Personal Finance

The Average American Can’t Answer These Simple Credit Score Questions

Published:

It turns out, that it doesn’t just require money to make large purchases, it also requires a good credit score. Why does one need a credit score? What is a credit score? How do you obtain a good credit score? In order to be successful, you need to know the answers to these questions and more.

Credit is the amount of money you have borrowed and not yet repaid to make large purchases like medical bills, homes, property, school tuition loans, and other types of loans. A credit score is a number that represents your history of loan repayment so future creditors can determine if they will or will not loan you more money.

Having a good credit score is important because it allows you access to more options in regard to where you live, what car you drive, etc. If you have a good credit score, you are more likely to access better borrowing terms which means lower interest rates, lower monthly payments, and greater options for renting apartments and houses. Having a good credit score helps you have more control of your major life decisions.

In 1841, a standardized method created by the Dun & Broadstreet Company used an alphanumeric system that took subjective information such as race, attitude, gender, etc. from borrows being used at the time and turned it into an objective way to evaluate credit.

The modern credit scoring models that we use today were implemented in America in 1958. The first credit scoring model called the Credit Application Scoring Algorithm, was created by Bill Fair and Earl Isaac, an engineer, and mathematician. In 1970, the Fair Credit Reporting Act was passed and required credit reporting bureaus to expunge biased data and delete negative history after a certain period of time.

In 1989, credit reporting agencies teamed up with Fair, Isaac, and Company (FICO) to find an industry-standard credit score. Today, 90% of all credit lenders use FICO scores when evaluating lenders, and it is considered to be the score that is most reliable and has the most accurate credit history.

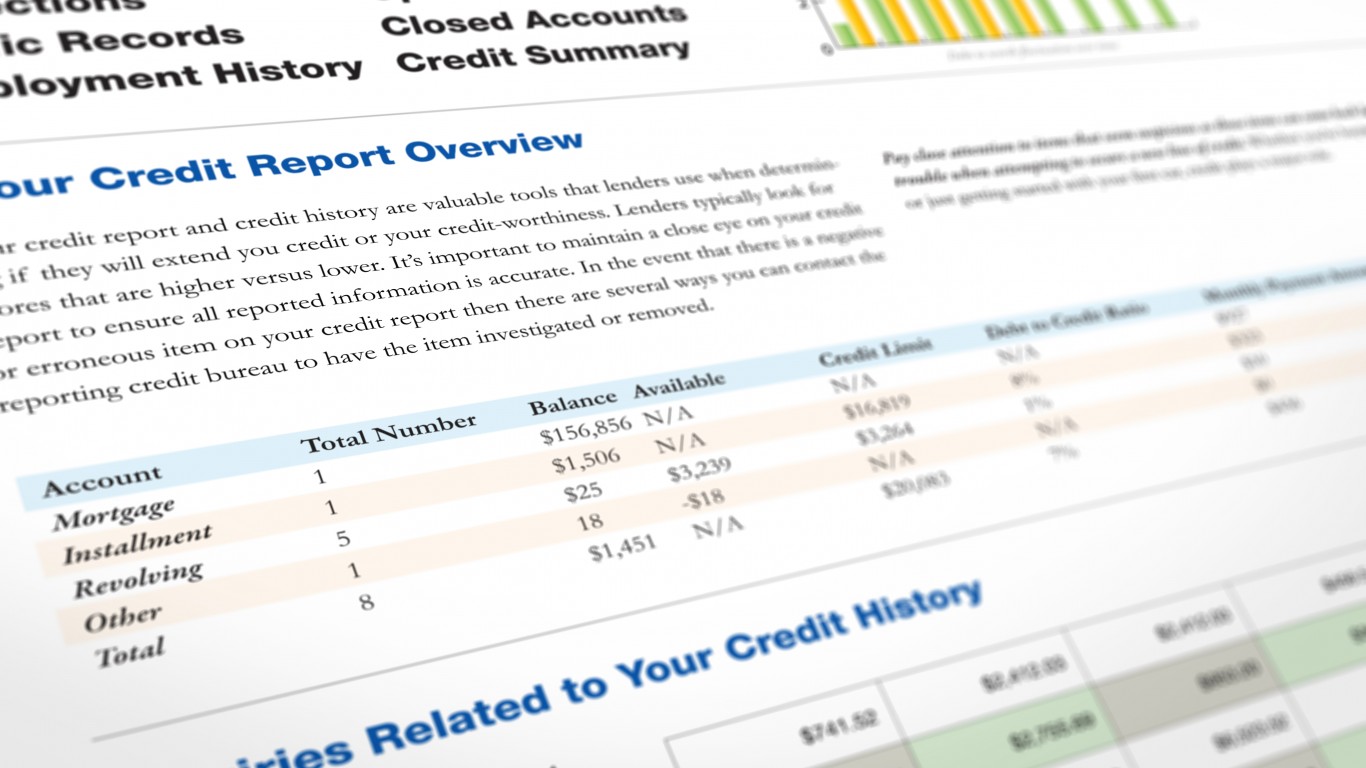

There are several ways to discover what your credit score is. The most popular way is to purchase your score from a credit report agency. The main three agencies are Experian, TransUnion, and Equifax. Sometimes you can check your score for free from these agencies.

