Personal Finance

If your household brings in $300k per year, this is how much you should have saved by your mid-40s

Published:

Last Updated:

If there is one certainty about saving for retirement, you want to start early. There is almost no room to argue about the notion that the sooner you start saving, the more you will have to spend later in life. This is especially true for those who earn big salaries.

If you are earning approximately $300,000 per year and earning around 6% through your portfolio annually, you should be looking forward to some terrific golden years. Of course, there are no guarantees in life, but there is truth to the idea that the more you earn, the more you have to spend later on.

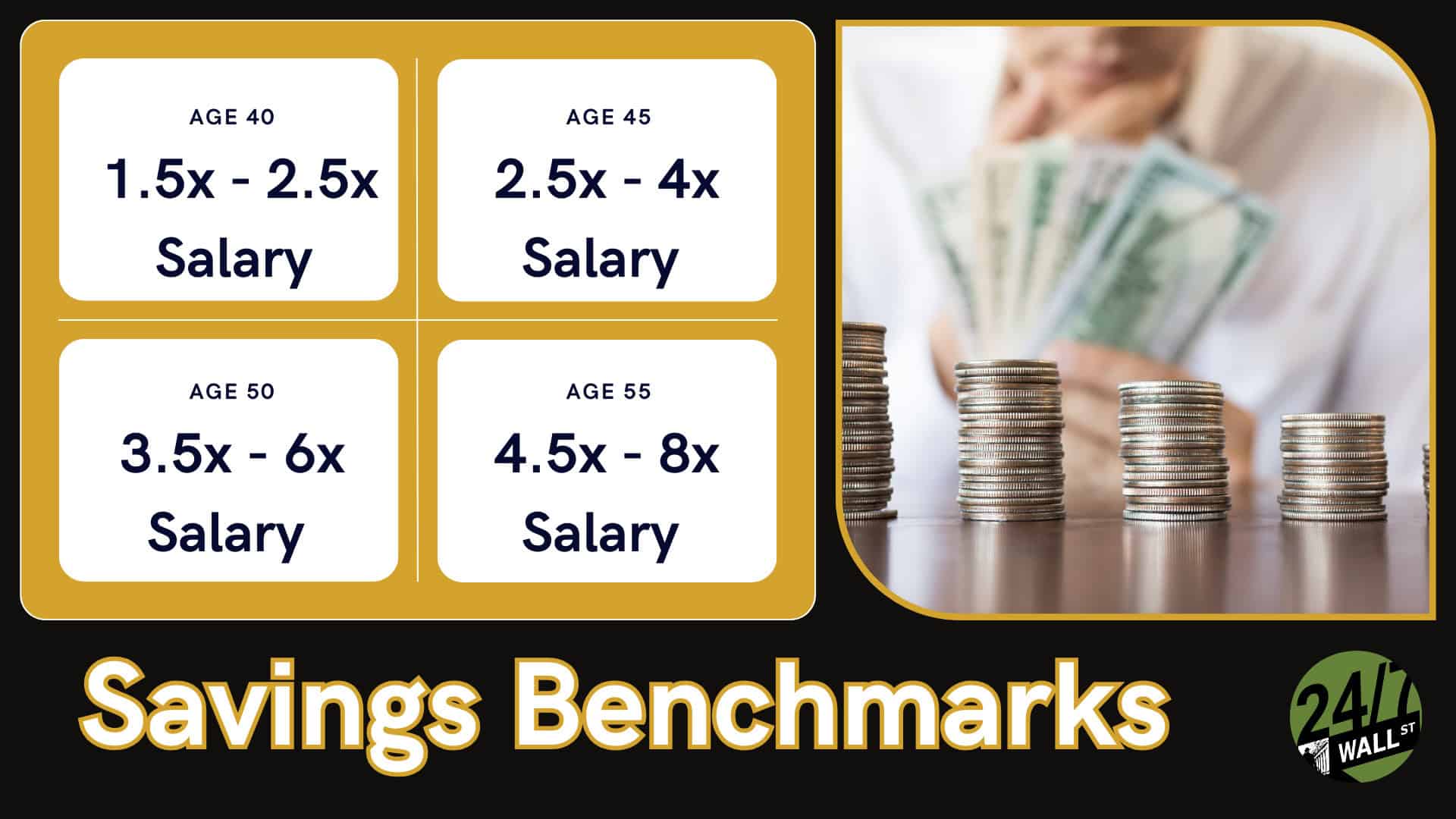

Okay, so let’s use the example of someone earning around $300,000 annually and staying at this salary for multiple years. The goal is that by the time this person turns 45, they should have approximately $1.33 million saved. It’s a lofty number, to be sure, but it’s a number that should be setting you on the right track toward a comfortable retirement.

There are a few factors to consider when hitting this goal. First and foremost, you should be contributing around 15% of your pre-tax retirement income to hit this number. This number also assumes you are at a 28% effective tax rate.

Perhaps most important is the level of contribution you are making before your retirement. To get to the $1.33 million number, you must make a 6% annual portfolio return. You’ll need a 5% yearly post-retirement portfolio retirement and drawing Social Security at 65 to maintain your spending level. Assuming all of this is attainable, you can sustain yourself throughout retirement.

Let’s assume you are behind on hitting the $1.33 million goal by the time you are 45. If this is the case, your first action should always be to increase the savings you contribute above 15%. While the specific number you would need to hit would be specific to how behind you are, the hope is that you can increase your contribution without dramatically impacting your current lifestyle.

Alternatively, you may have to get a little riskier with your portfolio to increase your exposure to growth investments. You’ll have to be comfortable with the additional risk you’d be undertaking, but you may be able to accelerate the size of your portfolio if your new investments increase.

Another method for increasing your ability to hit your goal is to pay down any high-interest debt. Doing so would free up more income to put away and raise your contribution above the 15% mark.

Lastly, alternative income sources such as a side hustle should be considered. In today’s world, almost half the workforce has a side hustle to increase disposable income. Whether part-time, freelance, or contract work, you could consider this option and dedicate any income you make toward your retirement portfolio.

You’re in a great position if you are ahead of your savings goal and should be above the $1.33 million goal by 45. The challenge now is thinking about what you can do to accelerate your position and increase your retirement fund even more.

You’re looking for tips to grow wealth and protect what’s already made. In this case, you might consider moving some money from a traditional IRA to a Roth IRA. Doing so would give you tax-free growth and withdrawals in retirement.

You might want to consider alternative investment methods depending on your risk tolerance. These could include investing in a private equity fund or exploring alternatives like rental properties. All of these options involve risk, but they can also offer big rewards.

If your employer has an employee stock purchase plan that offers you investment at a discount, consider buying additional company stock. This would be great for those working at companies with dividends, which could pay off down the road. Any dividend growth stock will provide regular income now and pay off with tax advantages should you hold onto these stocks for more than a year. You’ll also reap the rewards of compounding dividends, which speaks directly toward accelerating your financial position.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.