Personal Finance

I'm 62 With $2 Million. Should I Take Social Security or Wait?

Published:

Last Updated:

Key Points from 24/7 Wall St.

Social Security gives you a choice in signing up for benefits. You can file a claim as early as age 62, or delay your filing up until age 70 for a boosted monthly payday.

In fact, there’s technically no such thing as being too late to sign up for Social Security. You can claim benefits at any time, but understand that there’s no financial advantage to delaying your filing beyond age 70.

In between the ages of 62 and 70 is full retirement age (FRA), also known as the age when you can collect your complete monthly benefit (calculated based on your personal earnings record) without a reduction. FRA will hinge on your year of birth, and it’s 67 for anyone born in 1960 or beyond.

Delaying your Social Security claim beyond FRA boosts your monthly benefit by 8% a year until the age of 70. Signing up before FRA reduces your monthly benefit, and the formula there is a bit trickier.

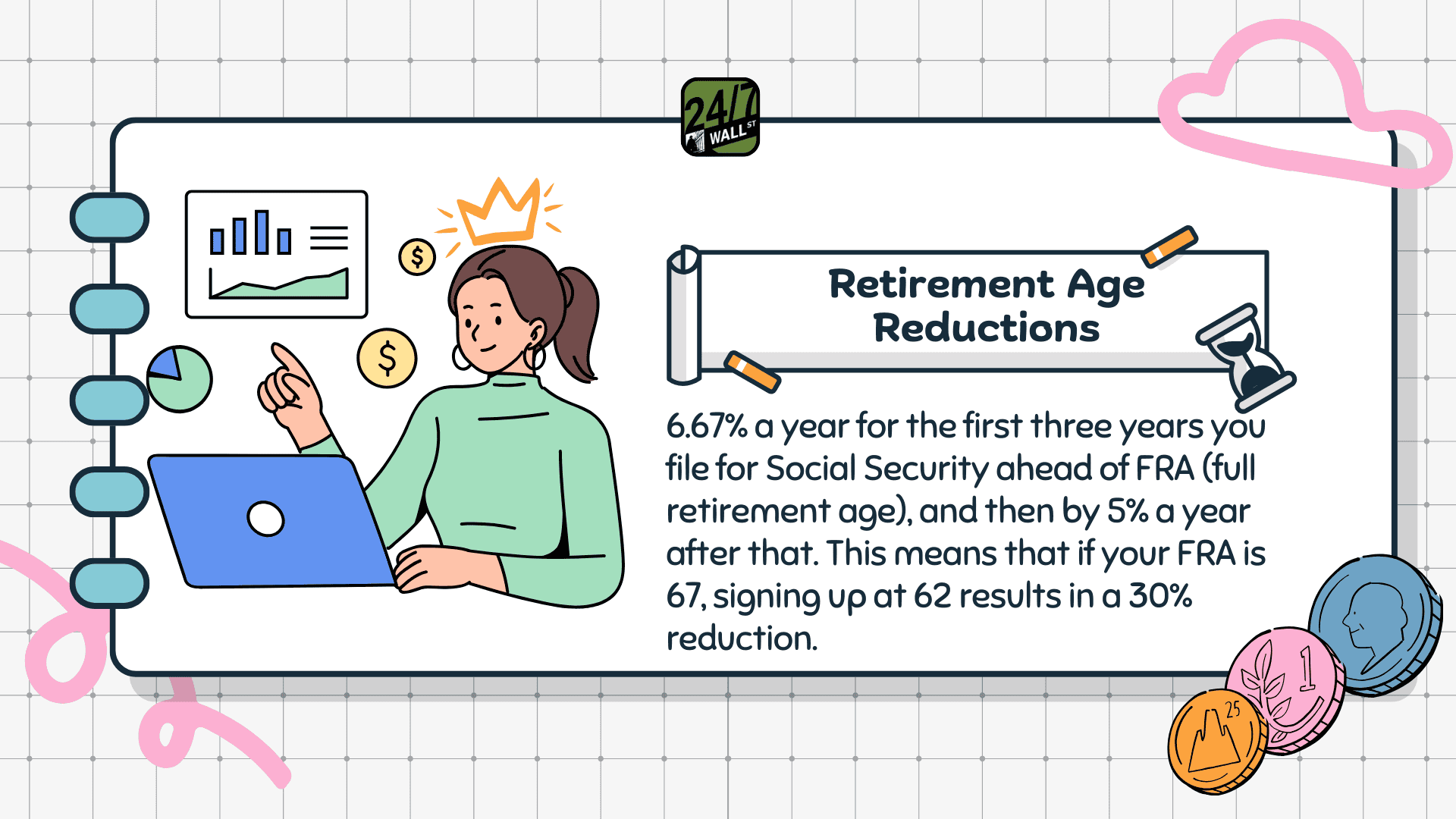

In a nutshell, your benefit is reduced by about 6.67% a year for the first three years you file for Social Security ahead of FRA, and then by 5% a year after that. This means that if your FRA is 67, signing up at 62 results in a 30% reduction.

That’s a problem if you don’t have a lot of savings to fall back on. And many older Americans are in that boat, with the median balance among 65- to 74-year-olds sitting at $200,000 as of 2022 per Federal Reserve data.

But what if you have $2 million in savings by age 62? That’s a very different situation to be in, and one where an early Social Security filing may not hurt your retirement finances too badly.

Shrinking your monthly Social Security benefit can be a problem when it’s your main source of income. But if you have $2 million to your name by age 62, you have more leeway to settle for a smaller monthly benefit because you can get plenty of income out of your nest egg.

If you follow the 4% rule, a $2 million IRA or 401(k) gives you roughly $80,000 a year in retirement income off the bat. Even a more conservative 3% withdrawal rate leaves you with $60,000. If your home is paid off and your living expenses aren’t outrageous, you may be perfectly fine to claim Social Security as early as possible and enjoy that money sooner.

It’s not necessarily a bad thing to claim Social Security at 62 if you have a lot of money outside of it. But don’t just sign up for Social Security at 62 because you can. If you’re going to file early, do so for a specific reason.

That reason could be that you hate your job and want to quit. It could be because health issues are making it harder to work, even though you love what you do. Or, it could be because your career made it tough to travel, and you want to see more of the world while your health is in good enough shape for it.

The upside of claiming Social Security at full retirement age or beyond is locking in a larger monthly benefit for life. That guaranteed income could bail you out if your portfolio doesn’t perform as well as expected in retirement, or if you end up far more burdened than anticipated by medical costs.

Ultimately, you’ll need to weigh the good against the bad. The benefit of claiming Social Security at 62 is immediate access to that money. The drawback is less guaranteed income per month. From there, it’s up to you to decide. But know that if you’re coming into retirement with a nice chunk of savings, an early filing won’t necessarily wreak havoc on your finances.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.