Personal Finance

I am looking to buy a $4 million house and have enough cash to buy it - should I use the cash or get a loan?

Published:

24/7 Wall St. Key Takeaways:

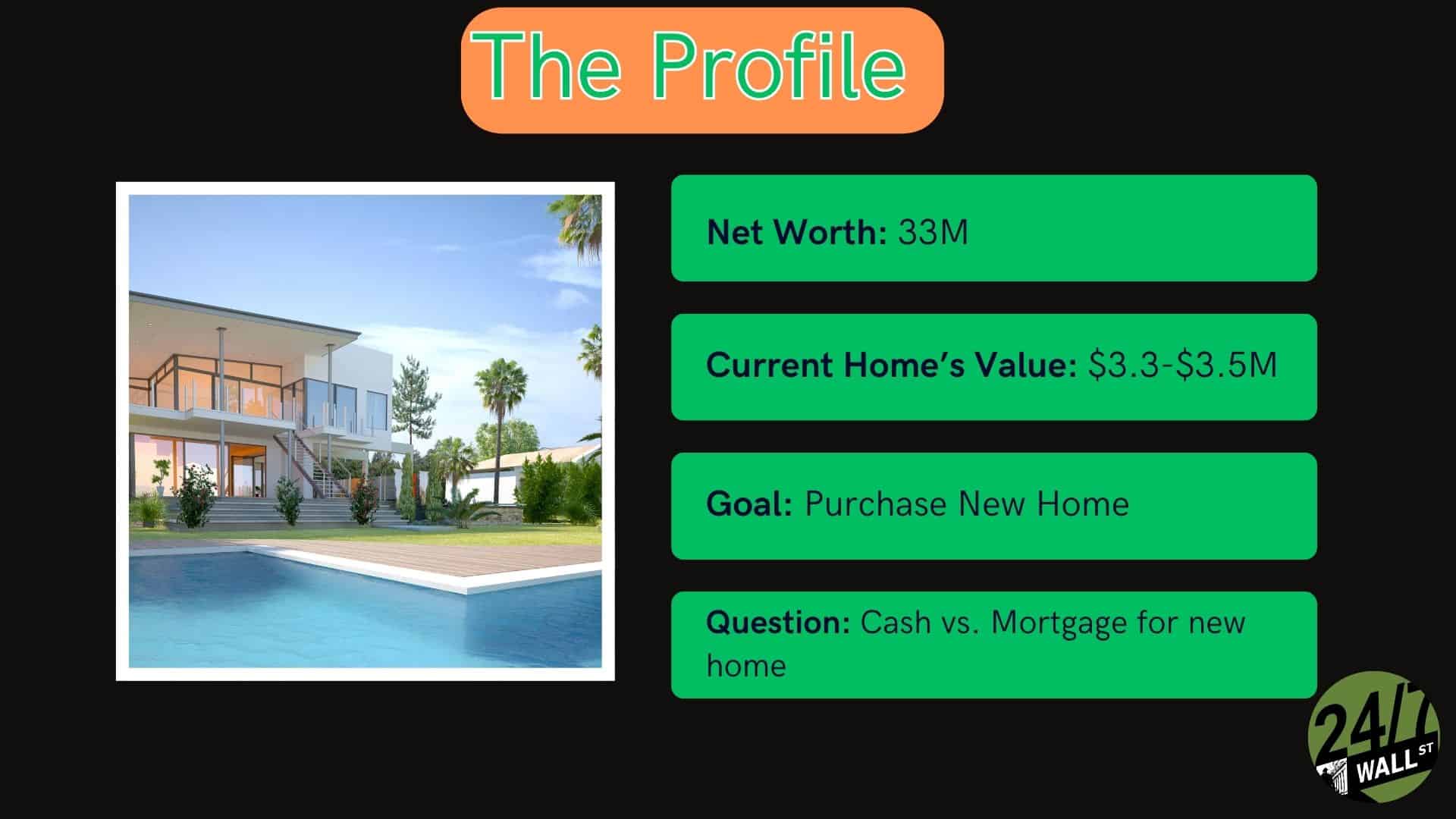

During one of my recent scrolls through Reddit, I came across a post by a user with an impressive $33 million net worth. Most of us imagine that people who are wealthy don’t have a problem with money, but this post proved otherwise.

The poster was asking for advice on financing a new $3.5M-$4M home. They have about $2 million in equity in their current home, and they’re considering just purchasing their new home in cash (given the high interest rates).

However, they’re also weighing the opportunity cost, as the invested $4 million could yield substantial returns.

Here’s my analysis of the poster’s situation and what we can learn from it. Remember, this is just my opinion and not financial advice:

With interest rates high, a cash purchase often seems preferable to avoid the cost of financing. The poster has plenty of liquidity to purchase the property outright, which would sidestep any mortgage fees, high interest, and financing hassle.

However, the choice isn’t as cut-and-dry as it might appear. Leaving the $4 million invested could potentially lead to a much higher cash flow than the money saved on the mortgage would. There is a big opportunity cost here.

The poster mentions that $4 million in equities would otherwise generate significant cash flow. That generated income could be far higher than what he would pay in mortgage fees, even considering our current high interest rates. This factor is a huge reason I don’t recommend paying off a mortgage early. The extra money often makes more in the stock market than you’d save on interest.

It’s important to consider the potential gains from investments that money could provide before locking it into real estate. Yes, it’s nice to own your home outright, but that doesn’t mean it’s the best financial decision.

Of course, the decision ultimately depends on your goals and risk tolerance. If you have a very low-risk tolerance and aren’t going to invest the $4 million in growth stocks anyway, using it to buy a house is preferable to letting it sit in a bank account.

However, if it’s already invested in the stock market, pulling it out to buy a house isn’t necessarily the best option.

This poster is in a very good financial situation. With $31 million in liquid assets, they have a lot of flexibility. This liquidity makes it easier for them to fund future opportunities, which is a good argument for funding their home outright. However, even though $4 million is only a small part of their net worth, it would still be better invested than sitting in a house.

That said, financial decisions are not made with math and logic alone. Emotions have a huge role, too. For example, eliminating debt has a huge appeal, particularly for those with low-risk tolerance. If it is going to keep the poster up at night, it may be better to use the money to purchase the house outright.

Your money should work for you, and sometimes that means making the less stressful decision, even if it isn’t the best one according to the math.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.