Personal Finance

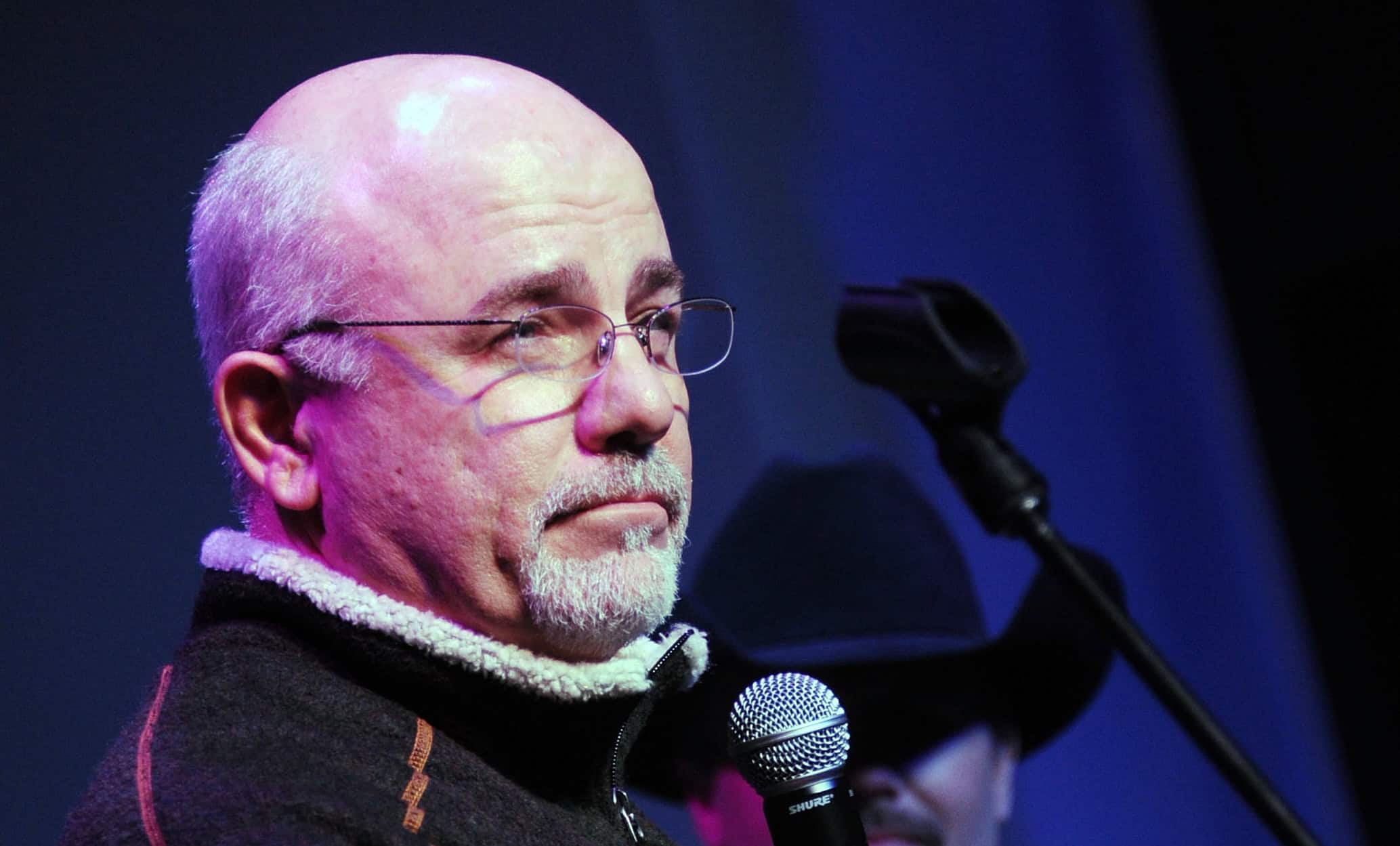

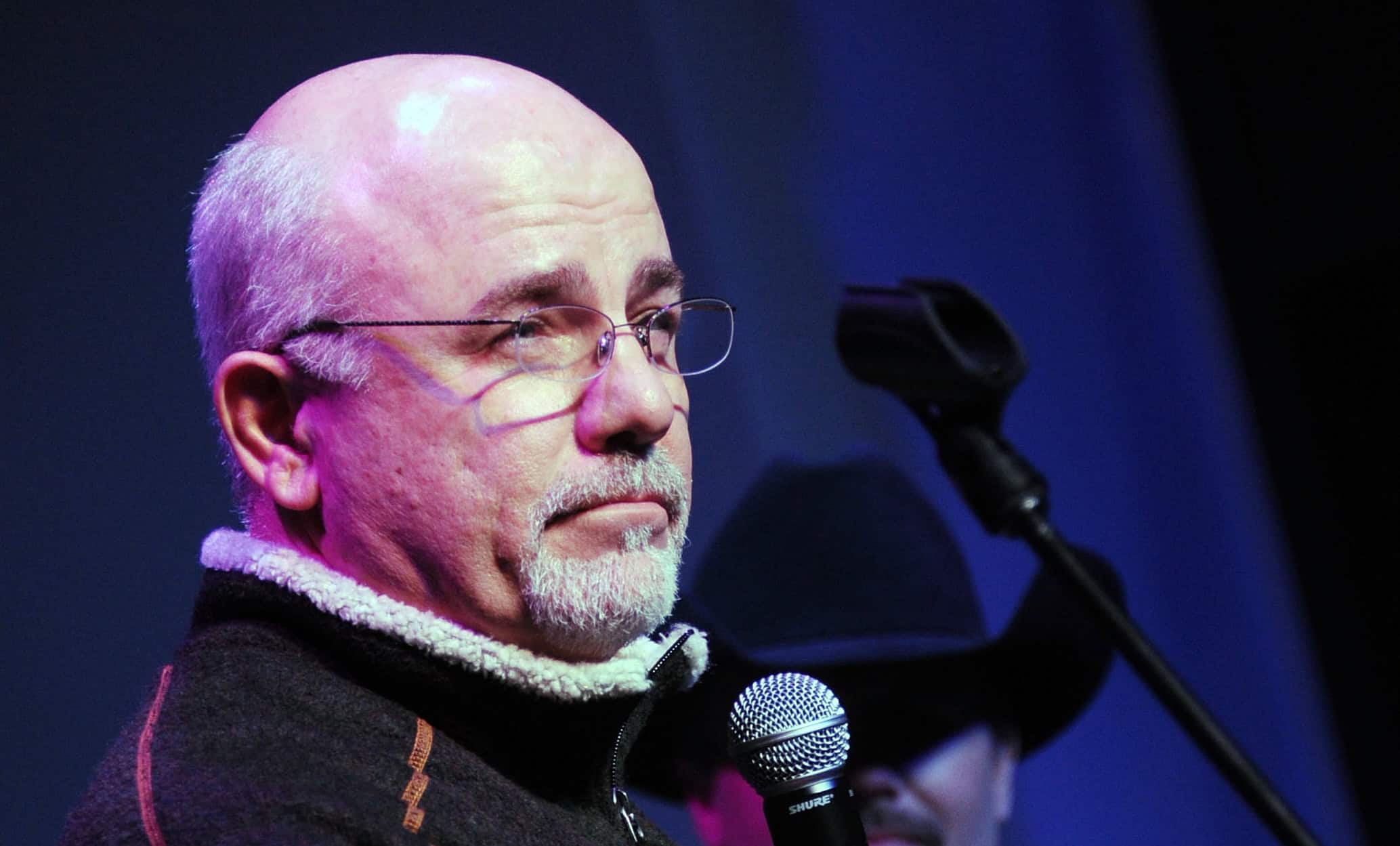

Dave Ramsey says this is what you need to do in order to retire off of a $3 million nest egg

Published:

Dave Ramsey’s show isn’t just entertaining; it can showcase deeply personal and fairly educational content. In this piece, I’m going to react to a recent caller who took to his radio show with an incredibly sizeable nest egg and concerns about its sustainability come retirement.