Other companies like lenders, nonprofit credit counselors, and credit card companies can check your score for free. The next most common way to check your credit score is to talk to a credit counselor. Credit counselors are usually fee-based and easily accessible. Another way is to check your loan and credit statements.

There are several ways to improve or “fix” your credit score after a significant hit. One of the best ways is to dispute any inaccurate information on your credit report. Another surefire way is to make on-time payments, keep your oldest account open, and diversify the types of credit that you have. The more types you have, the better your score will be.

A few other ways include limiting your credit cards to only a few, becoming an authorized user on someone else’s cards, and reviewing your credit reports regularly.

Credit card use is the fastest and easiest way to start to build credit. It can either help or hurt your score. Things that can increase your score are paying your bills on time each month, not utilizing your entire credit card limits, and having only a few credit cards.

Some factors that can harm your score include having many different cards, not paying off each credit card fully each month, using up your entire credit card limit, and owing too much money on your cards. Your credit can also take a hit when you apply for new cards, and immediately use a large portion of the credit immediately upon opening up a new card.

There are a few main types of credit scores: FICO, VantageScore, and Equifax. Most lenders usually use FICO and VantageScore. Those two main scores are very similar and allow a lender to know slightly different information. Different types of loans and lenders prefer to see different types of information, which is why there is more than one type of credit score.

Secured credit means that the money you are borrowing is secured by the item you are buying. If you don’t make the monthly re-payments, the lender can take possession of the item you are using the loan to buy. Examples of secured credit are home loans and car loans.

Unsecured credit are loans that don’t have collateral requirements. Instead, they generally have steeper interest rates than secured loans.

Installment loan accounts include home equity loans, auto loans, mortgages, and personal loans. Installment loans have a specific monthly payment requirement, interest rate, and repayment term. This can allow the borrower to access large amounts of money, more than a credit card or line of credit would allow.

Revolving credit accounts are the most common. Some examples of revolving credit are credit cards, store credit cards, personal lines of credit, and home equity lines of credit. They usually involve a contract that establishes a set interest rate, some more extreme than others, an upper limit, and require monthly repayments. It is revolving because the balance resets when you pay off what you spend.

The credit utilization ratio is an important equation that helps determine your credit score. It is the percentage that represents your total debt divided by the full amount of revolving credit that you are approved for. So, if you have a credit card that has a $20,000 limit, and you owe $2,000 on that revolving line of credit, your credit utilization ratio would be 10%. It is best practice to try to keep your credit utilization ratio under 30%.

A line of credit (LOC) is a loan with a borrowing limit usually issued by banks or credit unions for personal or business use. The advantage of an LOC is that it is flexible, and can be spent on anything. The downside is that they can often have high late payment penalties and high interest rates. A LOC can be borrowed, repaid, and then reborrowed an unlimited amount of times. Examples of Lines of Credit are Personal Lines of Credit, HELOC (Home Equity Line of Credit), Business Lines of Credit, and Securities-Backed Lines of Credit.

Consumer credit is just a classification of personal lines of credit. This is just credit used for various small personal purchases, not large ones like a mortgage or auto payment. Consumer credit can come in the form of revolving, installment, secured, and unsecured. Besides banks, consumer credit can come from payday lenders, pawn shops, family and friends, credit unions, consumer finance companies, federal agencies, and online lenders.

Examples of consumer credit are loans and credit cards. Consumer credit is an excellent way to build and boost your credit score, allow you access to credit perks and rewards, protect you against fraud, and reimbursements if a merchant won’t give you one.

There are also drawbacks such as interest rates, and fees, easily damaging your credit score, and being subject to predatory lenders.

In order to have a good credit score, a mix of credit is required. The standard is having a mortgage, a few credit cards, and an auto loan. Having these payments shows that you are capable of repayment, and are smart with borrowing money.

A FICO score is your credit score according to the Fair Isaac Corporation, which is considered the industry standard and used by 90% of lenders. It is a type of credit score and consists of a 3-digit number between 300-850. The higher the number, the better the score, and the more money you have access to borrowing, how low the interest rate is, and how many months you have to repay your loans. FICO scores are calculated with the data provided by Equifax, Experian, and TransUnion.

Your FICO Score is determined by 5 different categories, the most weight given to payment history (35%), amounts owed/ credit utilization (30%), length of credit history (15%), credit mix (10%), and new credit (10%). FICO scores take more time to establish than VantageScores but some of the advantages include allowing a 45-day window for mortgage and car-rate shopping and having 5 different credit score ranges, anything over 670 is considered “good.”

FICO is determined by the US Government as the most accurate for home mortgages. Government-sponsored entities like Freddie Mac and Fannie Mae are only authorized to use FICO instead of other credit score types.

