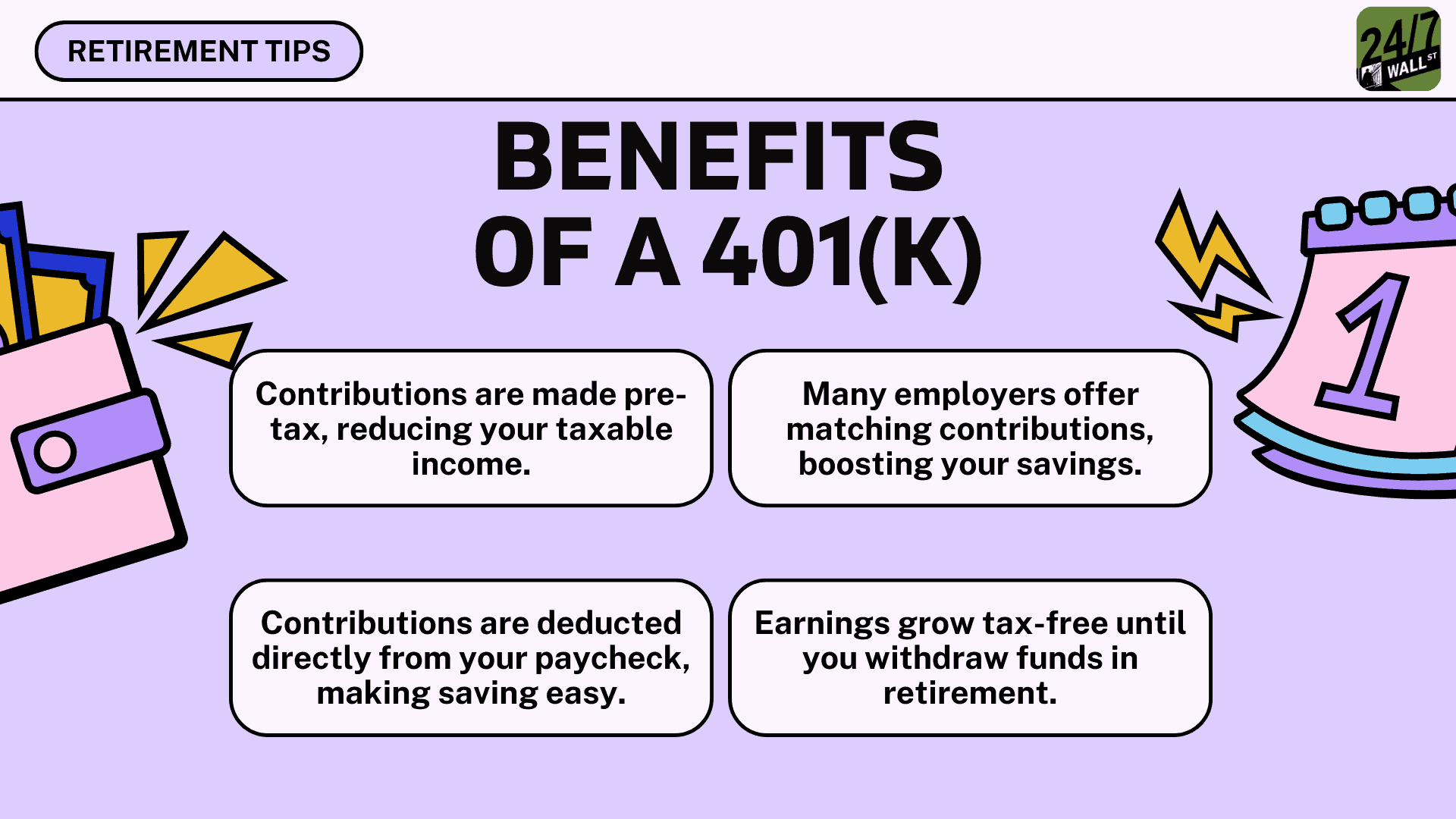

The federal government provides households and individuals with tax-advantaged investment and savings accounts such as the 401(k) to reduce your annual taxes paid while growing your savings inside these accounts by deferring or avoiding taxes entirely.

The earlier you open and utilize these tax-efficient investing and savings vehicles, the better.

One example of how individuals can maximize their savings is through the 401(k). Employers can contribute to your 401(k) through the employer match. Your employer will contribute a dollar amount, a percentage of your salary or a percentage of your contribution up to a capped amount.

Your employer may agree to match 100% of your 401(k) contribution up to 6% of your $100,000 salary or $6,000. To get the full match, you must contribute at least $6,000 to your 401(k). If you contribute $4,500, they’ll only contribute $4,500.

Vanguard found that 34% of 401(k) participants failed to save at least the percentage offered by their employer’s match.

If you want to reach your financial target for retirement in 20 years at 62, taking advantage of the low-hanging fruit is essential. The employer match is just that.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.