Personal Finance

Survey reveals that 75% of Americans who take this one step believe they will be financially prepared to retire

Published:

Last Updated:

It’s not hard to imagine why so many soon-to-be American retirees are still feeling a bad case of financial anxiety as they approach their retirement dates, even if they’ve got a fairly sizeable nest egg and social security benefits on the way. Undoubtedly, running out of money is a major fear of many folks winding down for retirement. It’s this fear that may keep those who can retire (comfortably) in the labor force for longer than they would have liked.

Indeed, it can be tough to tell what is enough, given everyone’s future expenses, passive incomes, financial “wiggle room,” and dreams will differ drastically. That’s why it’s so vital to have someone, like a financial adviser or wealth planner, in your corner to give you the personalized touch. With adviser-approved retirement goals and plans in place, those looking to retire can gain the assurance and confidence they need to not only retire but retire in comfort and free from anxieties.

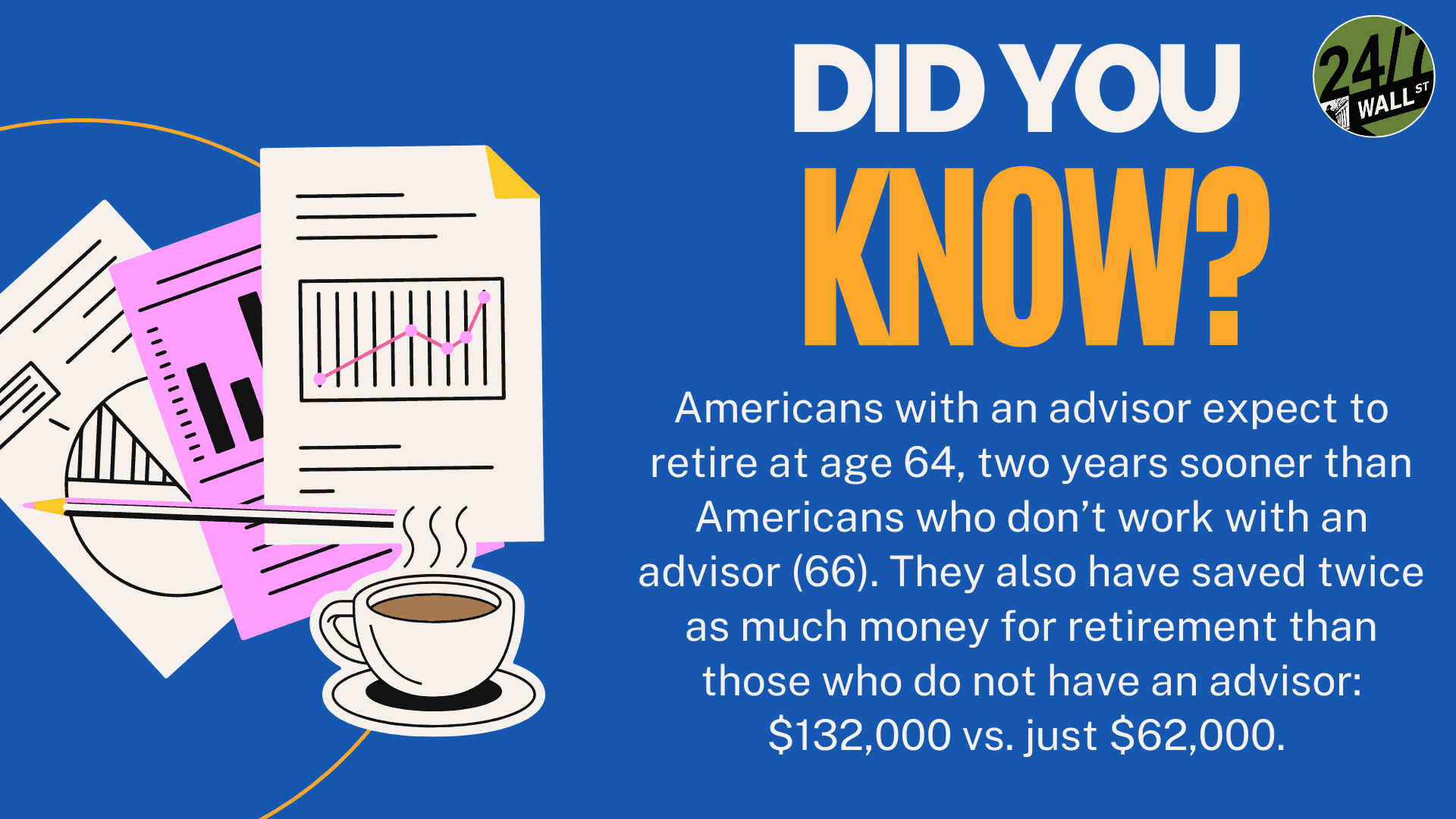

In a recent 2024 study conducted by Northwestern Mutual, about three out of four (75%) Americans who had a financial adviser felt financially ready to retire. For those without an adviser, only 45% of Americans felt prepared to enter their golden years.

Undoubtedly, this speaks to the value of having a financial pro who can evaluate your retirement trajectory and make the adjustments needed to ensure you’re on the right track and will not run into any unforeseen scenarios that could derail your retirement.

Indeed, it’s not just about “how much” one needs before one can hit the retirement button. Having a sound retirement plan is also about the timing, lifestyle, risks, and flexibility all in the right spot. According to the study, 62% of Americans with an adviser on their side know how much they’ll need to finance a retirement that’s “comfortable” for them compared to 34% who went it alone.

Undoubtedly, you can retire without the help of a financial pro. However, there will always be blindspots that you may not see without a different perspective. So, if you’re serious about retiring comfortably and free from financial stress, hiring an adviser could pay massive dividends. They can see all your blindspots and confirm the potholes that you may already see up ahead.

Even if you’ve recognized and reacted to all your blindspots, an adviser can, at the very least, offer you peace of mind, which, I believe, is well worth the price of admission on its own. Of course, you should be very selective with who you pick to help steer your retirement plan in the right direction. If you have doubts about the opinion provided by an adviser, it can’t hurt to get a second opinion!

It’s not just older Gen Xers and Baby Boomers that can benefit from the expertise of an adviser. Younger folks, like those in the Millennial cohort, can also get back on the optimal path, especially those who’ve been derailed by crippling amounts of student loan debt. Indeed, starting one’s career with student debt can be like playing from behind in one’s early days.

While some with six-figure sums of student debt may feel like retirement is an unrealistic endeavor, I do think that a financial adviser can help such young people get back in the driver’s seat of their financial futures. Americans with student loan debts and a financial adviser felt far more optimistic about paying off their loan by as much as three years sooner.

Indeed, moving forward with one’s financial goals without an adviser can feel like navigating in the darkness. An adviser can light up the path and give you the confidence you need to not only meet your financial goals but perhaps hit them far sooner than you would have thought.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.