Personal Finance

If your family brings in $100k per year, this is how much you need saved for retirement by age 65

Published:

Last Updated:

At some point, we all want to retire.

We don’t want to have to deal with the daily grind of work. We just want to take it easy, enjoy life, and downsize our responsibilities as much as humanly possible.

But to do so, you need to make sure you have enough to retire comfortably.

If, for example, you pull in $100,000 a year at the age of 65, you should have between $1.055 million and $1.205 million saved. That’s a goalpost. And while many people may not have that saved by the age of 65, there’s still time.

Of course, the money you save doesn’t depend on the average.

It depends on you, your habits, and your plans for when you do retire, or think about it. For example, what are your monthly expenses? How do you expect to maintain money flow to cover your monthly expenses? Do you plan on traveling? The answers to these and other questions will help you determine what you need.

Granted, some of us are behind. But there are solutions, if you’re serious about retiring.

Unfortunately, many Americans aren’t saving for retirement at all.

In fact, according to Kiplinger, one in five Americans above the age of 50 have no retirement savings. More than half are concerned they won’t have enough money even when in retirement. Others are working until they die at their desk, drown in debt, leave their families with ridiculous debt, and in some cases, depend on your kids to support you.

None of that sounds great at all. So, if you are behind and want to catch up, do these things.

Planning for retirement should be exciting. But it can also be a daunting task. Instead of getting overwhelmed if you are behind on saving, be proactive and check in with a financial advisor. Most can help review your current finances, identify areas for improvement, suggest different money-making strategies, and create a realistic retirement plan.

They can also help you determine when to take Social Security.

Remember, if you wait until your full retirement age, you’ll receive 100% of your earned benefits. Better, for every year you wait beyond full retirement up to 70 years of age, you can receive another 8% boost to your benefits.

According to the IRS, “The Retirement Savings Contributions Credit, also known as the Saver’s Credit, helps offset part of the first $2,000 workers voluntarily contribute to Individual Retirement Arrangements (IRAs), 401(k) plans and similar workplace retirement programs.”

Plus, you can make catch-up contributions. For 2025, the IRS says you can contribute up to $70,000 with an additional catch-up contribution of $7,500 if you’re 50 or older.

Even if you’re ahead with your retirement savings, these are great ways to do even better.

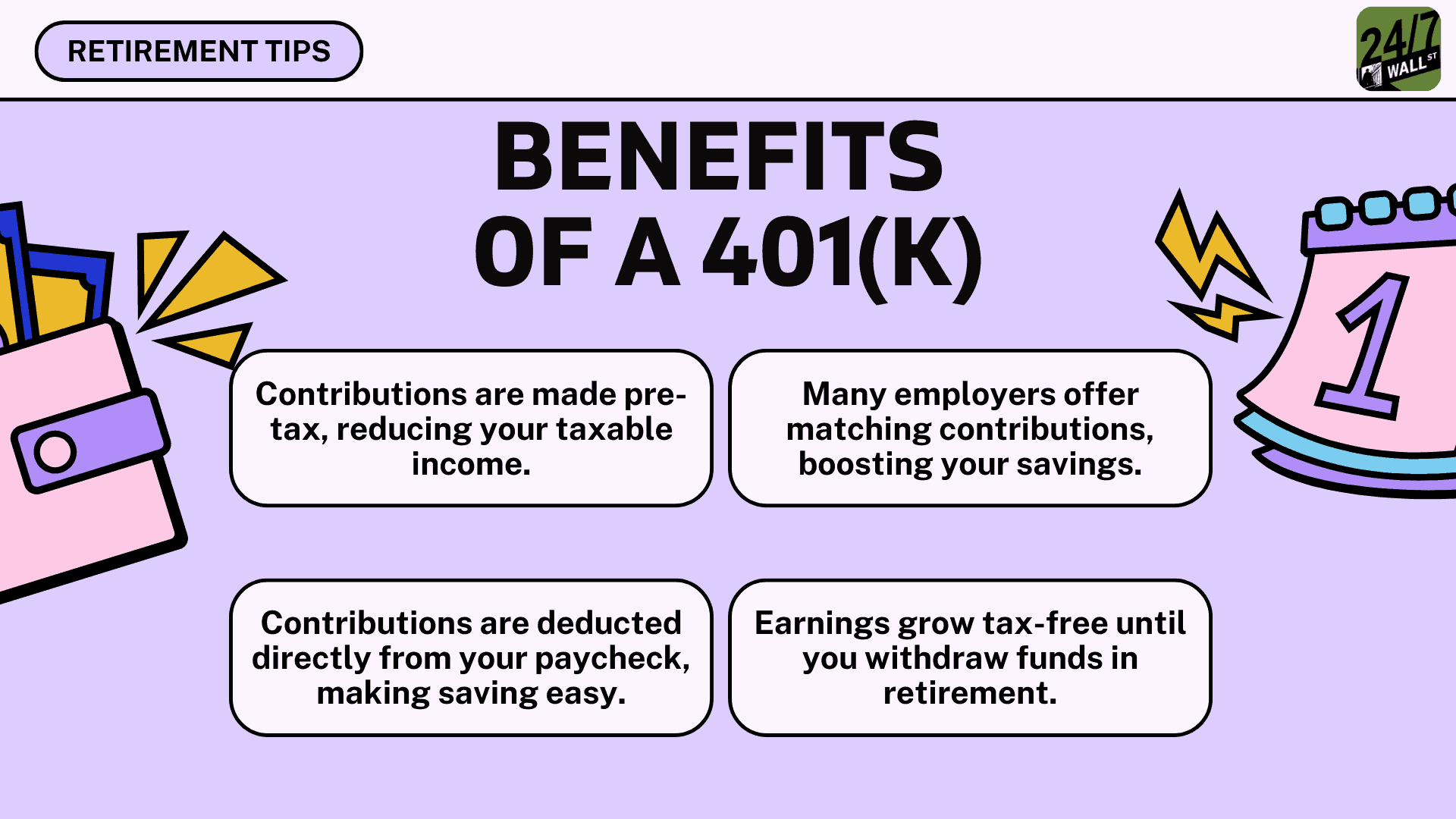

If your employer offers a 401(k) match, make sure you maximize your contributions up to the amount your employer will match. If your employer will match up to 6% of your salary, maximize that. If you earn $75,000 a year, and you contribute 1%, that’s $750 for retirement. If your employer matches that, you have $1,500 for retirement per year. If you contribute 6% and your employer matches that, that’s about $6,750 in retirement per year.

Other key tips to help save include reducing debt. Why pay high interest rate fees on a carried balance? That’s a waste of money. Pay off your mortgage if you still have one. Plan for healthcare costs. Analyze your monthly budget and do your best to stick to it. You can even get a side job, or even create a situation where you can collect rental income.

Most importantly, make sure you speak with an advisor.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.