Undoubtedly, the caller is looking to retire a few years earlier (at 58), just four years shy of the minimum age to collect social security benefits. In short, Ramsey thinks the soon-to-be retiree has more than enough for retirement with a net worth of $3 million (and counting).

I think he’s right on the money. Though it’s always prudent to plan for unexpected financial circumstances that can happen (think pricy health expenditures, long-term care, market crashes, and other disasters), Ramsey doesn’t think it’s good practice to concentrate so much on such so-called “doomsday scenarios.”

Sure, low-probability, high-impact events can happen, and one will need to prepare to roll with the punches as they come. However, fixating on such deals may leave one losing sight of the reality of the situation. Indeed, $3 million is no chump change. In fact, I believe that many would argue that it’s more than enough to sustain a reasonably comfortable retirement with little to no chance of running dry.

Of course, retiring in one’s 50s entails a bit extra precaution, especially since a 58-year-old can expect to live another 20-25 years. Arguably, if the soon-to-be retiree is healthy, they may just see their retirement span three decades. After all, it’s not unusual to hear of someone nearing the centurion mark these days.

In any case, I think someone with $3 million shouldn’t worry so much about running out of money if their lifestyle isn’t outlandish. In the case of the caller, they’ve got a pretty sizeable income ($300,000 per year). And if they keep on spending as though they are still living paycheck to paycheck, even a massive $3 million nest egg will not last.

The good news is the caller doesn’t have plans on spending lavishly. If the caller plans to spend a modest sum (let’s say $50,000-60,000), their $3 million nest egg, I believe, has staying power. That said, should wedding and college expenses arise, there may be a few outlier years where annual spending spikes. Ramsey doesn’t see such expenses as all too much of an issue. I’m inclined to agree with him. With a $3 million net worth, even the outlier years don’t seem enough to derail one’s retirement.

In my mind, the real red flag would be if the retiree plans to start ramping up their spending in the so-called “go-go” years of retirement, which entails more significant expenditures. While the caller has more than enough to enjoy their earlier retirement years, I would consult with a financial pro to ensure the go-go year expenditures don’t get out of hand.

It can be easy to get reckless in the first few years of retirement, especially if there’s a lot of travel involved. Fortunately, the caller doesn’t sound like he’s about to crank up the spending upon retiring. As such, I do not see too many things for them to get anxious about as they inch closer to age 58.

Of course, every personal finance situation deserves a personalized touch. And with that, I do strongly believe that someone in a similar situation should consult a financial adviser for their opinions.

At the end of the day, the fees incurred by an adviser will pale compared to one’s nest egg. Even if you don’t learn anything new, at the very least, you’ll gain the assurance you need to move forward with retirement without fearing you’ll run out of money.

Either way, Ramsey urged his caller to keep investing wisely, preferably in a wide range of mutual funds, most notably growth-focused ones. Additionally, he urged them to play the long game with their investments and not play it too safe with “risk-free” securities like bonds.

Sure, retirees should strive to play it safer. However, there are also pitfalls of playing it too safely and not continuing to grow one’s wealth. While I somewhat agree with Ramsey, I do think it ultimately comes down to how much risk the caller is willing to take to grow their nest egg in their golden years.

In short, Ramsey thinks his caller, with a $3-million net worth, is on some stable footing. They seem fully aware of the potential hurdles that could weigh on their nest egg in the future. And with the help of an adviser, I do think they’re well on track to pass such hurdles without tripping up.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.