Personal Finance

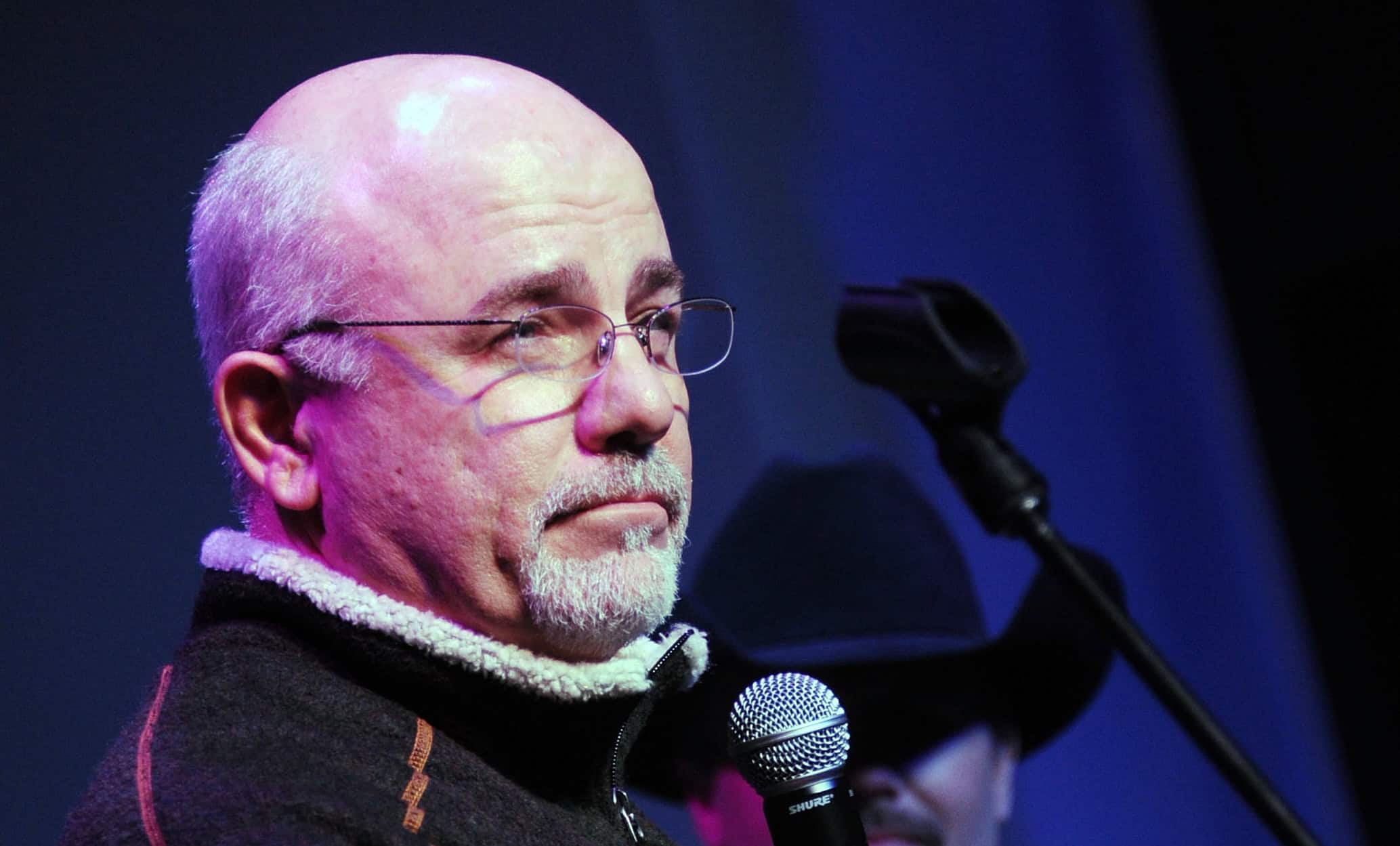

Dave Ramsey says these are the two questions that separate rich people from poor people

Published:

Last Updated:

Financial advice radio program host Dave Ramsey usually gets callers with specific questions on their personal situations. However, among general topics, one that has come up is the different mindset that separates the rich from the poor.

Ramsey noted that the major question that a rich person asks when posed with a proposition is: “How much?” Conversely, Ramsey says that a poor person will ask: “How much down payment?”

