Personal Finance

We're in our mid-30s and want to retire at 50 with $7 million - is our current strategy the right one?

Published:

Last Updated:

24/7 Wall St. Key Takeaways:

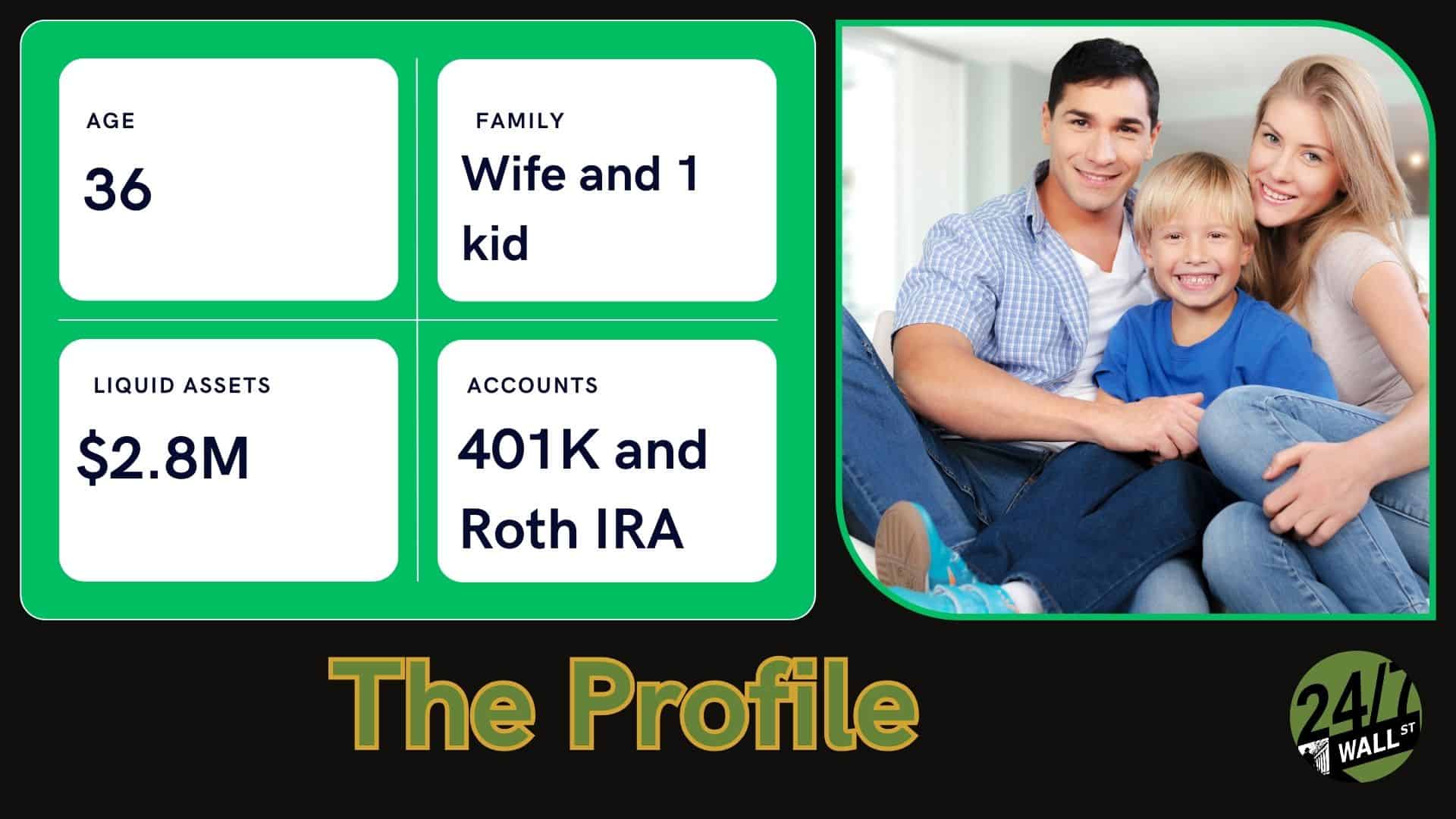

One Reddit post I came across provided an impressive snapshot of a couple who were aiming to achieve financial independence and retire early. With $3 million in assets at age 36, a high income, and diligent savings, this family is making impressive strides toward their $7 million retirement goal.

However, the family overlooked and underestimated several factors, such as healthcare coverage. Retiring early isn’t just about saving up enough money. It’s also about having reasonable expectations for how much things cost.

Let’s breakdown their situation and see where their plan may be lacking. Remember, this is just my opinion and not financial advice:

At first glance, $7 million is a conservative savings goal for their 15,000 monthly budget and retirement timeline. They plan to retire at 50, which leaves several decades of retirement they will need to fund. They plan on a 4% withdrawal rate, which comes out to about $280,000 a year with $7 million invested.

This should cover their retirement expenses.

However, reaching $7 million before 50 might be a bit more challenging. It’s a hefty goal and doesn’t account for potential market fluctuations. It may be in their best interest to see where they can cut spending and plan to retire with less than $7 million in the bank.

They’re currently saving around $150,000 a year, with a portfolio heavy on equities (predominantly the S&P 500 and growth stocks). This aggressive mix makes sense for now, given they’re in their mid-30s with a high income.

If the market comes crashing down, they have plenty of time to build their wealth back up. I’d stick with this allocation into their mid-40s to ensure their growth is as fast as possible.

However, they should consider shifting this focus before retirement, by around age 47.

Furthermore, given their heavy reliance on growth stocks, they should plan for volatility and give themselves plenty of wiggle room. I think this is a big area where they have not planned carefully.

Currently, this family spends a lot of money. This high cost does cover their mortgage and reflects the lifestyle they’re used to. However, scaling back this lifestyle would be at the top of my to-do list, especially given that their financial planning appears to be lacking in several key areas.

It’s wise to safeguard against future unknowns by lowering the amount of money they’re spending and increasing the amount they’re saving.

When you retire early, you do not qualify for Medicare. Therefore, you have to purchase your own insurance and fund your own medical costs. This is insanely expensive. The family currently plans to budget $1,200 for health insurance for the whole family, but this is extremely optimistic.

Health insurance costs can vary by location, but I would double this number at the very least. That doesn’t count deductibles and other medical expenses, either.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.