Personal Finance

3 Social Security Changes Every Baby Boomer Needs to Know About

Published:

Last Updated:

Most baby boomers out there are spending a disproportionate amount of time thinking about retirement. That makes sense, given the fact that many are nearing (with plenty already in) retirement. And with roughly 10,000 baby boomers entering retirement on a daily basis until 2029, it’s becoming clear that discussing the issues pertaining to this particular demographic is becoming even more important.

In order for anyone to enjoy retirement, having the resources available to travel, relax and ultimately take care of one’s healthcare and lifestyle needs in retirement is an important factor to consider. For millions of Americans, social security payments are going to play a central role in providing the quality of life everyone hopes for in their golden years.

Though most financial experts would suggest putting away as much money for retirement as possible, and that’s great advice, it’s not a reality for many. Accordingly, how social security changes over time will play a big role in determining how a significant portion of the populace is able to live when the time comes to hang up one’s work boots.

Here are three key social security changes all baby boomers need to pay attention to right now.

At this point, we’re all well aware that we’re going to have a new president in the White House in just a few months. And with varying appointments coming down the pike, how social security will be managed and potentially changed over time will come into better view in the coming months, most likely.

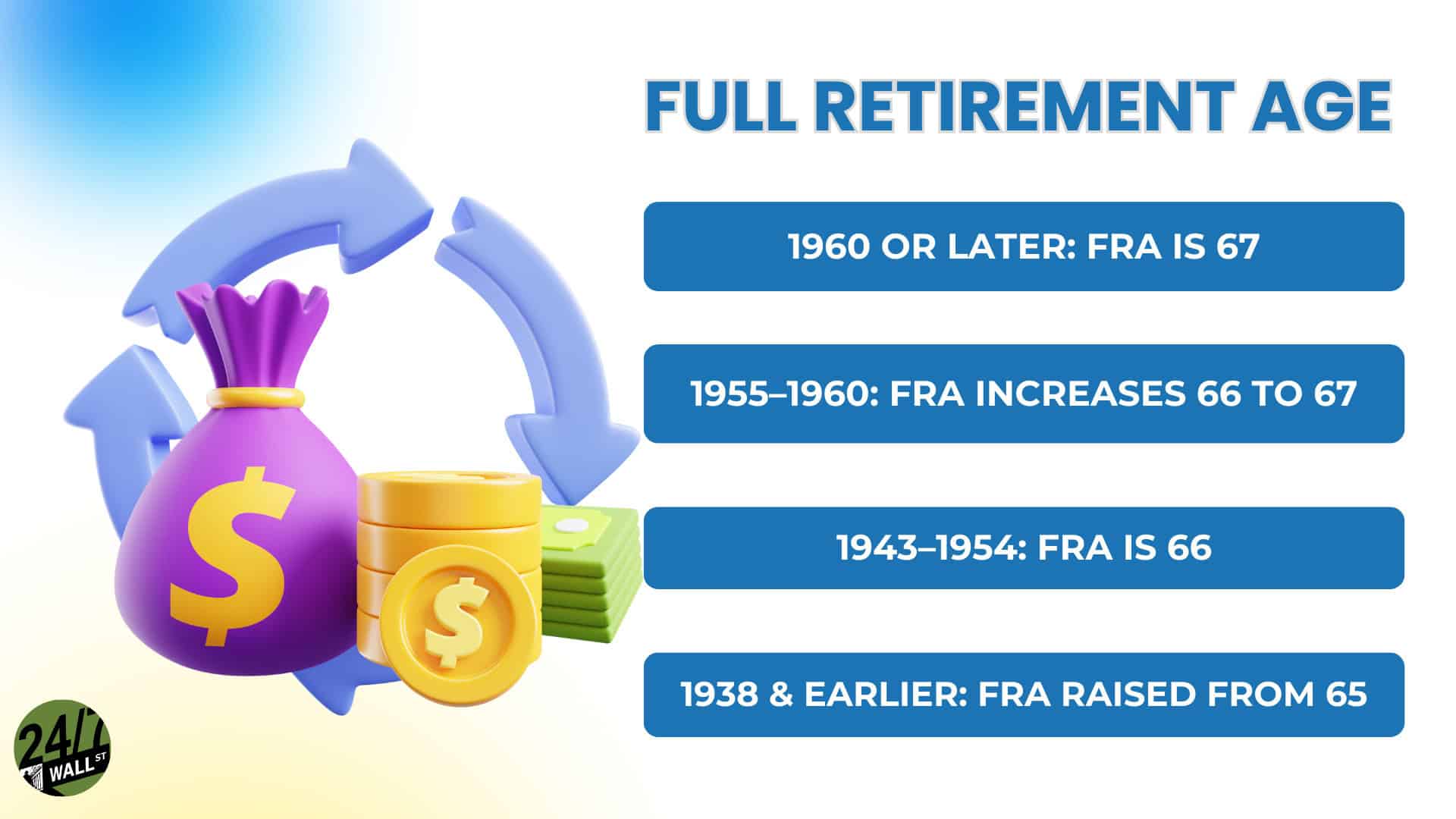

However, one thing that’s become a worrying point for many Americans is the potential for another increase to the full retirement age (FRA) for social security benefits. Originally set at 65, the FRA rose to 67 for those born in 1960 or later. For those born between 1943 and 1954, the FRA is 66 years old, but for those born after 1955, the full retirement age increases to 67. Some in the Republican Party have argued for additional changes on this front, though we’ll have to see if anything comes to fruition in the coming years.

When social security was first implemented in 1935, the average life span of an American adult was around 65. But as we’ve been all collectively living longer, the distribution of the population that’s living for decades past full retirement age has grown. This could certainly be one area that changes again moving forward, so those nearing retirement will want to watch for any FRA-related announcements. For now, the aforementioned age brackets will be important to consider.

Another key item worth noting is that for those who wait to take their social security benefits, monthly payments can increase up to 8% a year (up to age 70). Thus, there’s some financial incentive to wait to take payments until age 70, for those who are healthy and willing to do so.

Another important change that many Baby Boomers need to be aware of is how Social Security benefits are ultimately taxed. For individuals with higher incomes, up to 85% of your Social Security benefits may be subject to federal income tax. What complicates matters is that the income thresholds determining this taxation haven’t been adjusted for inflation since they were first established. This means that over time, more retirees are finding a portion of their benefits subject to taxes.

