Personal Finance

I'm 46 and can start receiving a $100k+ per year pension once I turn 50 - is retirement really that attainable for me or am I missing something?

Published:

Last Updated:

It’s a great feeling to know that you have a pension to backstop you come retirement. While a pension may be a powerful driver of a more comfortable retirement lifestyle, many pensioners may be unaware of just how much they’ll get once all their retirement passive income sources are consolidated. When you throw inflation and other factors into the equation, it can be easy to imagine many folks are being left in the dark with regard to their retirement timeline.

Indeed, it makes sense to hire a financial adviser and wealth planner so that they can clear things up and show you the clearer path to your retirement. If you’d rather save the cash and take to Reddit, though, do be aware of the risks!

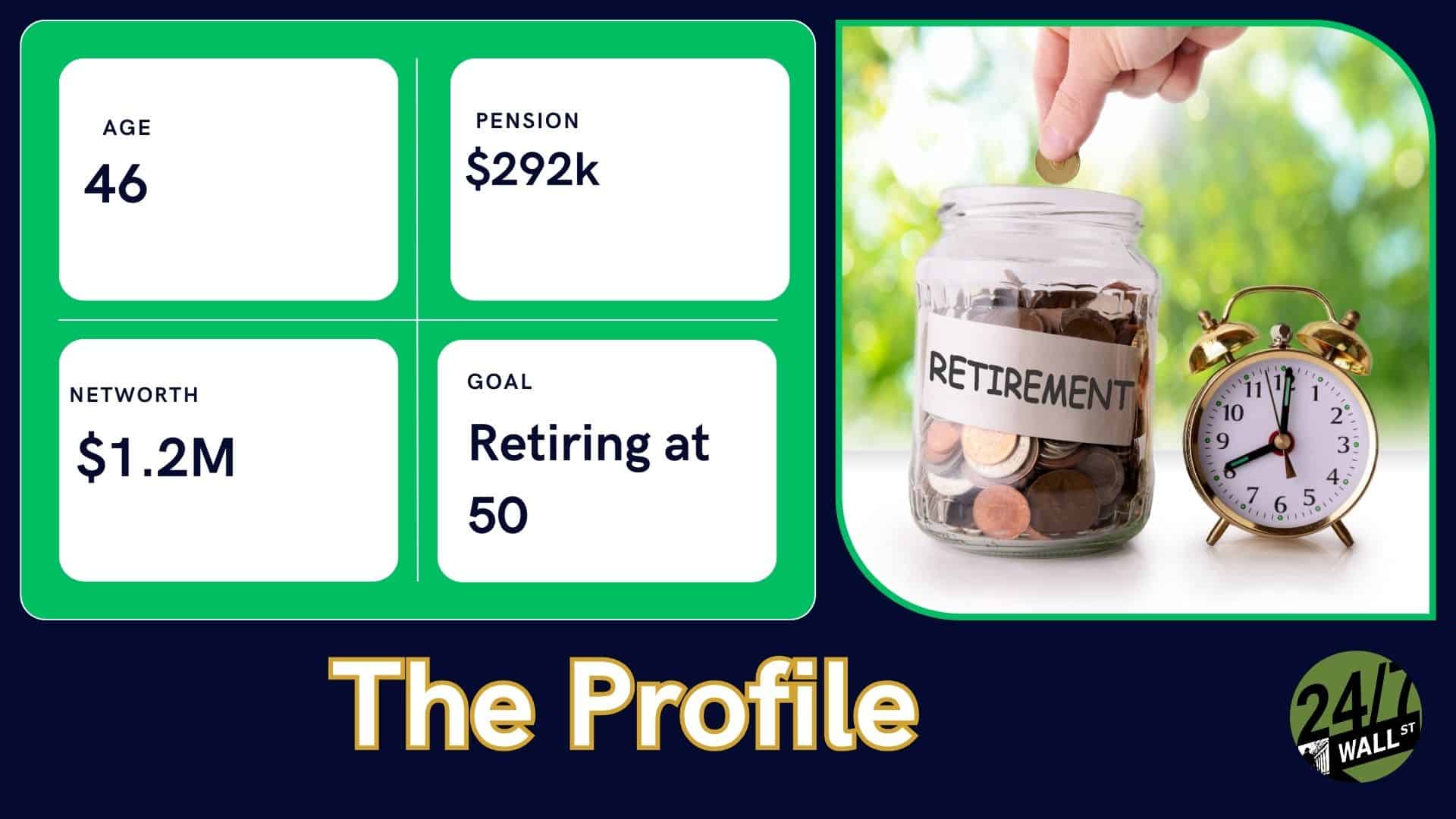

In this piece, we’ll have a closer look at a 46-year-old soon-to-be early retiree and r/chubbyFIRE Redditor who’s hoping to leave the labor force at age 50. They’ve got a net worth of $1.2 million and a nice pension with a current cash value of around $292,000. They expect the pension to pay $100,000 annually once they turn 50.

Indeed, things seem to be on track. That said, they’ll still be too young to take out social security benefits at 50. As such, they must plan accordingly to ensure the numbers make sense.

Either way, as a high-income earner (they’re pulling in $187,000 annually), they’ll really be putting the finishing touches in the next six years. On the surface, they look well-positioned to enjoy a nice early retirement that’s relatively chubby (a tad more lavish than average). However, there are risks that could derail their chubby early retirement, and they should be aware of them.

However, inflation has driven up prices of pretty much everything. And while it’s come down, there’s no guarantee it will stay down as interest rates fall. Further, there’s concern among some economists that potential Trump tariffs could act as an inflationary force.

Undoubtedly, if we’re bound for more inflation, the 46-year-old may have to stick it out in the workforce for a while longer if it’s a “chubby” early retirement that they seek. At this juncture, it’s really hard to tell how much of a concern an inflation resurgence could be. It’s a real risk and one that one may be quick to discount today now that it seems like central banks have gotten a better grasp of it.

If I were in the pensioner’s shoes, I’d not get my hopes up on a specific retirement date. Sure, retiring at 50 is still possible if the right cards fall into place. However, one should be open to sticking it out a year (or maybe a few years) in the workforce if the cost of living keeps rising at an above-average rate.

Of course, downgrading one’s lifestyle in retirement (think more of a standard early retirement) is also a possibility. Either way, I’m not so sure the Redditor would be up for such since he’s on the chubbyFIRE subreddit, which also values the “comfort” level of retirement. After all, a standard retirement won’t cut it for many higher-income earners.

The Redditor also has a big chunk of assets currently invested in their brokerage. Undoubtedly, if the stock market is in for another decade of 13%+ annualized gains, they could be well on their way to a chubby retirement at age 50. However, if the stock has other plans (a sell-off or crash could happen at any time), the retiree should be ready to adjust accordingly. Indeed, with close to a quarter million (and counting) in markets, a bad crash may just delay one’s retirement by a handful of years.

Personally, I think it’s unrealistic to expect X% returns from markets over the next six years. Instead, the Redditor may wish to adjust their asset allocation accordingly if they’re keen on retiring at age 50. If they’re flexible, I see no issue with their current asset breakdown. Arguably, it’s somewhat conservative, with less than 20% in the brokerage. However, if the market is in for a spill, there’s still some risk that the Redditor will need to make compromises.

While there are risks, the Redditor seems poised for a comfortable retirement at 50. Of course, things like inflation and market volatility could have other plans. As such, I’d say it’s wise for them to stay flexible at this juncture and perhaps reach out to an adviser.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.