Personal Finance

I am planning on retiring well before I turn 62 but am worried how it will impact my Social Security - how can I be sure?

Published:

Last Updated:

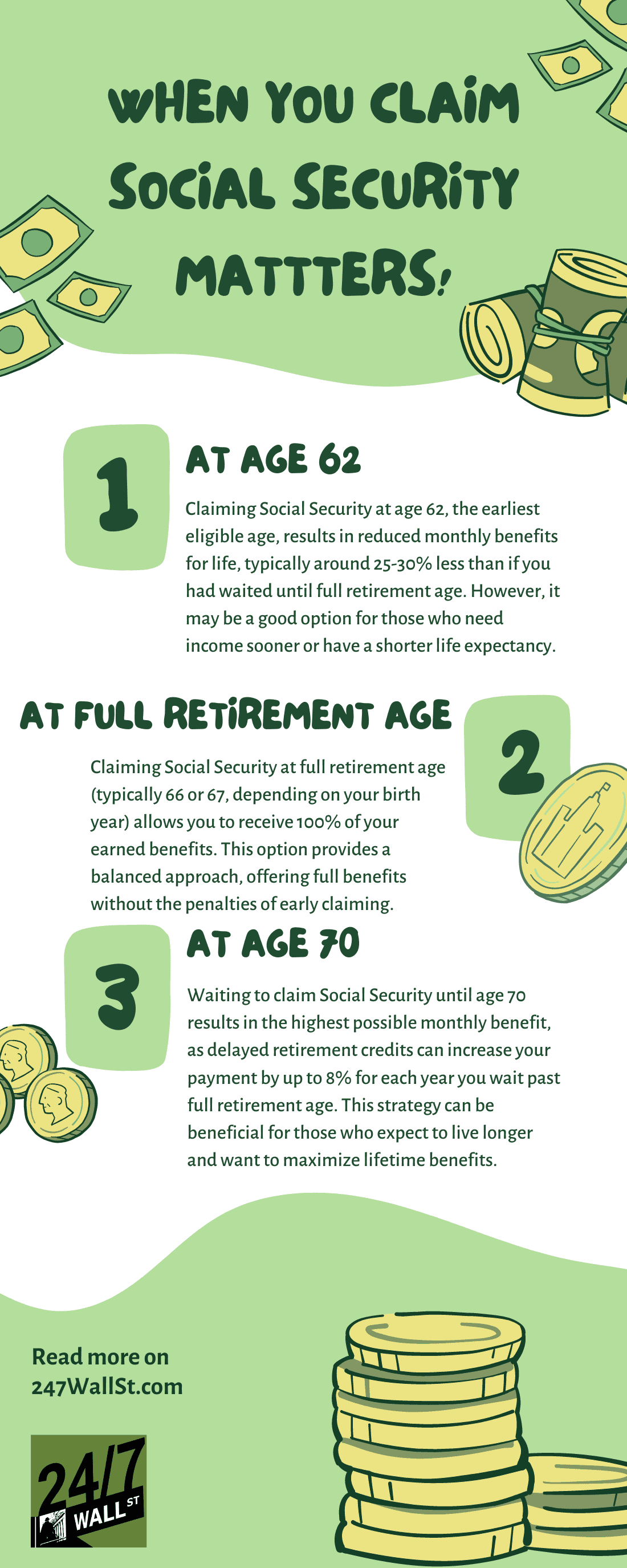

For many folks entering their 60s, the big decision is whether to take Social Security benefits sooner or later. Indeed, you’ll receive far fewer benefits by opting to get payouts at 62 rather than your late 60s. That said, the time value of money concept suggests a dollar in the present is worth more than a dollar at some point in the future.

But how about for those looking to retire even earlier than 62? Not only will one not have Social Security immediately off the bat if you retire, say in your late 50s, but you’ll also likely see an even smaller social security benefit once you turn 62.

That’s not to say an early retirement is a bad idea, though, especially if you have other income-producing assets that can make up for the smaller social security amount you’ll receive in the future. The big question comes down to how much you expect to depend on said benefits at age 62 and beyond.

Undoubtedly, everybody’s living situation is different. While it may seem most prudent to delay Social Security benefits for as long as possible for a more significant benefit amount down the road, I’d argue that there’s also a degree of risk in waiting out until you can receive maximum benefits.

Most notably, if you’re already encountering health issues that are making it challenging to keep working into your mid-60s or if such issues are severe enough to reduce your life expectancy, Social Security benefits sooner is likely the wiser choice.

For most others, it seems like the default financial decision to delay the gratification of Social Security for as long as possible. That said, this frame of thinking can also be less than ideal, especially if an early retirement (before 62) means a lot to you. If you can work around the smaller (perhaps much smaller) social security payment you’ll eventually receive, either by adjusting your lifestyle or shifting your portfolio into higher-yielding securities to supplement your income, retiring early may be the right decision.

At the end of the day, the time-for-money trade-off is a different balancing act for everyone. Retiring early with a more modest lifestyle can be a wiser idea than retiring in extravagance later on. That’s why I’d strongly encourage you to seek the advice of a wealth planner.

In this piece, we’ll look at a specific case from a poster who took to Reddit who’s set on retiring before 62 (the minimum age to collect Social Security) but is unsure how their benefits will be impacted. Indeed, retiring early, well before Social Security kicks in, will entail a drastically reduced benefit relative to someone who retires at a traditional age (around 65).

Just how much smaller will the Social Security benefit be if one retires a few years early? It can be tricky to gauge without more specifics. Either way, anyone in such a scenario should ensure they won’t lean so heavily on the benefits when they do kick in.

If you want a rough idea of how much you can expect to collect in social security benefits given your income and retirement date, there’s a useful SSA Retirement Estimator that can be reached on the Social Security Administration’s website (ssa.gov). You can also use this calculator to factor in the non-earning years. Perhaps giving the estimator a run could help better prepare you ahead of your meeting with a financial adviser or wealth planner. Of course, the only way to be 100% sure your early retirement plan is on the right track is to check it with a wealth-planning pro.

However, if you’re not a fan of the projected numbers that come up but are still keen on retiring early, do not fret. A passive income portfolio can more than compensate for the shortcomings of the reduced Social Security benefit you’ll eventually receive at 62.

The prospective early retiree on Reddit noted that they’re “on track” to retire early, so I’m guessing there’s an investment portfolio this poster can rely on as a source of passive income until their (smaller) social security benefits arrive.

Even if Social Security amounts are bound to be less impactful, a portfolio of dividend stocks, REITs (Real Estate Investment Trusts), CDs (Certificates of Deposit), and fixed-income securities can set the stage for not just an early retirement but one that’s somewhat comfortable. Undoubtedly, such a passive income portfolio will need to do more heavy lifting if you take the smaller Social Security amount that doesn’t kick in until later.

In essence, having a robust income portfolio and social security benefits to collect can grant you considerable financial freedom, perhaps enough to retire years before the minimum age you can collect benefits. If you value greater nearer-term financial flexibility and don’t see yourself regretting early retirement and the toll it’ll take on social security benefits, retiring before 62 may be right for you.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.