If you file your taxes as an individual, your Social Security benefits become taxable when your “combined income” exceeds $25,000. Combined income is calculated by adding your adjusted gross income, any nontaxable interest, and half of your Social Security benefits. For married couples filing jointly, this threshold is $32,000 in combined income. Again, that’s relatively low given today’s cost of living and the inflation we’ve recently seen. While cost of living adjustments have boosted social security payments for millions of Americans, the reality is that most income over and above social security will be taxed, and can be taxed at progressively higher rates. So, saving for retirement won’t save you from the tax man, unfortunately (outside of Roth IRA distributions).

This is the important part of the piece where it’s recommended that anyone nearing retirement that’s worried about the tax implications of their income situation consider talking to a tax professional or financial advisor about how best to manage their individual situation. Each household is different, and tax burdens will vary depending on a range of factors. However, the fact that social security payments are taxable currently (though Trump has talked about potentially removing or lowering this tax) is something to be aware of.

I’m sure millions of seniors will be happy if the Trump Administration ultimately removes taxes from tips and social security payments, but we’ll have to see if there’s enough wiggle room in the budget to do so. For now, this is something to keep an eye on.

Significant changes to spousal and survivor benefits have reduced the financial advantages that married couples and widows or widowers once enjoyed. The spousal benefit, which previously allowed a spouse to receive up to 100% of the primary worker’s Social Security benefit, is now limited to 50%. This reduction means that the higher-earning spouse’s benefit no longer fully offsets the lower-earning spouse’s benefit. In plain speak, what this means is that the net result for millions of American couples can be lower income received over the course of a retirement.

That’s a bottom line many Americans may certainly bemoan. Losing a spouse is one thing, but losing another 50% of the income they previously brought into the household can be devastating for those who are on fixed budgets tied to the previous combined income amount.

Survivor benefits have also been affected by recent changes. For most households, when one spouse passes away, the surviving spouse is no longer entitled to receive both payments from the government. The surviving spouse is able to receive either their own benefit or their deceased spouse’s (whichever is higher), but only one. This can obviously result in a significant loss of income for the surviving spouse, and is something that’s worth considering for those with a sick loved one.

Again, things can change, and rules around spousal and survivor benefits change periodically. We’ll have to see if any major announcements on this front come out of a Trump presidency, but for now, this is something baby boomers should plan for (when the time comes).

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.