Personal Finance

My husband makes 4-times as much money I do, and I’m afraid of being treated unfairly when we retire

Published:

Last Updated:

When couples under age 40 get married, planning for retirement, burial plots, long-term healthcare, and other issues dealing with advanced age are often put on the back burner or are conveniently delayed until it’s too late. What can exacerbate the awkwardness of even approaching the topic are unequal individual pre-marriage net worths. Among the pro and con questions that may crop up:

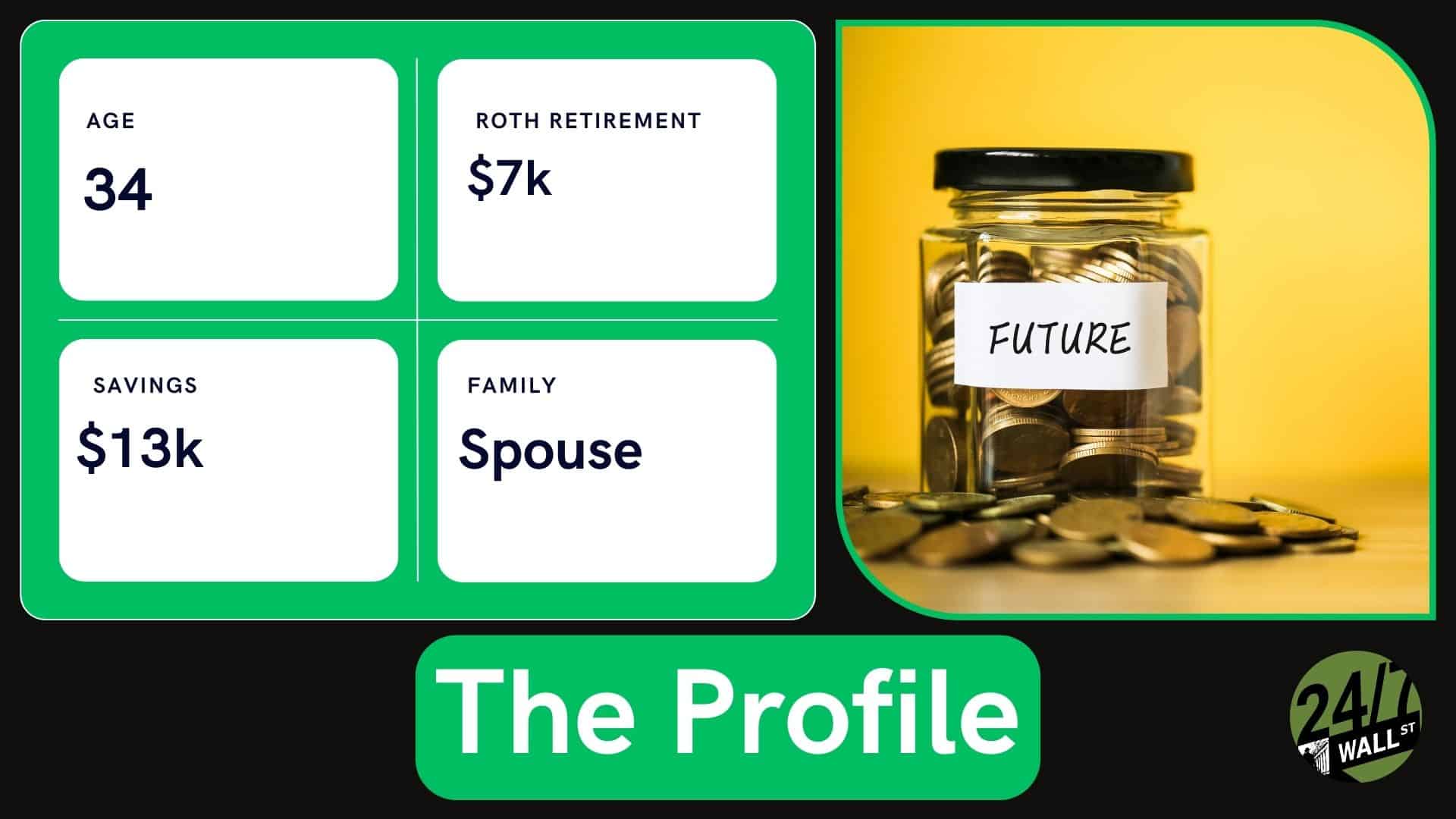

After an 8-year courtship, a 34-year old recently married woman posted her requests for retirement advice on Reddit. Perhaps the questions stem from financial insecurities and the statistical high rate of divorce. Perhaps they stem from her relative lack of financial management savvy when she compares herself to her husband. The details she disclosed include:

|

Assets |

Him |

Her |

|

Income |

4X |

X |

|

Roth IRA account |

$100K+? |

$7,000 |

|

Savings Account |

$60,000 |

$13,000 |

|

401-K |

$100K+? |

$8,000 |

|

High-Yield Savings Account |

$100K+? |

$0 |

|

Totals |

~$360,000+ |

$28,000 |

The couple have since opened a joint bank checking and savings account, as well as a joint High-Yield Savings Account with $20,000 received as wedding gifts.

