Personal Finance

If your family brings in $100k per year, this is how much you need saved for retirement by age 40

Published:

Last Updated:

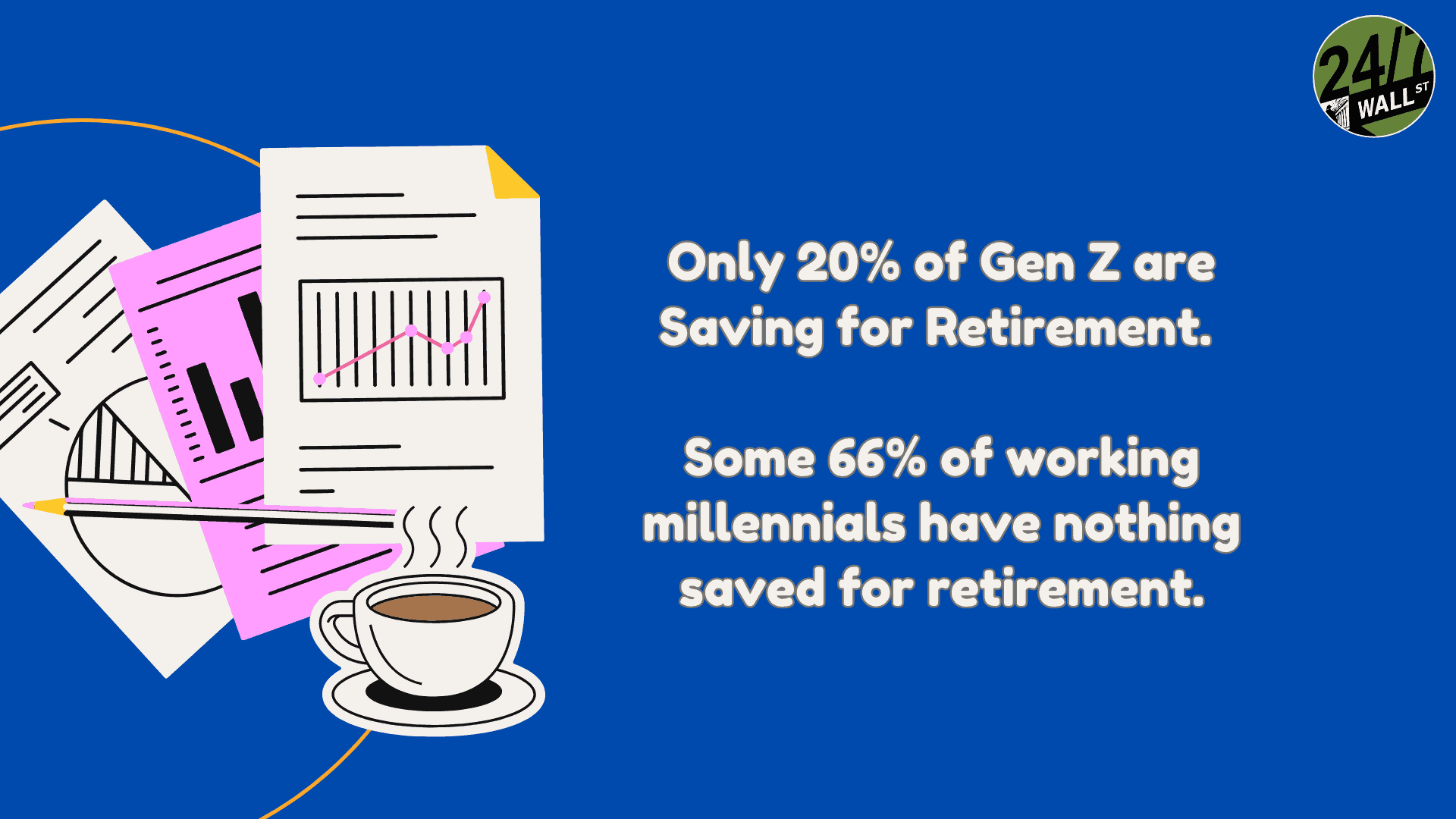

The devastating inflation of the past four years has created a hand-to-mouth economic scenario for millions of Americans. The dearth of savings ability, due to escalated prices of essentials, has led to crushingly high credit card debt levels for many, with credit card debt overhang averaging over $20,000 per person. Retirement saving is a consideration that many believe they can now return to, with the prospects of a Trump economy boom resumption in 2025.

Gen-Zers who entered the workforce in the past ten years are the ones who may be behind the curve in retirement savings. Those who are a bit older may be close but have been forced to neglect retirement savings due to inflation. Additionally, assumptions on costs and lifestyle expenses made ten or more years ago may no longer be valid or adjusted for the escalated prices of goods and services from inflation.

Retail broker Edward Jones handles thousands of individual accounts from all age brackets, so they are a reliable information source when it comes to optimal retirement savings levels. For millennials and Gen-Zers earning $100,000, Edward Jones has a benchmark reference for retirement savings level averages. Here is a sample of the list from ages 25-40:

| 25 | $0-$20,000 |

| 26 | $0-$35,000 |

| 27 | $0-$55,000 |

| 28 | $20,000-$70,000 |

| 29 | $35,000-$90,000 |

| 30 | $50,000-$105,000 |

| 31 | $65,000-$125,000 |

| 32 | $85,000-$145,000 |

| 33 | $100,000-$165,000 |

| 34 | $120,000-$185,000 |

| 35 | $140,000-$205,000 |

| 36 | $160,000-$225,000 |

| 37 | $180,000-$245,000 |

| 38 | $200,000-$270,000 |

| 39 | $220,000-$295,000 |

| 40 | $245,000-$315,000 |

For those people who find that their retirement savings levels are below the average range and wish to achieve parity, there are several remedial measures that can be taken.

For those people who find that they are ahead of the curve, bravo! There are still steps that can be taken to build on that advantage and possibly assume a F.I.R.E. (Financial Independence Retire Early) strategy, which will afford a range of career and retirement choice options in the future. Those steps would include:

This opinion article should be viewed solely for informational value. If customized financial advice is sought, consulting with a financial professional should be conducted.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.