Personal Finance

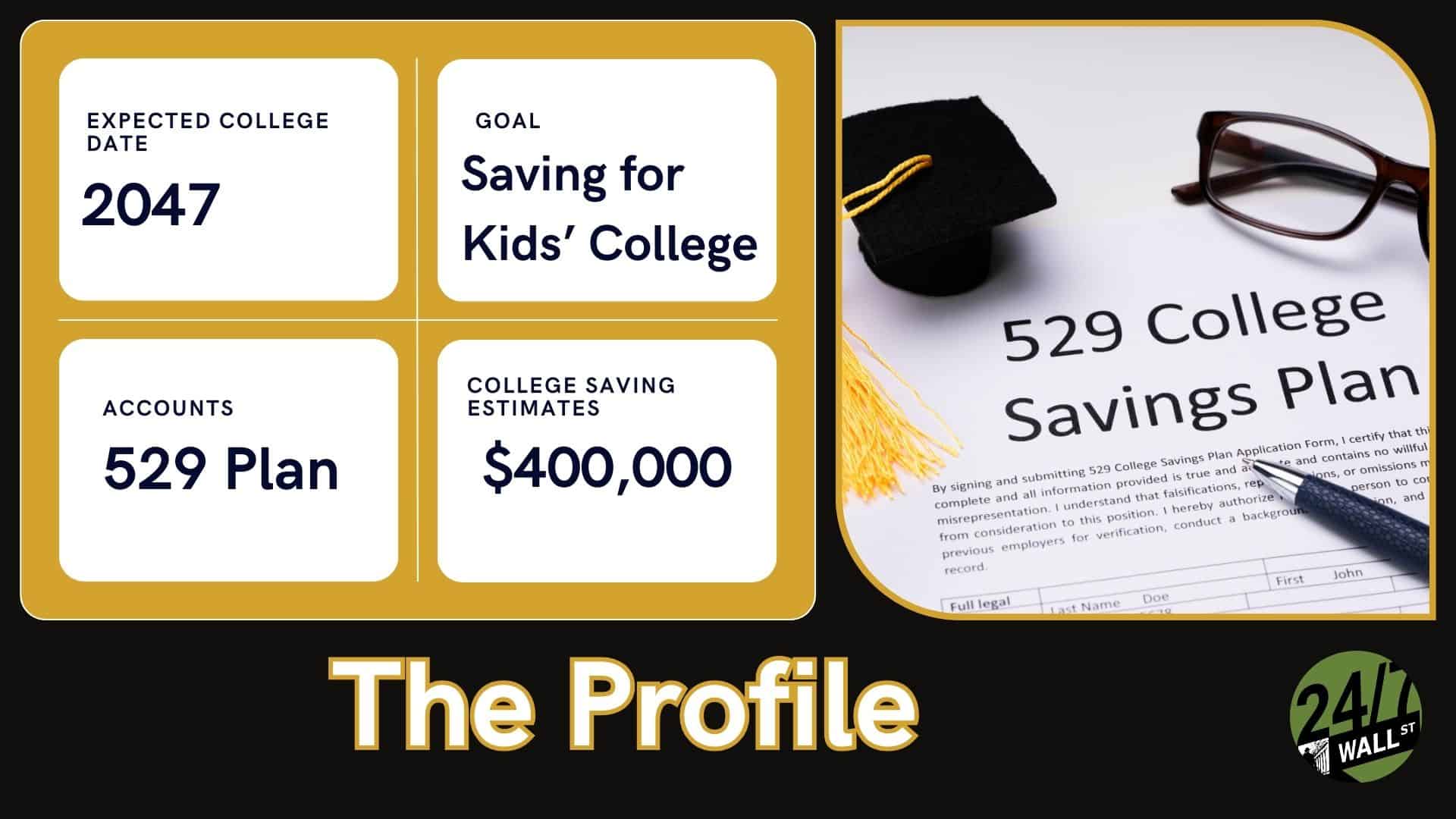

My partner and I are starting a 529 plan to save for our kids college - will $400k by 2047 be enough when you factor in inflation?

Published:

Last Updated:

If there is one moment in a child’s lifetime that parents both dread and hope for, it’s sending kids off to college. Of course, before a kid can make their way to a school, someone has to figure out how to pay for it. Whether by savings, financial aid, or a 529 plan, someone somewhere has to come up with the money for children to receive a higher education.

The good news is that there are options, like the 529 plan, that help parents put away money for future education. Interestingly enough, in this case, we have a Redditor posting in r/DaveRamsey who wants to start putting money away for children he does not have. As he notes in his post, he doesn’t plan on having children for another 5-6 years but wants to get ahead of the 529 game.

What I love about this post is that this person is already correctly preparing to have children. This shows a heightened level of responsibility far beyond what most non-parents think of.

In this scenario, a Redditor of unknown age and their partner are making the right moves to start a 529 plan to save for “our future children’s college costs.” This Redditor notes that they are 5-6 years away from having children, so they have named themselves beneficiaries for the moment.

However, they will switch the beneficiary to any children once they are born. If they start a 529 plan now, they hope to be well ahead of the game regarding savings. They expect their children to start college around 2047, hopefully giving them enough time to save over $400,000 per child.

One important note is that the Redditor and his partner already have a full emergency fund and have maxed out retirement contributions. In other words, this college plan is the only financial goal they have left to accomplish. The hope with the Redditor’s post is that he can find the appropriate amount to put into this 529 account monthly to hit the right goal by 2047.

Given that I am not a financial advisor, I would start any recommendation by saying you should talk with one for concrete savings advice. However, saving for this expense is at the top of my mind as someone with two young children who will be ready for college in just a few years.

While plenty of people recommend not putting the money into a 529 right now, before children are born, I don’t think this is a huge consideration. So long as this Redditor and his partner are already in an excellent financial situation and can afford to put additional money aside, I say go for it and be well ahead of the game come college time.

Interestingly enough, many recommendations in the thread are not related to saving for college at all. Instead, plenty of people say that giving money for a home, focusing on financial aid, or the $400,000 number is “crazy high.” I don’t think it’s high at all. Instead, I think it’s exactly right.

The best scenario is not to start saving until the children are born. A lot can happen before children are born, and you may not want any money tied up. When a child is born, they can then figure out exactly how much money to set aside.

This is a tough thread because this Redditor and their spouse appear healthy financially and want to do something smart with their money. However, they don’t need to do anything at this point, but who are we to say no? I don’t think the $400,000 per child is as insane as other commenters, especially when you account for room and board, covering books, and any other miscellaneous expenses during four years of school.

Ultimately, college is a personal goal, and this family can pivot. The children may decide trade work is the best path for them. They may want to enter the military and have the GI Bill help cover college costs. The bottom line is that many different “what ifs” can be passed around for the moment, so don’t do anything until the children are here.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.