Personal Finance

We make $300k per year but still spend more than we make - how do we get our heads above water?

Published:

Last Updated:

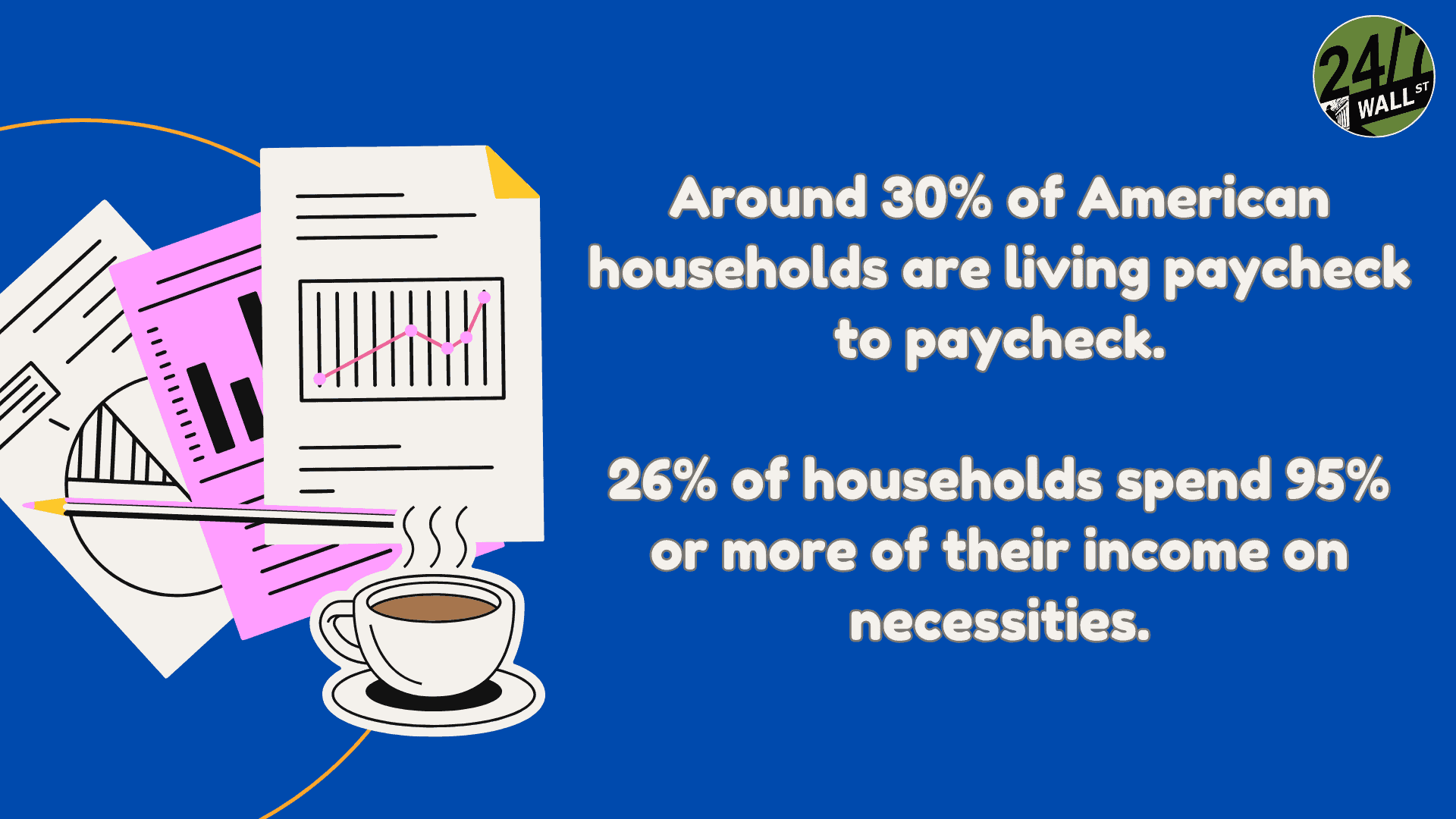

Even if you’re pulling in a high six-figure income, it is still possible to be living paycheck to paycheck. Undoubtedly, building wealth is all about ensuring that income exceeds expenses. And if a concept known as “lifestyle creep” really starts creeping up on high-income earners (they justify higher spending because of the more work they’re putting in), it is possible to have a high income alongside a rather limited nest egg.

Rami Sethi, the man behind hit book I Will Teach You To Be Rich and upcoming title Money for Couples, is one of my favorite personal finance gurus. He’s all about telling it like it is and not subscribing to traditional personal financial decisions, such as getting a mortgage to buy a home. Indeed, I feel Sethi is really relatable to the younger crowds out there, like those in the Gen Z and Millennial cohorts. After all, he is a Millennial, albeit an older one.

In any case, Sethi went into depth on a couple that pulls in a $300,000 income but is spending as though they earn well more (think closer to $1 million).

Indeed, it can feel tempting to “upgrade” one’s lifestyle to keep up with the Joneses or to better reward oneself for working so hard to achieve such an enviable income. Undoubtedly, a $300,000 household income is impressive and could really help kickstart a retirement plan. If one’s lifestyle isn’t in alignment, however, there’s a possibility that all those years of high wages may not amount to meaningful wealth creation over time.

To put it simply, the couple who reached out to Sethi likes to spend a lot of money. They’re both relatively young (in their early 40s) and spend a great deal on dining out and shopping. With such spending comes some amount of credit card debt.

Fortunately, with such a high income, such debts don’t seem like all too much of an issue, especially if the couple can change their spending patterns and stick with a budget.

As is typical with most couples, however, money is never a hot topic of conversation. Indeed, the last thing some couples want to talk about is the family finances, especially if they’re afraid of how the expense statement may look.

In any case, Sethi has always been about knowing where the money is going. And in the case of this couple (and many others like them), it’s vital to sit down and talk about the financial reality of the situation. Either way, it’s on the couple to take action to ensure their high incomes aren’t met with equally towering expenses.

Though the couple does have a nice nest egg (and some investments), their credit card debt is at an egregious level. Arguably, selling off the portfolio to cover the debts seems like a smart move. After all, it will not be easy to score a return from stocks or bonds that are anywhere close to the rates credit cards charge.

Even if the couple eliminated their debt with such a move, it wouldn’t do them much good if they continued racking up debt by spending more money that’s coming in. Undoubtedly, the couple’s financial hygiene does not seem great right here. But the good news is it’s fixable with lifestyle changes. The big question, however, is whether the couple can curb their expenditures in a way that leaves them satisfied.

In any case, Sethi’s message was clear: the couple needs to build up emergency savings and reign in spending in a way that allows them to grow their wealth in a sustained fashion. I’d say Sethi is right on the money. This couple needs to have “more regular” conversations about their finances. Otherwise, an unexpected job loss for either of them could land them in a very difficult spot financially.

In short, Sethi is spot on when he encourages the two of them to really chat. Only then can the appropriate lifestyle lifestyle changes be made. Sethi’s sitdown with the couple to go over their monthly budget, I believe, is just the start of some positive (sustained) changes. Indeed, it sounded like he was able to make them a bit more comfortable about talking about finances and budgeting, which really is the first step in the right direction.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.