Personal Finance

My wife and I just realized we'll likely get $75k per year from Social Security - can we actually retire sooner than we planned?

Published:

Last Updated:

Just because social security benefits don’t begin to kick in until your 60s doesn’t mean you should wait until a traditional retirement age (let’s say 62-65) before you make the big leap. Undoubtedly, if you’ve got the mortgage paid off and a sizeable enough portfolio to get you through the years before social security kicks in, you may just have the financial flexibility to embrace the FIRE movement (financial independence, retire early) with open arms.

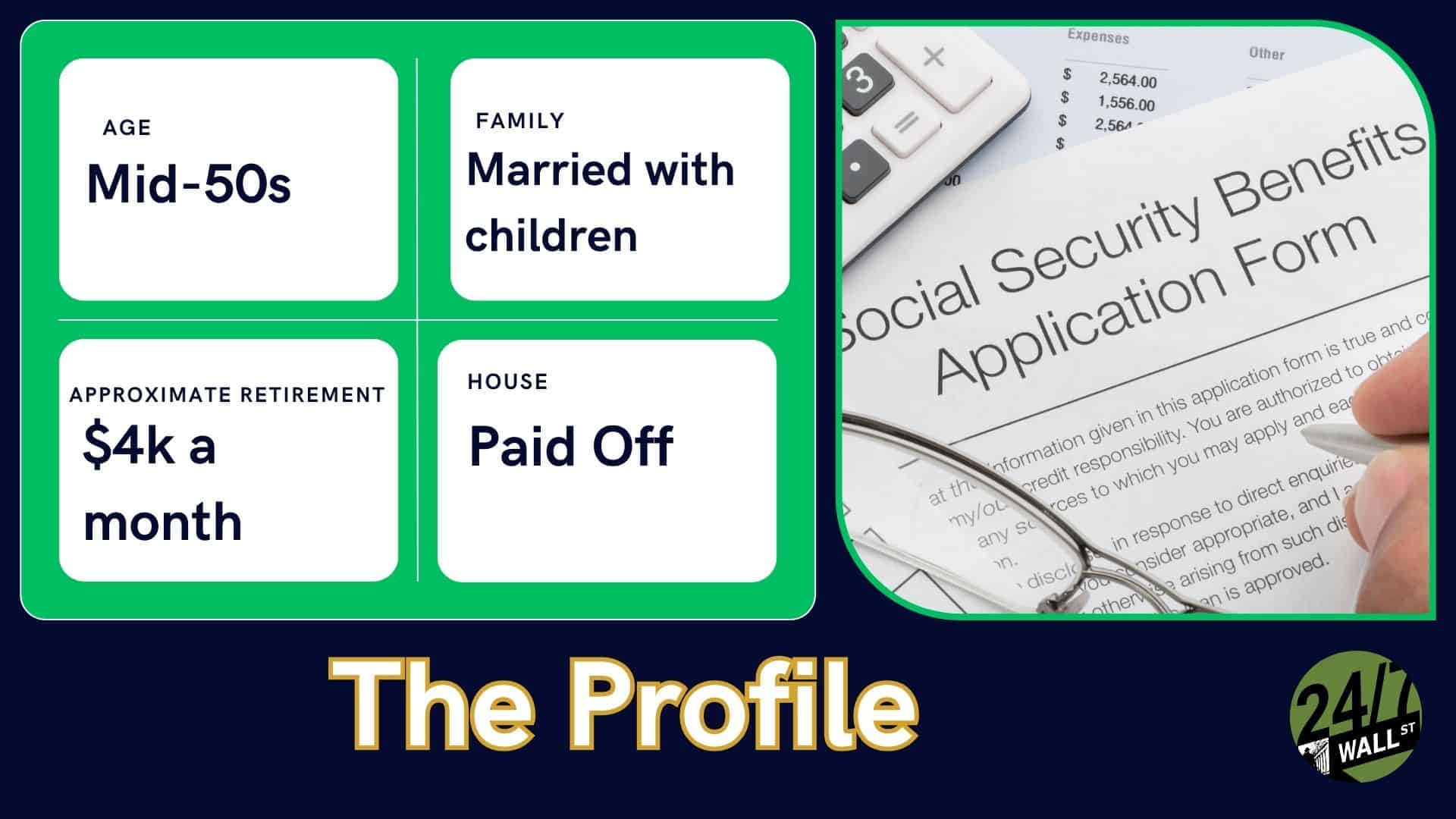

In this piece, we’ll look at a married couple from Reddit in their mid-50s with a fairly generous amount of social security payments ($75,000 per year) waiting for them. Undoubtedly, the social security benefits appear to be more than enough to cover a relatively modest retirement at 62.

That said, with many significant expenses (think the home and the child’s education) covered, it certainly seems like the couple has options, even in the years before they’re eligible to collect social security. Of course, only a financial adviser will have the answer for this couple as they look to wind down after a lengthy career.

In this piece, we’ll review some ideas the couple may wish to run by their adviser as they weigh the pros and cons of early retirement versus sticking it out at work for just a few years longer. Undoubtedly, putting in the extra years would amount to a more comfortable retirement (think chubby FIRE versus traditional FIRE) rather than a modest one as savings and social security benefits amass.

That said, if the couple is feeling burned out, stressed, and unsatisfied with their work, counting down the days until their retirement date, perhaps it’s far better to retire sooner rather than later, even if it means fewer vacations and spoils to the kids and grandkids.

In any case, here are three questions I’d encourage the couple to bring up with their adviser:

If one has a large enough investment portfolio, the couple may be able to make an earlier retirement work years before they choose to start receiving social security benefits. Undoubtedly, if such a portfolio can generate enough passive income to meet or even exceed the couple’s burn rate (their expenses in retirement), there’s the option to retire some years earlier.

Undoubtedly, I’ll assume the couple is invested in index or mutual funds rather than higher-yielding securities (think 4-5%-yielding dividend stocks), which would allow them to reposition with income in mind. Though going for yield over growth could make the numbers work for earlier retirement, the couple should consider the trade-offs.

Either way, running such an idea by an adviser seems like a smart move so they can paint a more accurate picture of your retirement ambitions and help you make the right choice.

Unexpected care costs could quickly derail a seemingly sound retirement plan in its tracks. Though it’s never a comfortable conversation to have, the couple should ask their adviser about potential financial risks that could arise later in life and what they can do to mitigate them before they decide on a specific retirement date.

A slew of insurance products (think long-term care insurance) can make sense if the couple is looking to ensure their nest egg has the staying power to last as long as they do. Additionally, there’s peace of mind that comes with not having to rely on one’s children to act as caregivers a few decades down the road.

In short, the couple seems to have solid footing as they gear up for an earlier retirement. However, unforeseen health expenditures may eat into social security once the couple enters the middle of their retirement. Though products like long-term care insurance aren’t right for everyone, I do think they’re worth bringing up in a meeting with one’s adviser.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.