Personal Finance

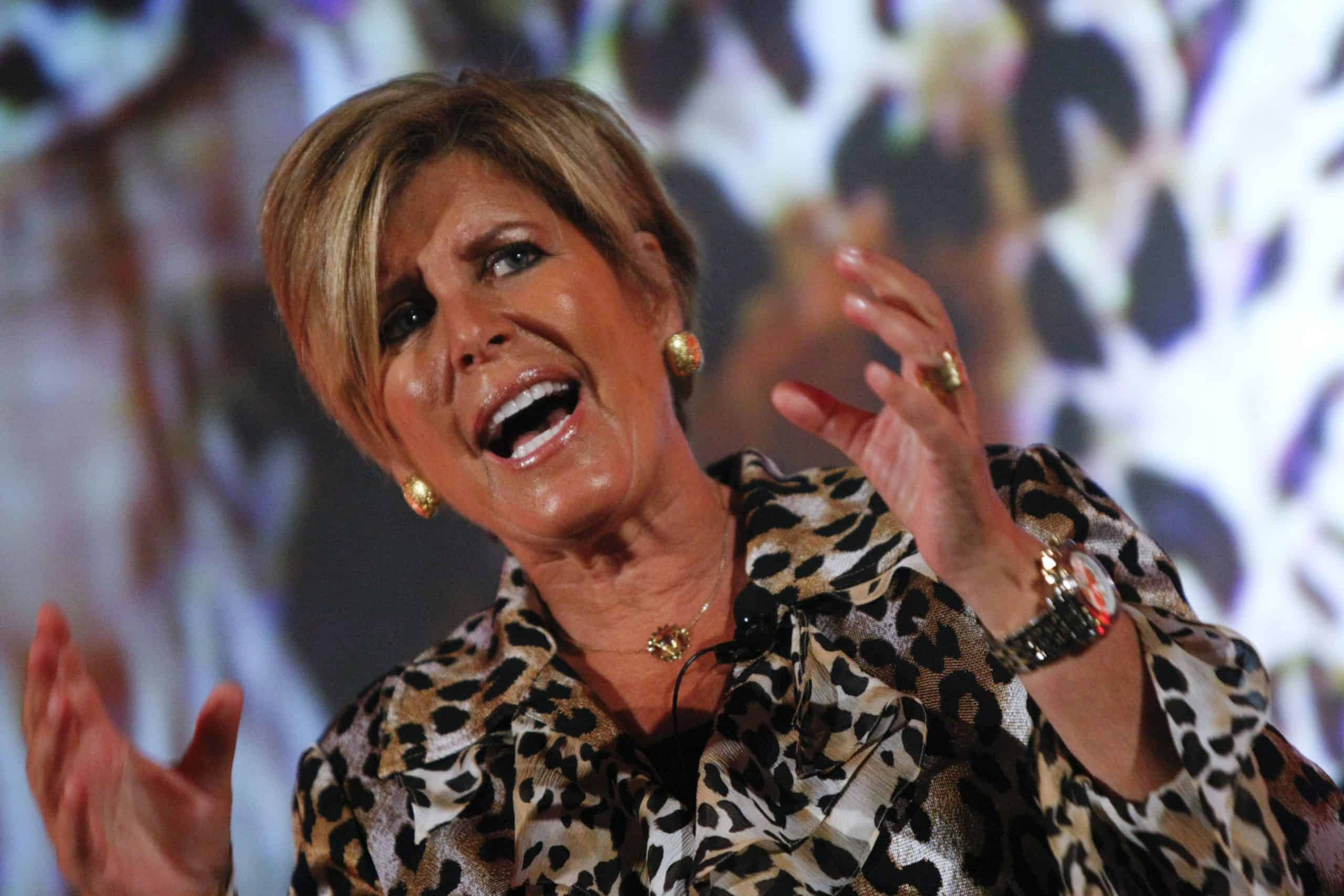

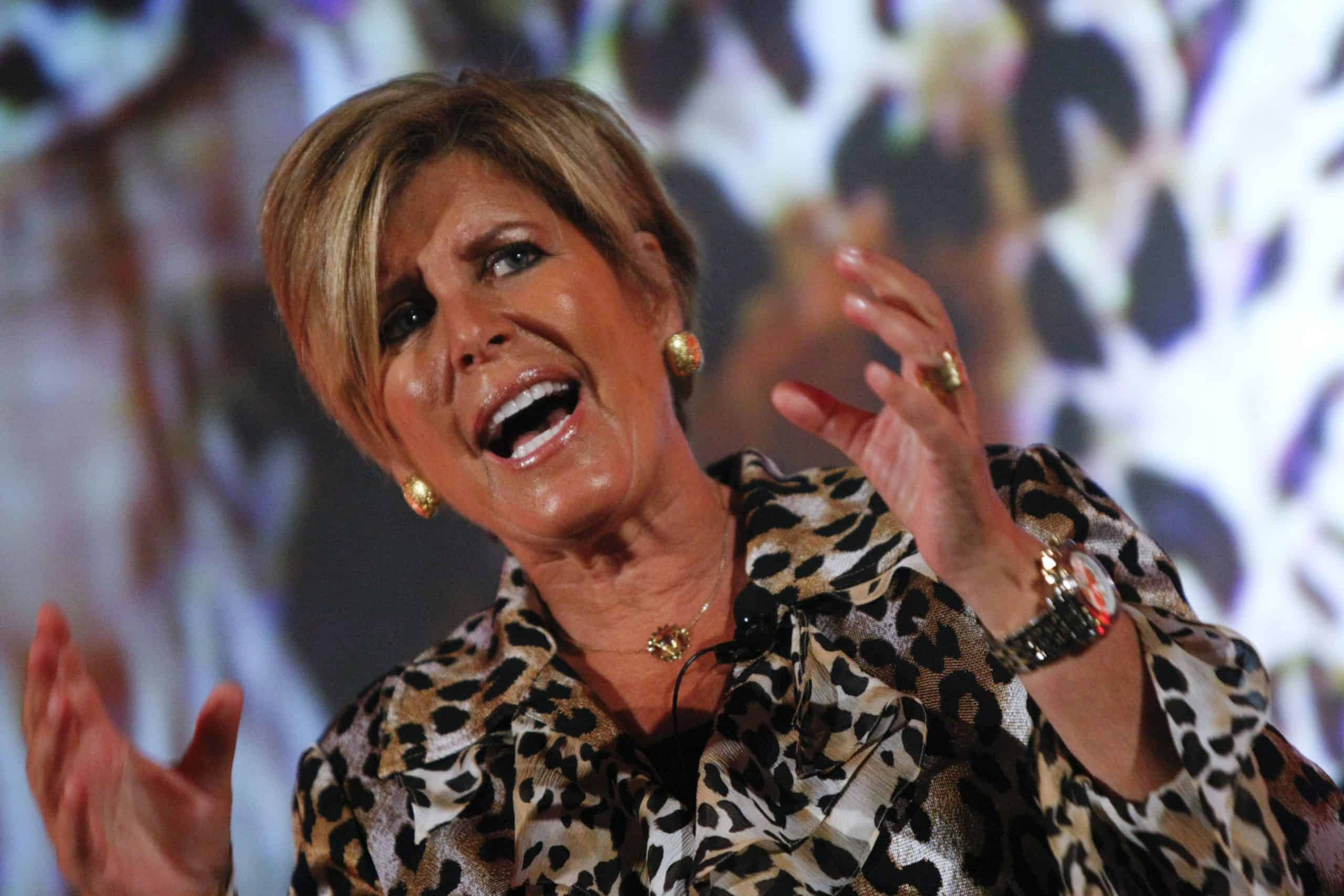

Suze Orman says this common emergency fund strategy is nowhere near enough money

Published:

For years, financial pundits have argued you should have money in a savings account earmarked for emergencies. That way, if you lose your job, worst case scenario, you’ll have access to money to cover your expenses.

Those pundits also argue that you should have at least three to six months of expenses saved at any time. However, as Suze Orman learned in the wake of the pandemic, you should have at least eight months of expenses saved to comfortably get by.

In fact, if you go any less than that, you are taking a risk, she added.

For example, let’s say you were involved in a terrible accident and you can’t work. Unless you have a catastrophic insurance policy, you and your family should have at least eight months’ worth of living expenses saved through that rough period.

For many of us, saving eight months of expenses is easier said than done.

If you can’t swing that, start small with an emergency savings goal of at least $1,000. Sure, it’s small but it’s a safety net, and it’s a start. In fact, if you can put away about $85 a month, you’ll reach that goal and have some wiggle room. However, be sure to store this in a separate “don’t touch” account, automatically depositing money every time you’re paid. Plus, if you ever receive another source of income, such as a bonus or a gift, put it directly into that “don’t touch” account instead of spending it immediately.

Or, look at your current spending habits to save.

For example, how often do you go out to eat as compared to saving a few dollars and a few calories by making meals at home? How often are you grabbing drinks with friends? Perhaps you have subscriptions you could live without for a while. Sure, you should have fun and live life to the fullest with your money, too. But maybe cut back here and there.

In short, if you’re financially unprepared, a medical emergency, car issues, or even job loss can wipe out your finances. That’s why it’s safer to have money stashed away should any of those things happen.

As many of us know, emergencies often happen at the worst times.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.