Personal Finance

The typical millennial in America thinks they need over $1.6 million to retire - and they are way behind

Published:

Last Updated:

Thoughts of attaining a comfortable retirement have been slipping from the grasp of Americans as the cost of living has spiraled higher.

Although inflation’s growth has been tamed, its cumulative impact over the past four years has been devastating. And people now believe they need more money than ever to achieve their retirement goals.

Just four years ago, Americans of all ages estimated they would need $951,000 to retire comfortably. Today, after years of rampant inflation, that figure has ballooned to $1.46 million, a 54% increase. Worse, everyone is way behind on their goals.

Yet according to a study by Northwestern Mutual, Millennials may be the worst off of any age group. They believe they will need $1.65 million to retire comfortably, which is more than any other age group except high net-worth individuals who understandably believe they will need twice as much, or almost $4 million, to retire and maintain the lifestyle they’ve grown accustomed to.

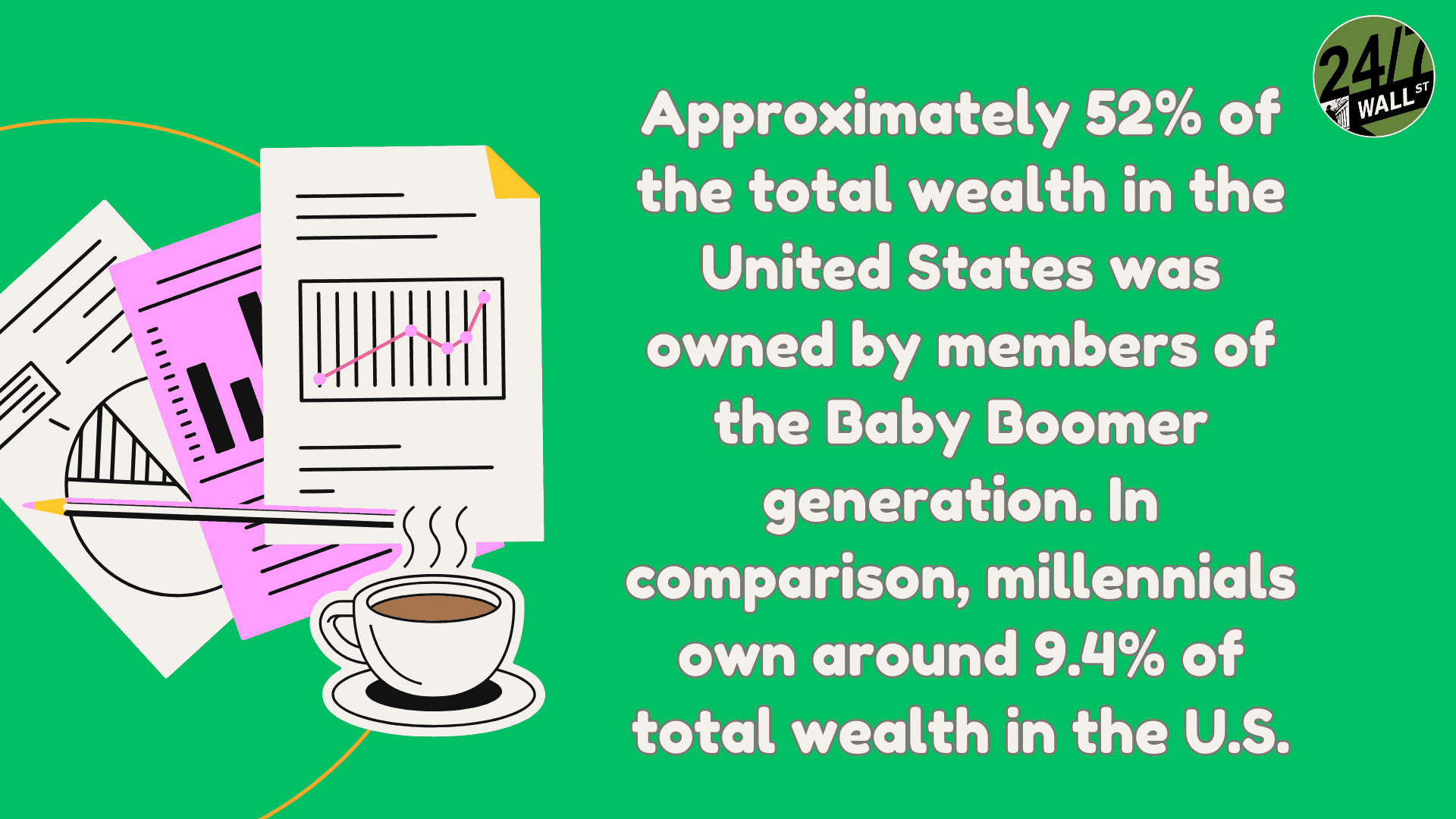

Millennials, though, are further behind in their goals than most. It represents a real problem because in less than 20 years they will begin retiring, giving them less time to make up the difference.

The Northwestern Mutual study found Millennials have saved $62,600 on average for their retirement, giving them a deficit of $1.59 million.

Gen Y study respondents actually had a slightly higher deficit between current savings and what they believe they need in retirement, or some $1.61 million. Yet because Gen Y’ers think they will need less than Millennials to retire comfortably ($1.63 million), and due to their having more years ahead of them to work toward their goal, they are really not as bad off as Millennials.

There are also some other headwinds ahead of Millennials that put them in a deep hole. Pew Research Center says this age group has a greater share of outstanding student debt and owes more than prior generations. The median amount of debt Millennials owed was $19,000, one-third greater than the amount Gen X owed.

Fortunately, not all is lost for Millennials. In fact, they still have plenty of time to make up the lost ground. Having nearly 20 years to go at a minimum before you retire is quite a long time. There are numerous actions this group can take — and all groups can take, for that matter — to narrow the gap they face.

First and foremost is to invest in the stock market. Maximize your 401(k) retirement plan contributions, contribute to a Roth IRA, and then add more to a regular brokerage account. Stocks have generated historic returns of around 10% annually for decades and you have plenty of time to capture those gains in your accounts.

Then, start living below your means, not just within them. Cutting expenses now so that you can save more ensures you will not outlive your retirement savings.

A $1.6 million gap between what you have saved and what you need seems like a lot, but you still have the chance to put the powerful combination of time and compound interest to work to your advantage.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.