Personal Finance

This is how much you should have saved by 65 - are you behind or ahead?

Published:

As you approach retirement age, knowing how much to have saved by 65 is crucial to ensuring a comfortable future. While everyone’s financial needs differ, there are general benchmarks based on income that can help guide your planning.

Additionally, for many Americans, a large percentage of their net worth is often attributed to the equity they have in their homes. However, as you approach your 60s, it’s important to have savings beyond just the equity in your home. While home equity can be a valuable asset, it isn’t liquid, meaning it’s not easily accessible for everyday expenses or emergencies. Selling your home or borrowing against it might not be ideal in retirement, especially if you want stability.

Having liquid savings in retirement accounts, investment portfolios, or emergency funds ensures you have the flexibility to cover healthcare costs, and unexpected expenses, or enjoy the lifestyle you envision without being reliant solely on your home.

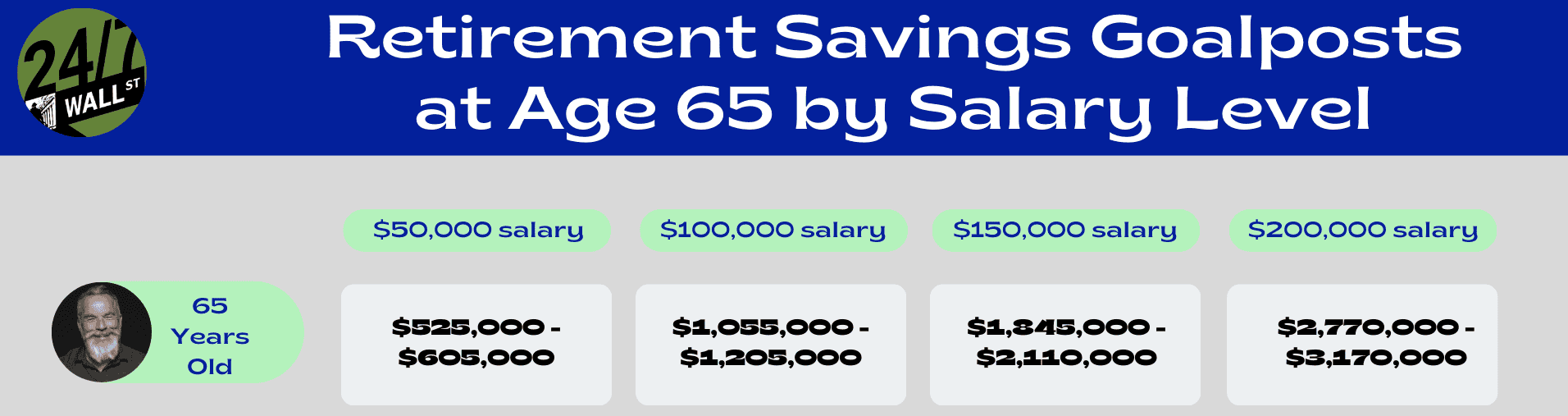

According to data from Edward Jones, for a 65-year-old earning $100,000 annually, a savings goal between $1.05 million and $1.21 million is considered reasonable for maintaining your lifestyle throughout retirement. For those earning $200,000, the target is between $2.77 million and $3.17 million.

These figures are based on the assumption of retiring at 65, living until 92, and maintaining current spending levels. However, it’s important to factor in variables like inflation, healthcare costs, and market volatility, which can impact your financial outlook. Investing a portion of your retirement savings strategically and planning for long-term expenses like healthcare will be crucial in maintaining your financial health.

If you’re falling short of these benchmarks, it’s not too late to adjust. Work with a financial advisor to ensure your savings strategy aligns with your long-term goals. This approach can help you develop a retirement plan that gives you the security you need to enjoy your golden years without financial stress.

If you’re approaching 65 and find yourself behind on retirement savings, there are several strategies to catch up. First, take advantage of catch-up contributions—those over 50 can contribute an additional $7,500 to their 401(k) or $1,000 to their IRA annually. You should also revisit your budget to reduce discretionary spending and increase savings. Additionally, consider working a few extra years or picking up part-time work to delay Social Security, which increases your benefits by 8% each year after your full retirement age.

If you’re ahead of the curve on retirement savings, you can further boost your financial security by continuing to invest strategically. Diversify your portfolio to include a mix of equities, bonds, and other growth assets that align with your risk tolerance. Consider Roth IRA conversions to minimize taxes on future withdrawals, or invest in tax-efficient accounts like Health Savings Accounts (HSAs). You can also revisit your long-term care and estate planning strategies to protect and optimize your wealth for future generations.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.