Personal Finance

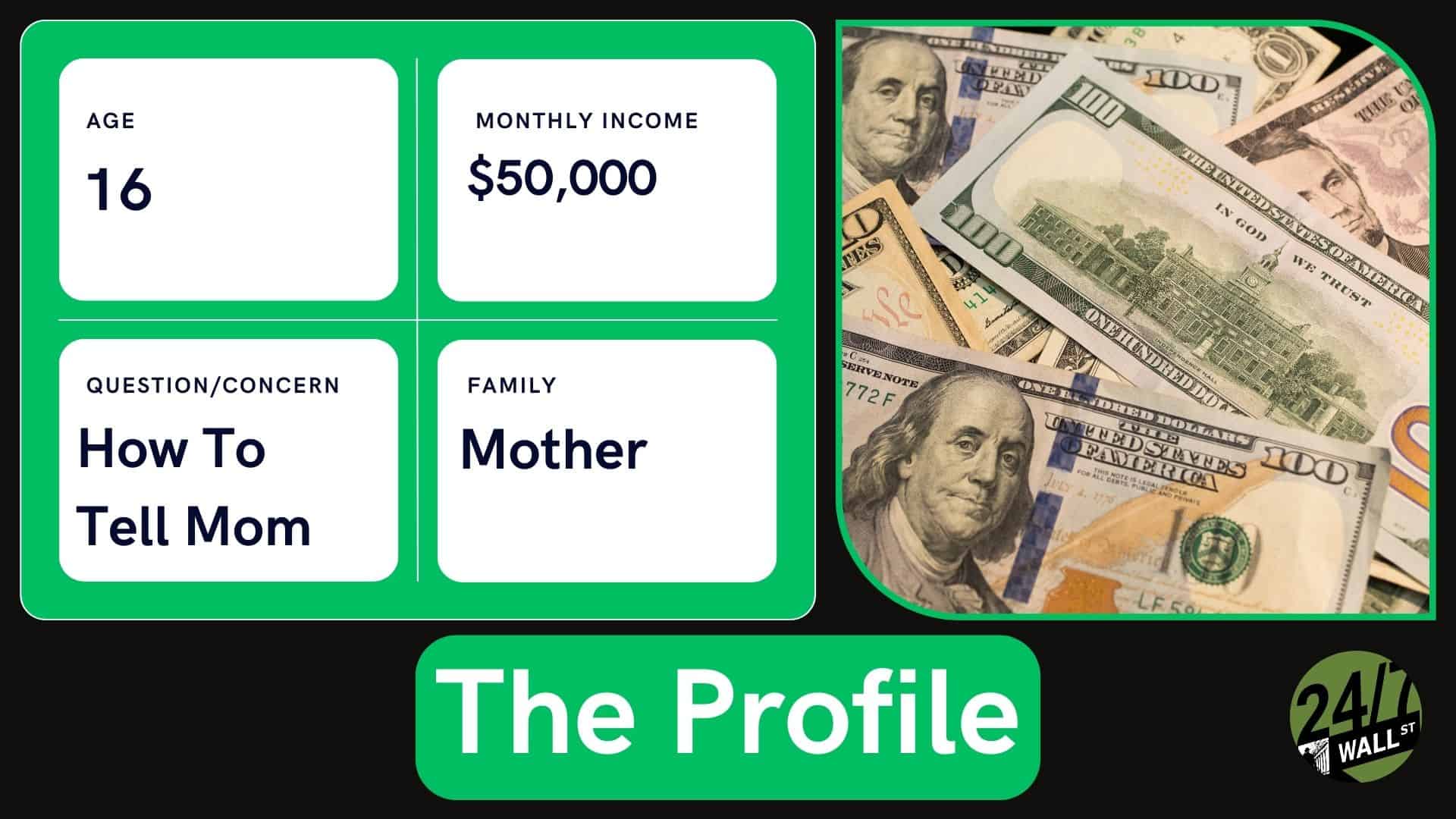

I'm 16 years old and make $50,000 per month online - but I'm scared to tell my mom the truth

Published:

Every once in a while, a caller with a fascinating and unique case reaches out to Dave Ramsey’s radio show. Indeed, it’s these peculiar cases that make his show incredibly popular. In this piece, we’ll give my reaction to a 16-year-old caller who’s pulling in a jarring $50,000 income per month via his dropshipping via e-commerce platforms and seizing arbitrage opportunities.

Indeed, it’s clear that the teen has the entrepreneurial spirit, and with a $300,000 (and counting) sum in his PayPal (NASDAQ:PYPL) account, he’s a prodigy of sorts. Heck, Ramsey called him a “child prodigy,” and he’s right on the money.

That said, there’s one minor issue that the teen has. He has not told his mother about his endeavors or the six-figure sum accumulating in his PayPal.

Ramsey thinks it makes sense to reach out to a trusted third party (a mediator) to help the teen shed light on the situation with his mom. Though I wouldn’t be against such, I do think it’s better to just have the conversation with his mom directly without outside help.

Indeed, a parent with so-called “traditional” values may react in a somewhat unpredictable fashion. Regardless, I don’t think a parent can get angry at a child who’s found their way earlier in life. And by coming clean face-to-face, without external forces, a deep and honest conversation can be had.

Arguably, making (likely) more than one’s parents as a teen is an incredibly impressive feat that a parent should be proud of, no matter how “traditional” they are. Indeed, the teen may have nothing to fear other than the fear itself as he looks to tell his mom about his business.

Either way, Ramsey is spot-on when he says it’s not good to be “deceptive” with a close family member, even if revealing the truth entails some downsides. Most notably, the teen worries she’ll pull the plug on his endeavor.

Though I could be wrong, I do not think a parent would put away a golden goose that’s been laying massive eggs. Will there be some compromises the teen will need to make? Possibly. Performing well in school and getting good grades could be a part of the agreement with his mom to keep the endeavor going.

Any way you look at it, this kid has set himself up very nicely for his future. The major concern Ramsey brings up is that the opportunity the teen has uncovered may not last. And he’s absolutely right to bring up this point.

Sure, it may sound like raining on a young person’s parade. However, arbitrage opportunities tend not to last once a market under question gets efficient and market participants catch on. That’s why it’s vital that the teen doesn’t “give up” on educating themselves because, for now, the $300,000 figure in PayPal isn’t nearly enough to retire on, especially given such a nest egg would have to support them for 60-70 years.

Arguably, the sum would be best invested in the teen’s educational pursuits or his next big entrepreneurial endeavor. Indeed, it’s not hard to imagine that many young people in the Gen Z cohort would much rather start something for themselves than work for someone else for a salary.

Ramsey’s concerns, I believe, will also be the mother’s concerns once the teen reveals the truth. And it’s vital that the teen goes through the conversation in his head before finally revealing the details. At the end of the day, it’s vital to be honest with loved ones, even if it’s about profoundly positive achievements.

While we can’t know for sure how the mom will react, honesty, I believe, is usually the best policy. And regarding this teen’s accomplishments, I’d argue that revealing the truth is something to be proud of, regardless of how a parent takes it.

At the end of the day, parents want what’s best for their children. When it comes to this teen, it makes a ton of sense to be honest with the mother so that he can shift the funds into their joint account and start putting the sum to work in an equity fund. In that regard, there’s ample upside (via investments) to be had by coming clean.

If you’re in a similar situation, do contact a financial adviser. Often, they add immense value for the price you’ll pay.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.