Personal Finance

I've been maxing out my retirement accounts - but is it actually hurting my early retirement goals?

Published:

Last Updated:

Key Points from 24/7 Wall St.:

While scrolling through Reddit, I recently came across a post where the user shared a key challenge many in the early retirement community face: balancing contributions to tax-advantaged retirement accounts with building accessible funds for early retirement.

Many in the FIRE community max out their IRA annually, which helps them reach their retirement goal. Low-cost index funds help these accounts grow steadily.

However, this poster was wondering whether they should be prioritizing these tax-advantaged accounts or instead focus on increasing their access to cash. There are pros and cons of each approach.

Here’s my analysis of this dilemma and the key takeaways for anyone in a similar position. Remember, this is just my opinion and not financial advice.

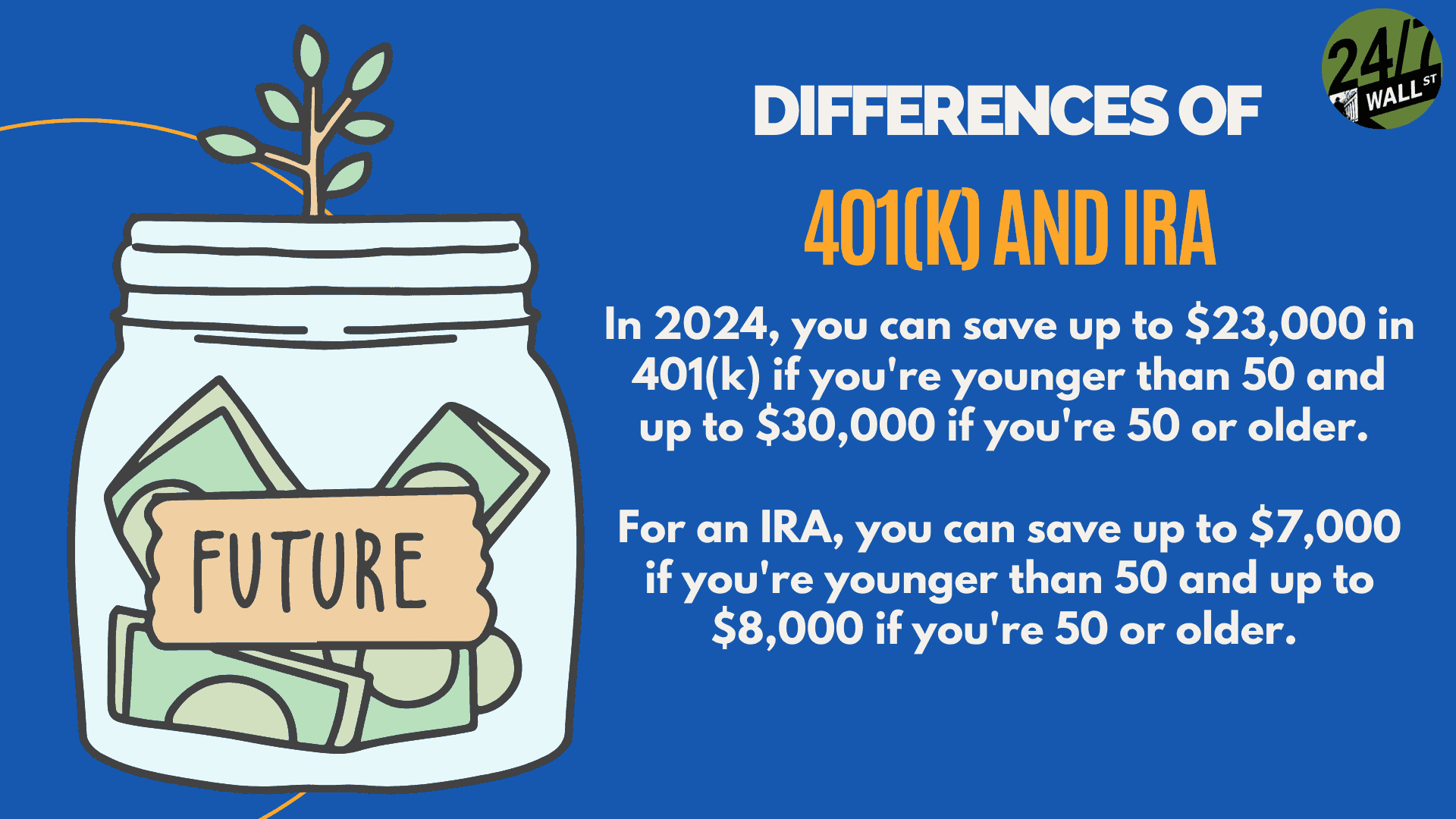

Neither approach is obviously better than the other. Tax-advantaged accounts like IRAs and 401(k)s have serious benefits. They let your investments grow tax-free or in a tax-deffered environment. Both of these facts can help you save money for retirement faster. It is possible for a 401(k) to get potentially too big, though.

However, tax-advantaged accounts also have several restrictions. In many cases, pulling from them is challenging until you reach retirement age and fraught with penalties.

This major downside makes having a “bridge fund” a good idea. This fund is a more accessible account that you can draw from tax-free before your tax-advantaged accounts can be drawn from.

Simply put:

Tax-advantaged accounts allow your funds to grow faster, but a bridge fund is often required for early retirement for flexibility.

You don’t need to choose one type of account over another, though. In most cases, early retirees need tax-advantaged funds and a bridge fund. They work together.

Striking a balance between both of these accounts is the challenge.

Generally, it’s recommended that you focus on tax-advantaged accounts. Over time, you can gradually shift to a bridge fund as you get closer to early retirement.

That said, I also recommend directing any “extra cash” (think bonuses and tax refunds) to your bridge fund, assuming you’re maxing out your traditional accounts.

So, when should you shift to a bridge fund? In most cases, that depends on how soon you’re considering retirement. If retirement is within 5-10 years, you may want to reduce your IRA contributions and put more toward your bridge fund.

When you’re decades from retirement, it often makes more sense to focus on tax-advantaged accounts to maximize the growth of your funds. As you get closer, the amount of growth you can expect lowers.

That said, the most important part of any retirement plan is adapting the plan to your specific situation. Life changes, like increased income, are good opportunities to take a look at your current plan and shift things around as needed.

If you suddenly have extra cash, consider using it to kickstart your bridge fund. Your goal should be to take full advantage of tax-advantaged plans and fund your bridge.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.