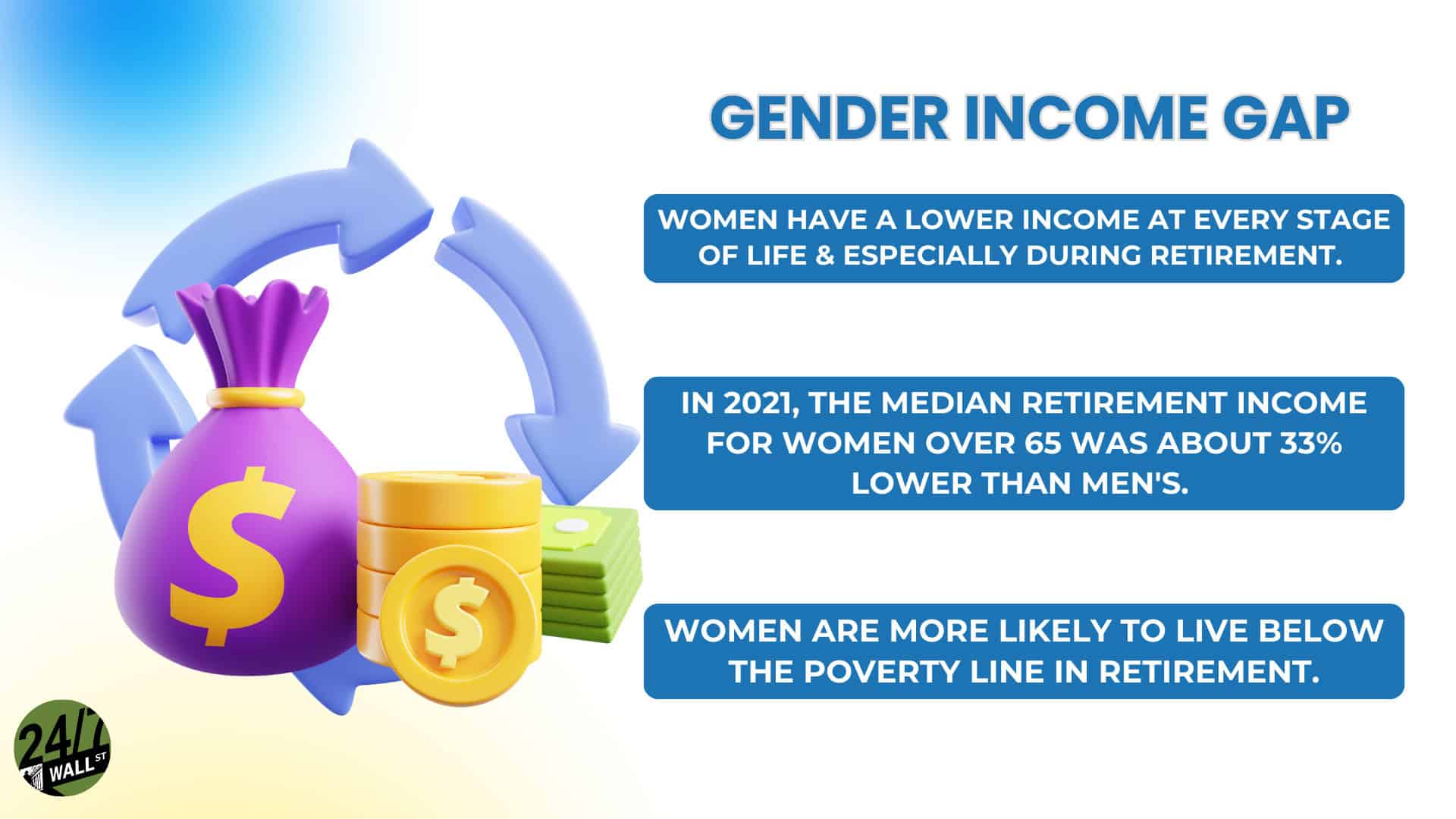

The poster’s primary concerns are being screwed over financially when older, and being unable to financially provide for herself in her twilight years, while her husband might be enjoying a much better lifestyle.

Setting aside the likelihood that she would inherit her husband’s wealth in the event of his early demise, her concerns seem to stem around a potential divorce down the road, or perhaps a fear that her husband won’t provide for her during retirement. While there is insufficient evidence to make any judgments about their marriage, the fact that the husband has opened a pair of joint banking accounts with her might indicate that the fears are unfounded, However, there are some practical steps that the couple can take to provide for contingencies as well as better plan for their golden years.

Given the husband’s cooperation to date and the poster’s concerns, a prudent first step would be to create a Joint Retirement Plan. Some of the areas where they need to find agreement entail:

Enlisting the aid of a certified financial planner could also make the couple aware of financial options with which they may be unfamiliar, and can structure sufficient contingencies and protections into the retirement plan to give both spouses peace of mind.

The husband, whose earnings are larger, might need to delay his retirement to assist in boosting the wife’s retirement account, while she strives to add her contributions to the joint retirement and benefits fund. By working as a team, they can prioritize communication and avoid conflicts in the marriage as they cohesively build towards their retirement goals together.

This article should be considered as opinion only, and not as professional advice. Readers seeking professional retirement plan counseling should contact a Certified Financial Planner or comparable professional.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.