This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

compensation for actions taken through them.

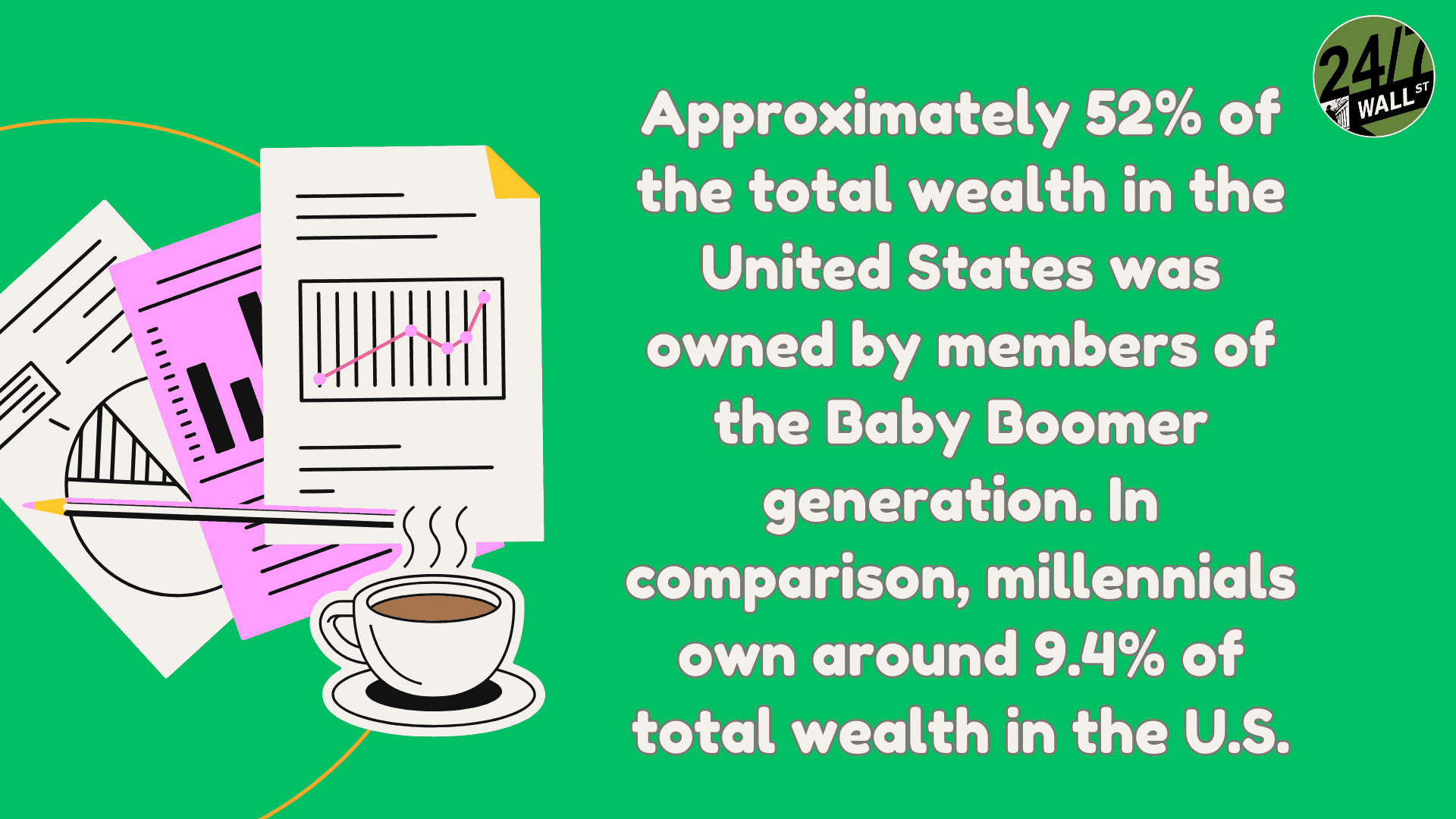

Baby Boomers have been dealt a pretty good hand, at least relative to most other generations (including their children in the Millennial cohort, many of whom are struggling to break into the housing market). It’s hard to believe, but the youngest Baby Boomers turn 60 this year. As they look to enter retirement over the coming years, questions linger as to whether Millennials or Gen Z will have a shot at retiring in a timeframe their Baby Boomers parents did.

Undoubtedly, many Millennials aren’t as well-off as their parents were at around the same age. Housing prices have rocketed over the decades, the past few years of inflation have eaten into savings, and wages have been relatively stagnant.

Additionally, there are also significant uncertainties regarding social security and future stock returns — Goldman Sachs (NYSE:GS) recently rang alarm bells in the ears of many when it predicted that stock returns for the next decade would be far lower (around 3% annualized) than the past decade (closer to 13% annualized).

Simply put, it seems like Millennials could continue to play the game of life on hard mode as the youngest Baby Boomers enter their golden years with a swollen retirement portfolio and likely generous social security payments.

Key Points About This Article

- Baby Boomer nest eggs have gained considerably from many decades of solid stock returns.

- As they shift to risk-free investments, like bonds, they could thrive even in the event of a “lost decade” for stocks.

- Also: Take this quiz to see if you’re on track to retire (Sponsored)

A “lost decade” probably won’t affect Baby Boomers as much in retirement.

In many ways, it seems like the Baby Boomer generation hit the retirement jackpot, with many decades of solid stock returns, low barriers to entry into the housing market, and relatively consistent employment prospects. And though stock returns may very well be luckluster in what Goldman Sachs may dub as “the lost decade,” the retired Baby Boomers may not be all too affected by the waning out of the stock market, especially as they pile into low-risk dividend payers, high-yield real estate investment trusts (REITs), and risk-free investments like certificates of deposit (CDs) and bonds.

As it stands today, stocks are pretty frothy, with the AI boom and “soft landing” scenario likely mostly baked in. Though Goldman and various other pundits foresee lower returns moving forward, it’s tough to tell what the future trajectory for markets will be.

Will we see more of a flat-ish ascent over the next 10 years? Or could there be more significant volatility (think a big crash or multiple bear market moments) en route to a more modest level in the coming decade?

It’s impossible to tell, but Baby Boomers may have a shot to continue faring well as they overweight bonds and bond funds, which could prove much more competitive versus stocks in the type of environment that Goldman foresees.

It’s hard to remember when bonds were this compelling versus stocks.

At this juncture, Baby Boomers can score some pretty solid rates of bonds and bond funds. For instance, the Vanguard Total World Bond ETF (NASDAQ:BNDW) boasts a generous 4.01% yield at writing, making the exchange-traded fund (ETF) an effective way to land a nice payout without having to take on any stock market risk. The BNDW is a low-cost way to expose one’s portfolio to the global bond market.

As interest rates fall, bond ETFs like BNDW stand to gain while the yields look to take a hit. Perhaps Baby Boomers looking to put the finishing touches on their passive income portfolios may wish to capture the relatively high yields in the bond market while they still exist so that they can cruise into a comfortable retirement.

The bottom line

It certainly seems like the Baby Boomers are set up for a smooth sailing into retirement. Impressive stock returns in the past decade have helped many of them grow their nest egg swiftly. As the youngest of the Boomers enter retirement, they’ve been granted the opportunity to land a generous (3-4%) risk-free rate of return from bonds and bond funds.

If there is a “lost decade” for stocks ahead, Boomers big on bonds may just be able to sidestep lackluster stock returns. Indeed, bonds look very competitive right here, with still-swollen yields and upside potential as more interest rate cuts are served up going into the new year.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.