Personal Finance

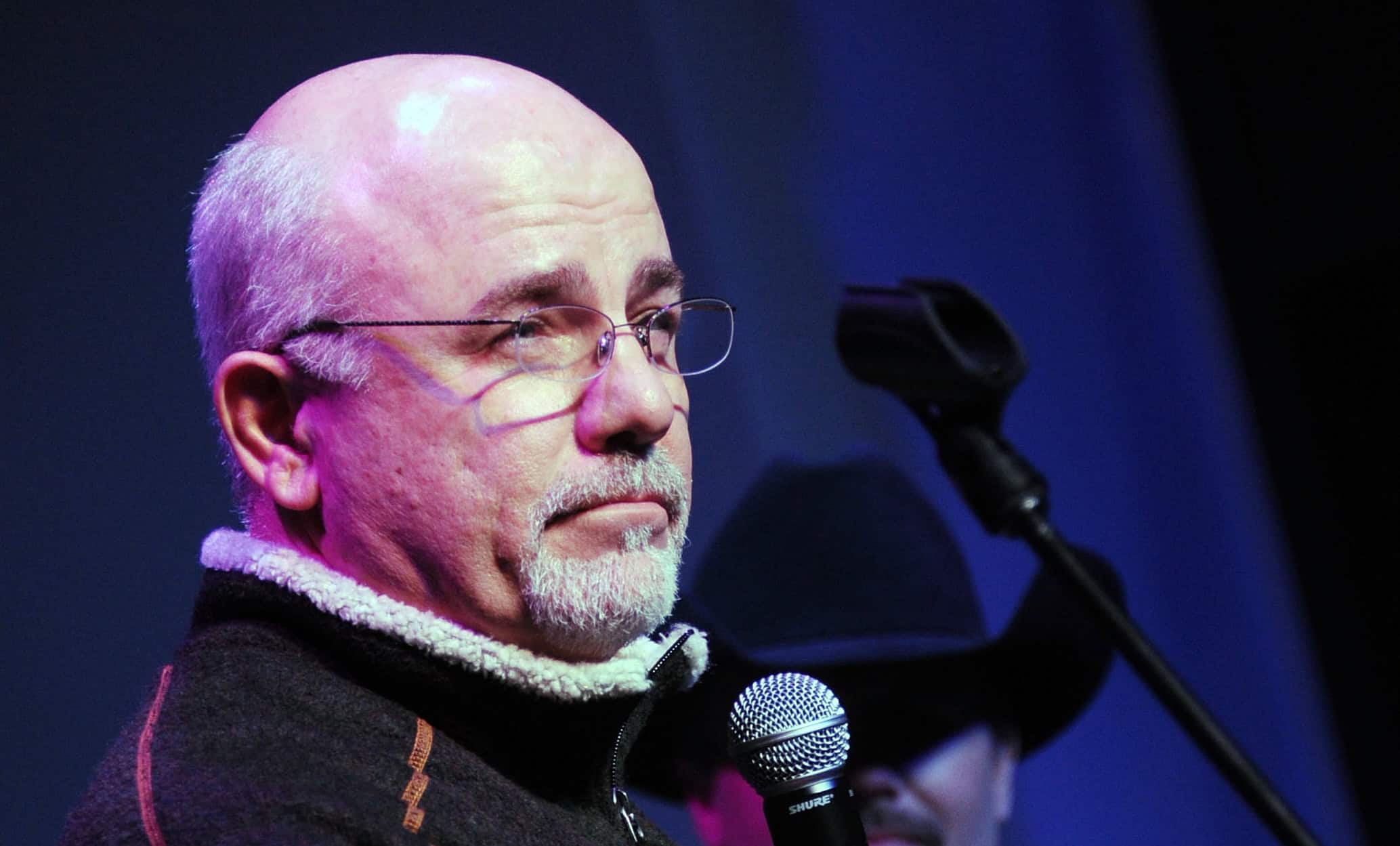

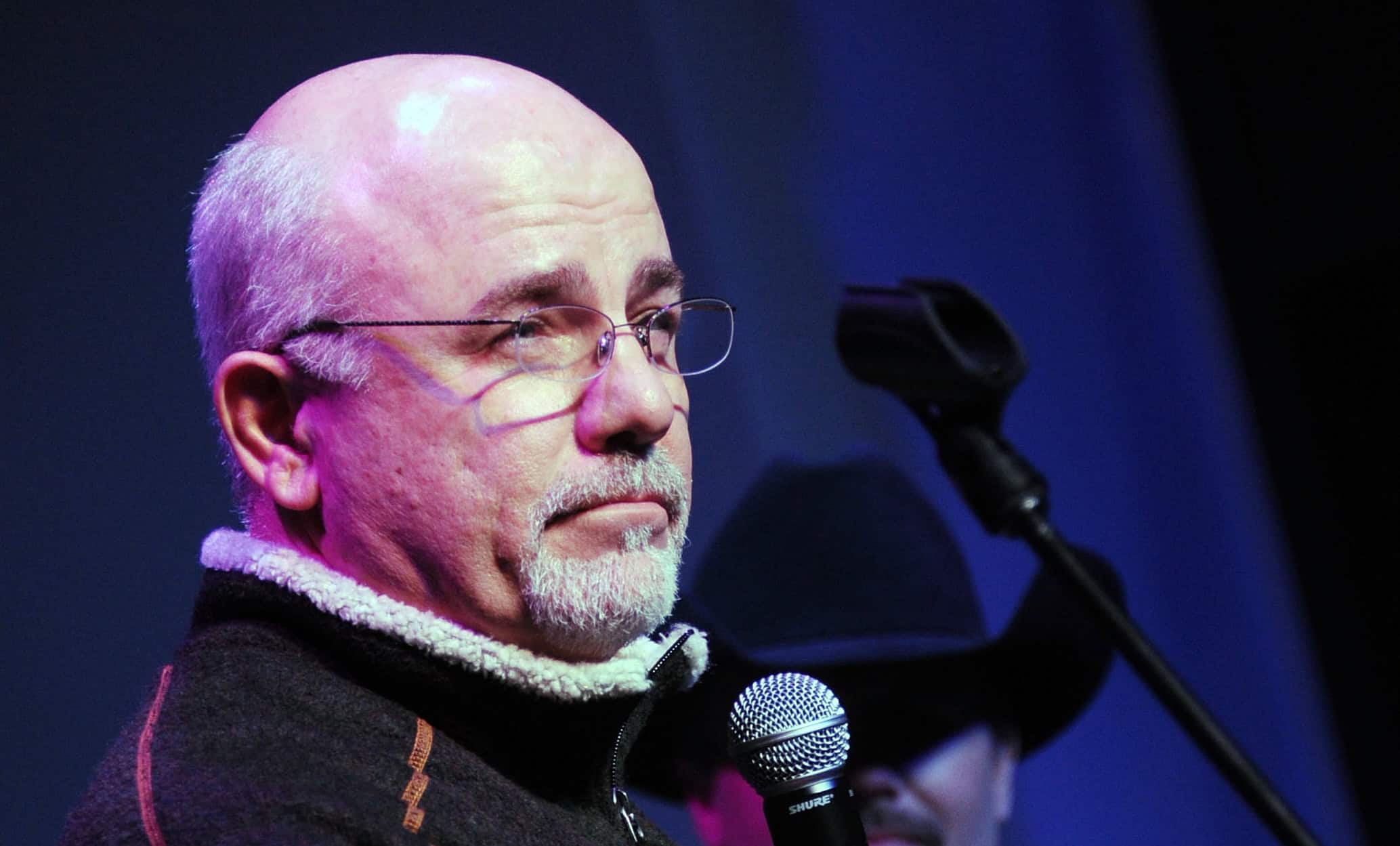

Dave Ramsey says this retirement strategy "extra gravy on the biscuit" and here's how to use it

Published:

If you’re working at a company that has a generous 401(k) match option, you should probably take it as you would “extra gravy” on your biscuit, as long as it fits within your personal budget. In a recent episode of The Dave Ramsey Show, famed personal finance guru Dave Ramsey recently referred to company contributions to a 401(k) as “gravy on the biscuit,” an analogy I agree wholeheartedly with.

Indeed, I’ve heard employer matches being referred to as “free money.” And in many ways, it is, provided you can put up a sum of your own to stash away in your 401(k). Many savers have the option of adjusting the percentage they contribute. Oftentimes, it makes the most sense to put up the maximum amount that your employer will match. After all, you want to get the most “gravy” or “free money” you possibly can, even if it means having to save up a bit more of your own cash for your retirement.

Understandably, it can be challenging to pay yourself first, but with generous employee matches, there is an incentive to kick your 401(k) retirement portfolio into overdrive.

A caller named Joel recently had the opportunity to ask famed personal finance guru Dave Ramsey an intriguing question on his show relating to retirement contributions. He’s currently contributing 15% of his paycheck — that’s Dave Ramsey’s Baby Step #4 — to a traditional 401(k), which is on the high end of his firm’s 10-15% profit-sharing contribution.

Joel asked Ramsey if he should change the contribution amount and whether he should consider the Roth 401(k). Indeed, these questions are likely on the minds of many listeners who also work at a firm with generous retirement contribution plans.

Dave Ramsey noted that Joel is on the right track by contributing the maximum amount of 15%, even if the company didn’t match the amount in full.

