Personal Finance

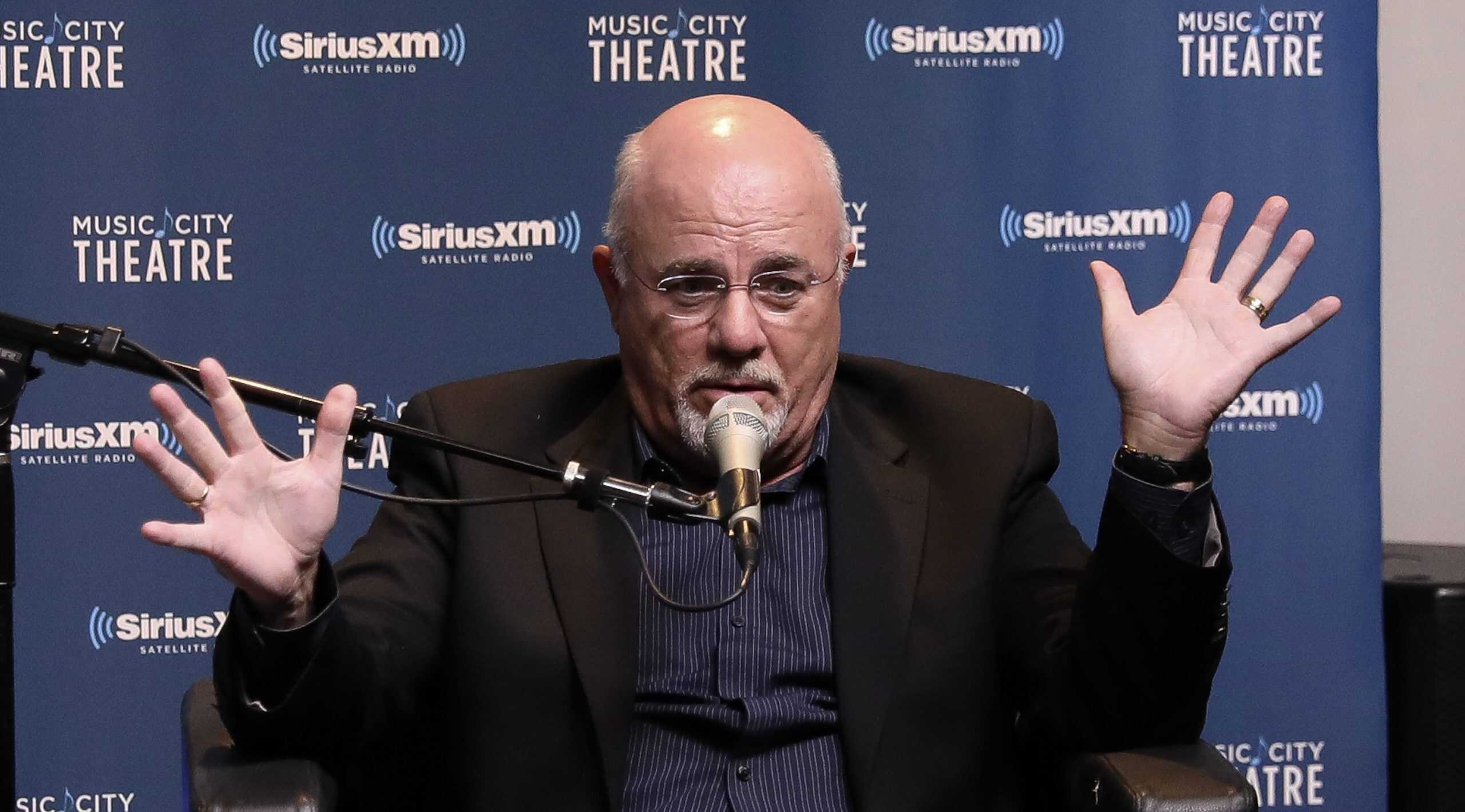

Dave Ramsey gives this direct and perfectly accurate take on the reason behind why rich people stay rich

Published:

Working and middle-class Americans have really felt the squeeze amid rising prices. For many, there just isn’t much of one’s paycheque left over after one has covered their bills. Meanwhile, the rich just keep finding ways to increase their net worth in spite of inflation and all other economic factors that have weighed heavily on your average American household.

As the phrase goes, the rich just keep getting richer. But how is it that they manage to keep swimming forward even as the tides move against us all?

Financial guru Dave Ramsey put things into very simple terms: rich people get rich because they save money. To take things a step further, though, rich people also benefit from the magic of compounding, something that people with little to no savings or investments cannot tap into.

At the end of the day, people striving to get ahead need to spend less than they earn. Otherwise, they won’t be able to wield the potent tool that is compounding. With wages stagnating and costs of just about everything going higher, spending less than one earns is easier said than done. That said, by prioritizing savings and trimming non-essential expenses where possible, one can slowly position their portfolios in a way to enjoy the profound wealth-creative effects of compounding.

Compound interest really is the “the eighth wonder of the world,” a saying attributed to the great Albert Einstein. Though, there’s no actual evidence that Einstein actually said this. Regardless, the fact remains that compound interest really is a really big deal! And it’s one of the most underrated forces that makes the rich richer, even in the face of more challenging economic circumstances.

Sure, reinvesting the $400 annual dividend payment trickling in from $10,000 or so invested in index funds may not seem like all too big a deal when you’re first starting out. After all, $400 is a drop in the bucket compared to the invested principal.

However, as your portfolio grows in size, so too will the dividends that’ll flow in. And if you keep reinvesting all your dividend payments, your nest egg (or should I say snowball) will get a bit of a boost, even if you don’t add new money to it.

With the stock market continuing to surge to new highs ahead of the U.S. presidential election, it should be no surprise as to why the wealthy just keep getting wealthier. Staying invested over the course of many years has its perks. While the stock market will wobble, rumble, and even tumble on occasion, staying on the ride is how one can benefit from compounding. Indeed, it’s a concept whose effect is most felt over extended periods of time.

Undoubtedly, all it takes is a run-of-the-mill S&P 500 index fund to get the ball rolling on compounding. Of course, the larger the snowball (or invested sum) you have initially, the more snow it’ll pick up when it rolls with time.

For non-affluent Americans, the key is saving what you can so that you can get more skin in the (stock market) game. While compounding won’t make you rich overnight or even over a few years, every incremental amount saved and invested will help you get that much closer to a level of compounding that helps you get ahead even when the wind isn’t at your back.

Save, invest, reinvest the dividends, repeat.

Also, consulting a financial adviser could help you a great deal as you look to up the amount you save and invest.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.