Personal Finance

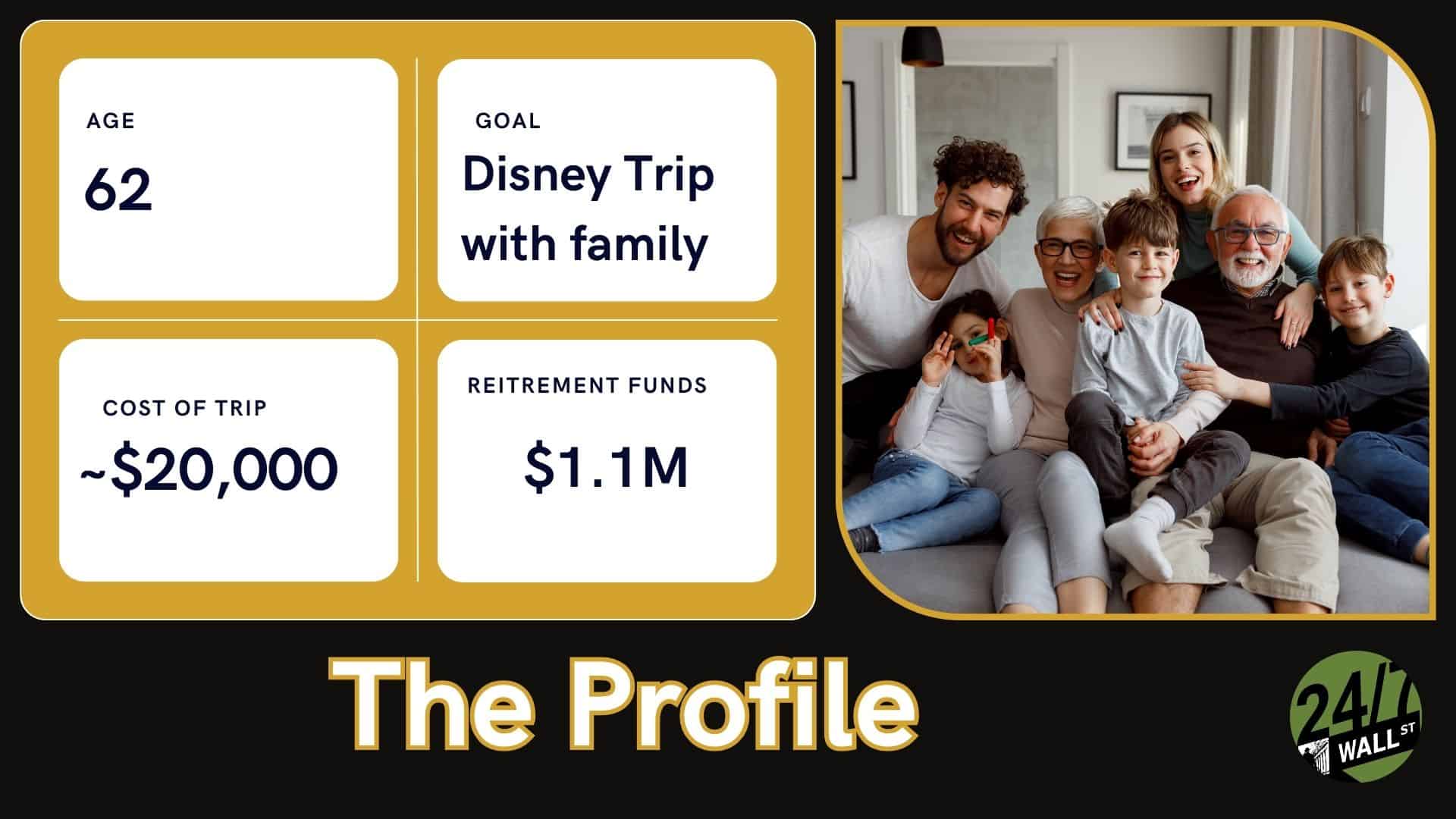

We're 62 and have $1 million saved for retirement - should we pay $20,000 to take our family to Disney world?

Published:

24/7 Wall St. Key Takeaways:

I like to watch Dave Ramsey’s show if only to listen to the wacky positions people get themselves in. However, one recent caller was very different. The 62-year-old caller shared her plans to take her entire family on a trip to Disney World, covering expenses for around 20 people.

Dave Ramsey’s advice: Go for it.

Here are some interesting key takeaways from this exchange:

The caller is in a strong financial position with over $1.1 million in her nest egg, no debt, and a steady income from pensions. She’s not only financially independent but can afford to live comfortably on her pension without touching her retirement savings.

For retirees in a similar situation, a one-time large expense like this can fit very easily within a long-term budget without derailing their whole financial plan.

Ramsey’s advice to go for it highlights that accumulating wealth doesn’t mean you have to just sit on it. You can also use it to create memorable experiences!

Yes, saving money is important. (We even have a whole article on Warren Buffet quotes on saving that demonstrate this.) However, splurging from time to time has its place, too. Once you have a nice nest egg built up and have paid off debt, splurging on a vacation or two isn’t going to put you in a bad financial position.

In fact, this is a huge reason why we focus on finances – so we can do these experiences without putting ourselves in debt.

Of course, you don’t want to splurge $30,000 and then find out you’ll need it later! The caller is reasonably cautious about spending her retirement funds on a vacation. However, at her age and with her expenses, this spending won’t have a major impact on her financial security.

Simply put: she’s earned it!

A healthy retirement balance, no debt, and a sustainable income allow her to take this vacation. Context is key, though. This choice could look very different for someone without such a solid retirement base.

Of course, Ramsey’s green light was reliant on the fact that this is a one-time expense. It’s important to keep it that way. Her savings could quickly dwindle if the caller decided to splurge on a vacation every few years. It can add up if it becomes a habit.

When you decide to do something “one time,” it’s important that it really is one time.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.