That said, any employer matches were “gravy” to help fast-track one to a more comfortable retirement. Of course, things are always made much better with a bit of fresh gravy poured on top. But even without it, a biscuit can be a delicious treat on its own.

Regarding the Roth 401(k), Ramsey gave the thumbs up to Joel for switching contributions moving forward. In terms of precedence, he noted that one should first contribute to accounts that involve employer matches. The second option would be Roth, followed by the traditional 401(k). In short, assuming “matches,” the Roth 401(k) should be preferred over traditional, given its added flexibility in retirement and the potential to save one significant sum on taxes.

Though I agree with Ramsey’s order of preference, I would check in with a financial advisor or wealth planner before following in Joel’s footsteps by switching contributions over to a Roth 401(k).

After all, everyone’s situation is different, and you may find your employer offers an even more (or less) generous 401(k) match that impacts where you choose to redirect a chunk of your salary. Either way, the big takeaway was that employees should take charge as firms move away from pensions and toward “generous” 401(k) matching plans.

Knowing the optimal places to make retirement contributions can mean the difference between a frugal, late retirement and an early, comfortable, or even lavish one. If your employee has a matching plan in place, you should seek to take full advantage of it.

Even if it doesn’t, going for the Roth 401(k) or even the traditional 401(k) can make sense as you look to provide the means for your nest egg to grow at the quickest rate possible. Dave Ramsey is right on the money in that the Roth 401(k) is “better” than traditional unless, of course, there’s an employee match thrown in.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.