A VantageScore is another type of credit score. Instead of using the Fair Isaac Corporation’s algorithm, it was developed by three separate major credit bureaus: Experion, TransUnion, and Equifax. Like a FICO, it also uses a 3-digit number scale from 300-850. Your VantageScore puts the most weight on your payment history (40%), Amounts Owed (34%), Depth of Credit (21%), and Recent Credit Applications (5%). Your VantageScore is determined by the data in your credit reports. It could vary based on what information each bureau has because creditors don’t report to each one equally.

A VantageScore takes less time to establish than a FICO and other advantages include allowances for natural disaster victims, and ignores paid collectors. Some disadvantages include only allowing 14 days for car or mortgage rate-shopping counting each inquiry within that window as one inquiry, and putting more weight on late mortgage payments.

The length of time it takes to fix an error on a credit score depends on what type of error it is. For accepted disputes and other human errors, it takes around 3 months for a correction to reflect on your report.

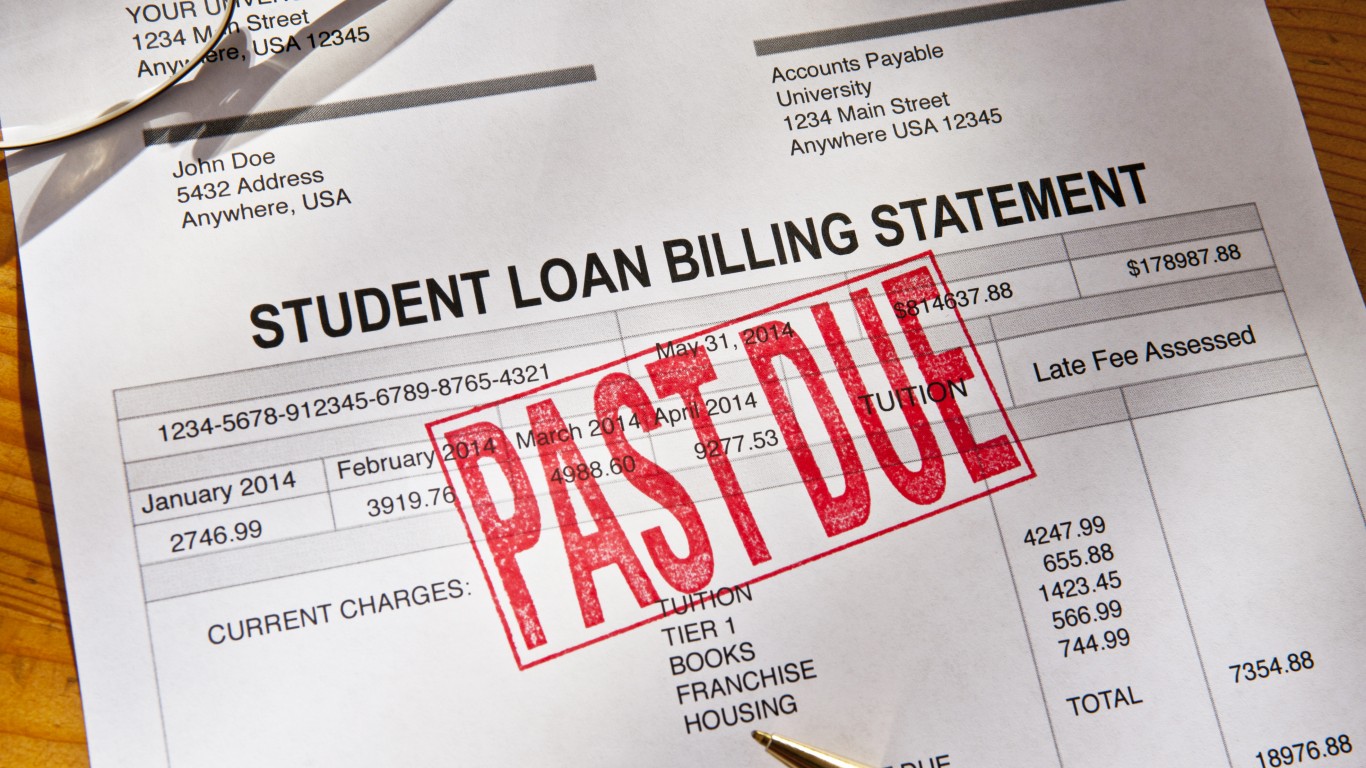

The time it takes to improve your credit score depends on the type of credit you are trying to improve. For example, negative credit-building actions such as collections accounts, and missed or late payments could stay on your report for up to 24 months, even if you pay off the debt completely.

High credit utilization, even if paid off entirely, will stay on your credit report anywhere between 12-24 months.

If you declare bankruptcy, your mortgage goes into foreclosure, or you show a debt that has gone to collections that remains unpaid, that will stay on your credit report and negatively affect it for up to 10 years.

Every time you apply for a new line of credit or a loan, a creditor will request to view your credit score. This is called a hard inquiry and will reflect negatively on your credit score for up to 24 months.

Depending on the type of credit score, determines how each type of credit will affect it. For example, 10% of your FICO score is determined by how well of a mix of credit types you have, while more weight is given to late payments on your VantageScore.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.