Personal Finance

Only 1 in 3 Americans Trust Financial Planners - Here's How to Find the Actual Good Ones

Published:

Last Updated:

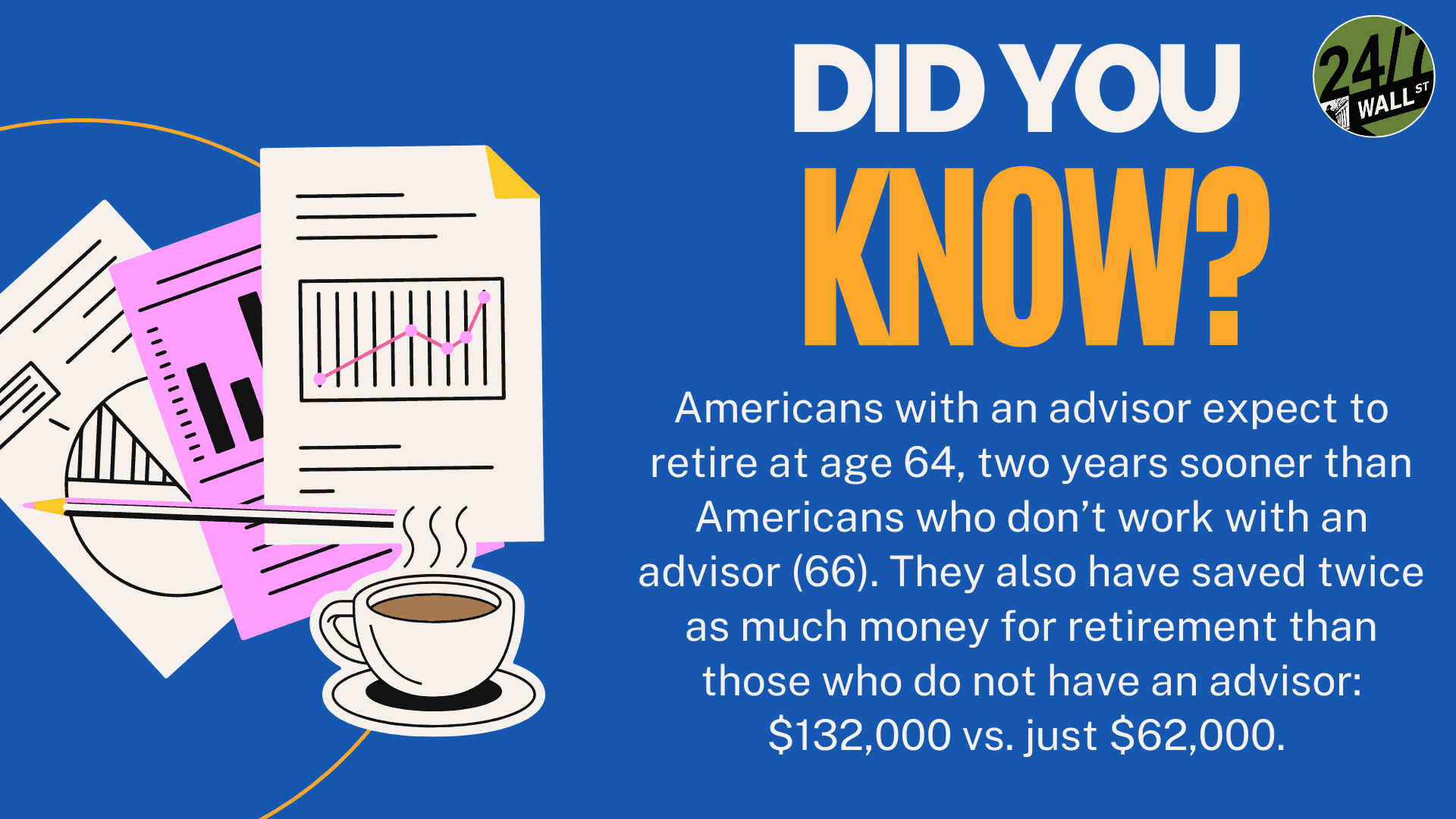

If you’re thinking about retiring, or already retired, it’s important to have a trusted financial planner. After all, according to Smart Asset:

“A 2019 Vanguard study found that, on average, a hypothetical $500K investment would grow to over $3.4 million under the care of an advisor over 25 years, whereas the expected value from self-management would be $1.69 million, or 50% less. In other words, an advisor-managed portfolio would average 8% annualized growth over a 25-year period, compared to 5% from a self-managed portfolio.”

Sadly, according to Northwestern Mutual, only a third of the general public trust them. Granted, they’re not all worth the time or the effort. But there are plenty of good ones, too. Here’s how you can find those worth your time.

Before you start looking for a good financial planner, know why you want to go in the first place. Do you need help with personal finances, retirement plans, debt, investing, tax planning, or even estate planning? Maybe all of that. Just know what you’re looking to do to avoid looking like a deer in headlights when they ask what they can help with.

Is the financial planner bound by a fiduciary duty, which means they have to act in their client’s best interest before their own? Not all financial advisors are bound by that. Is the person a certified financial planner (CFP), which does have a fiduciary duty?

Or are they registered investment advisors (RIA), most of which are registered and regulated by the U.S. SEC and, or state regulators. After all, these are the people you’re conversing with about your money. Make sure they have credentials before proceeding.

The last thing you want to hire is an untrustworthy crook.

So, no matter what title, designation, or license the advisors say they have, it’s on you to check them out. Again, it’s your money we’re talking about. You either want a legit planner or a dud that’s going to cost you a good deal of money. One way to do that is by looking up their Form ADV, which is used by advisors to register with the U.S. SEC and state regulators. These are available on the US SEC’s Investment Adviser Public Disclosure (IAPD) site.

You can even check out advisors on FINRA’s BrokerCheck site.

Word of mouth is also a great way to vet good or less-than-good advisors. Ask family and friends who they use and trust. Then, once you find a good advisor, schedule a consultation to discuss your financial needs.

Again, it’s your money. Make sure it’s managed well.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.