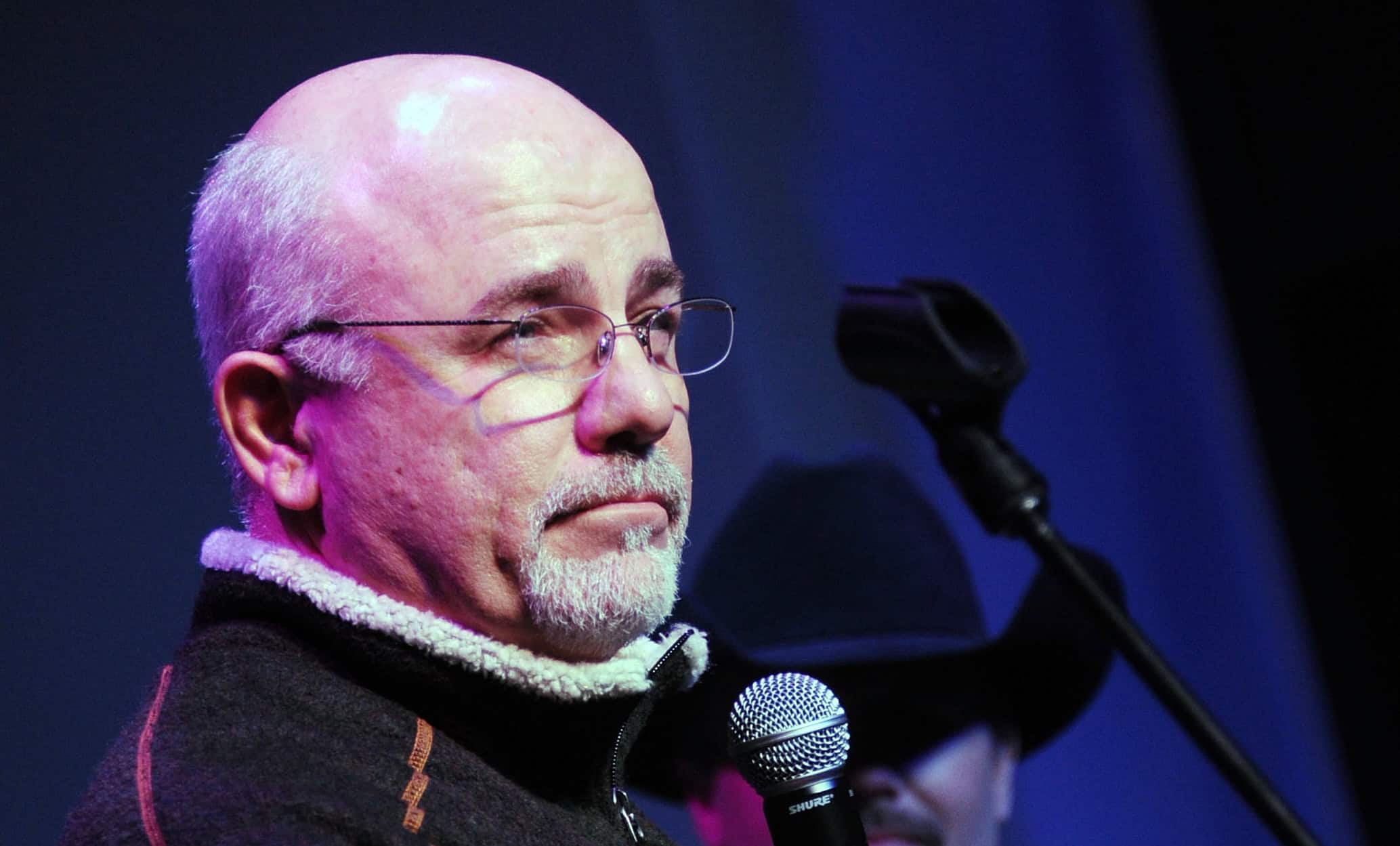

The implication is that rich people don’t spend beyond their means, while poor people habitually overspend themselves into debt scenarios. They purchase based on whether or not they can afford the down payment, without consideration about how high interest rates, sudden emergencies, a loss of employment or a pay cut can impact the ability to maintain payments, not to mention the higher total net cost when the interest is added on.

According to Business Insider, the average American is $104,215 in debt, inclusive of mortgage, credit cards, auto loans, and student loans. The yoke of debt around American taxpayers’ necks grows continually larger; the national debt is presently increasing by $1 trillion every fiscal quarter.

There is absolutely no question that the debt and credit business is huge. Visa Inc. (NYSE: V) stock, at the time of this writing, is currently 4 points shy of its 52-week high of $296.34, and Barclays has just announced its 12-month target for Visa is $347.00. Rival MasterCard (MYSE: MA) is trading at $506 and has an analyst consensus 12-month target price of $544.36.

