Personal Finance

I'm 39 and worth millions and I want to quit my job. But, my wife would still be working - does that make me a bad husband?

Published:

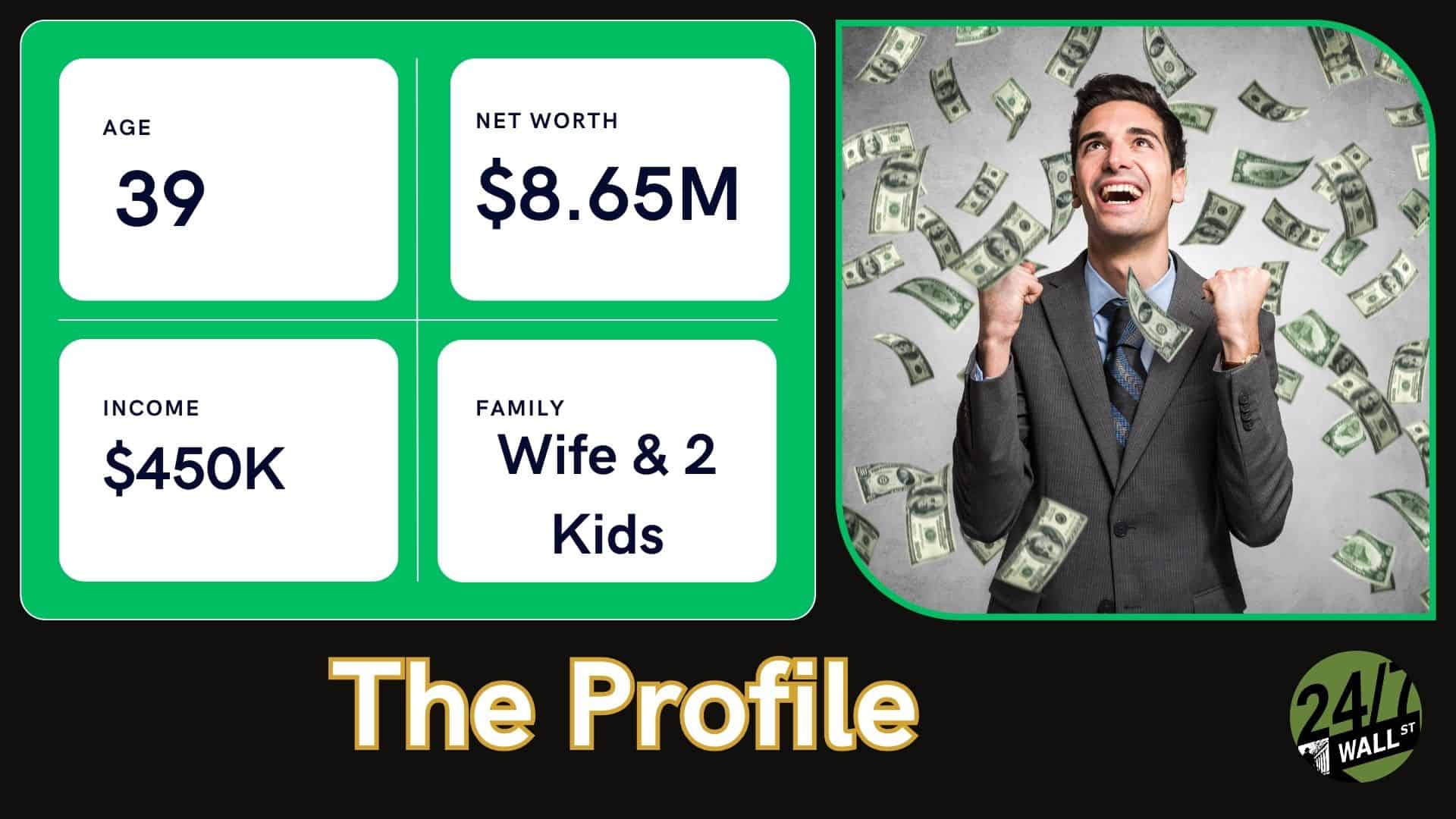

When it comes to how early you can quit your job, most Redditors in r/fatFIRE agree on one thing: as soon as possible. This is the case with this post from a 39-year-old Redditor looking to exit the workforce after feeling burnt out and suffering personal setbacks.

While he notes that he does feel better overall, his unhappiness at work has not subsided. As a result, he’s come to Reddit to see where he stands on being able to quit, with the caveat that his wife would still look to work.

I love these Reddit posts as they highlight the need to find a balance between making a better-than-good living while dealing with the burnout that can come from doing so.

In this Redditor’s scenario, he lives in a very high-cost-of-living area and makes around $450,000 annually. His wife, who again still wants to work, earns approximately $800,000 annually, or almost double that of her husband.

The couple’s net worth is currently around $8.65 million, with around $6.75 million of the total being liquid. They also have around $1.5 million in home equity and $400,000 in an investment property. The couple’s current expenses, including their mortgage and insurance, amount to around $240,000 annually.

According to this Redditor, the family would have a liquid net worth of $13 million in a perfect world. Out of this money, they would use $3 million combined with their existing home equity and buy a forever home in their current area.

With three kids, two of whom are under 3, school is top of mind, and they remain focused on public school education. In addition to school, the family will remain focused on parenting, marriage, health, and fitness.

Overall, there are a few important caveats to consider when recommending. First and foremost is the one the Redditor has about retiring and potentially re-entering the workforce. He isn’t sure if he could find the same income should he want to return to work. I find this concern very valid, and considering the toll it takes to go through the recruitment process, it’s exhausting.

Separately, I share the Redditor’s concern about leaving his wife shouldering the burden of the family’s income, even if she does make a lot of money. It’s a lot for one person to be worried about, and with the family already having a lofty net worth goal, leaving her to stress out about her job seems ill-advised.

While I am not a financial advisor and don’t play one on television, I do think I understand the burden of working. There is no question it’s stressful, but this individual is only 39, so what does he plan to do every day? Retiring sounds great, but does he plan to become a stay-at-home dad?

If this were me, I would look for more meaningful and less stressful work while he is still in the workforce. The hope is that there is plenty of time to retire, but unless he can plan out every day, I see entirely too much free time in this Redditor’s future.

It’s again important to mention that every Redditor in the r/fatFIRE subreddit has grand plans to retire soon. This is the meaning behind the FIRE (financial independence, retire early) philosophy. However, for some people, there is a stark difference between practical and ideal.

In this case, you have a scenario where this Redditor should stay in the workforce. He’s considering retiring and potentially returning to work in the future, which tells us he’s not ready to stop. Instead, he should focus on finding a job that doesn’t stress him out to the point where it’s affecting every aspect of his life.

I vote to keep working until you hit the liquid net worth target number and then talk seriously with your spouse about the best path forward. Make sure she is aligned with you, whether it’s stopping working or taking a step down in pay to be happy. If you both agree, start making the moves for this life change.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.