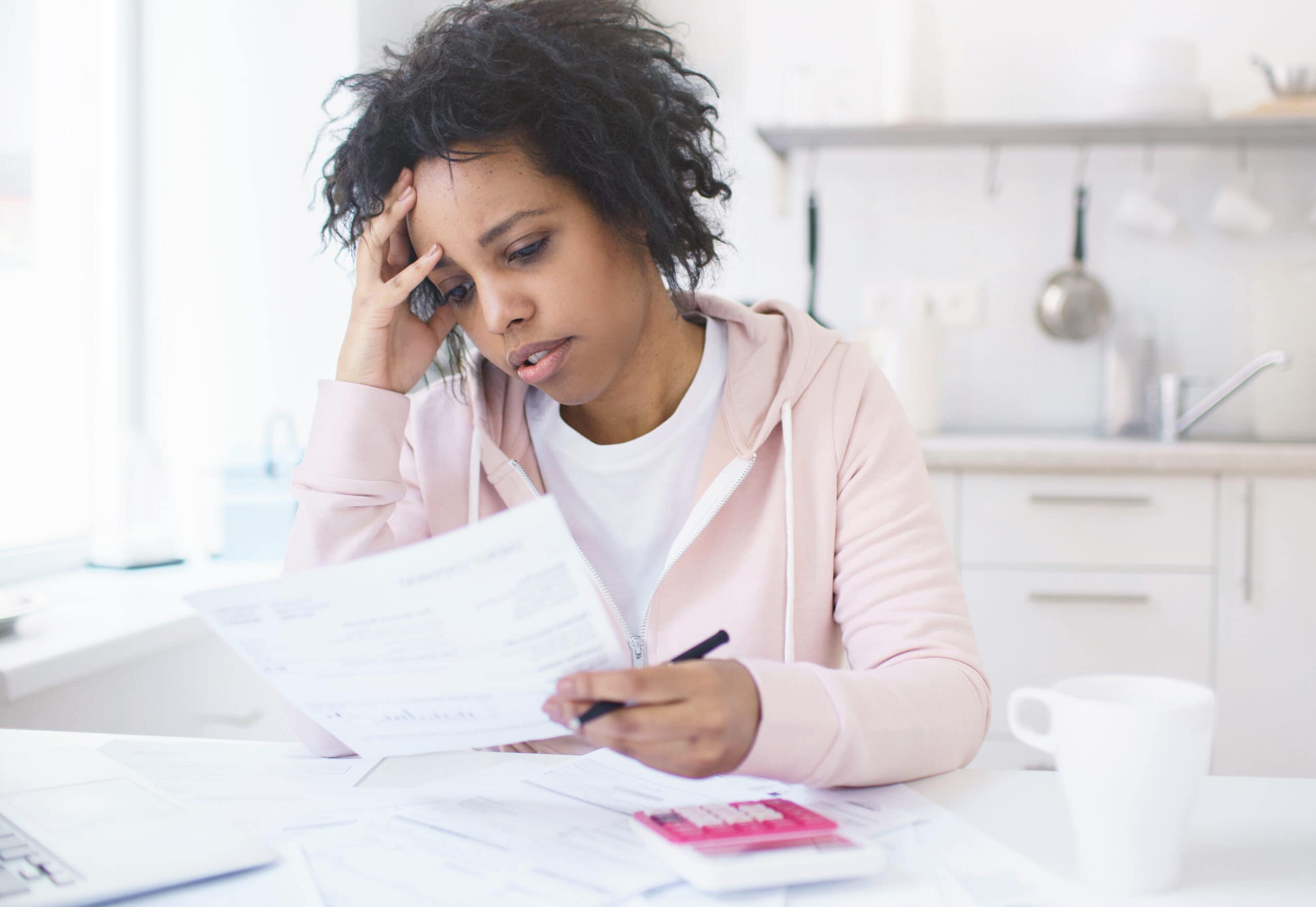

Credit card balances exceeded the $1 trillion milestone in Q4 2023. A Debt.com report cited the following statistics among American respondents:

Ramsey’s fundamental advice is essentially, “Don’t buy it if you can’t afford it.” Sadly, the omnipresence of 24/7 marketing in our social media, emails, television viewing, and even in reading newspapers and magazines, makes this advice even more difficult now than in bygone days.

Given that inflation is still a threat that is lurking around the corner to jump higher yet again, cutting credit cards that may be needed in emergencies is not a practical option in the current economic climate. However, there are some steps that those trying to handle debt can take to get out from under:

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.