Personal Finance

We have earmarked $350,000 to give each our kids for college and other expenses - is this too excessive?

Published:

Last Updated:

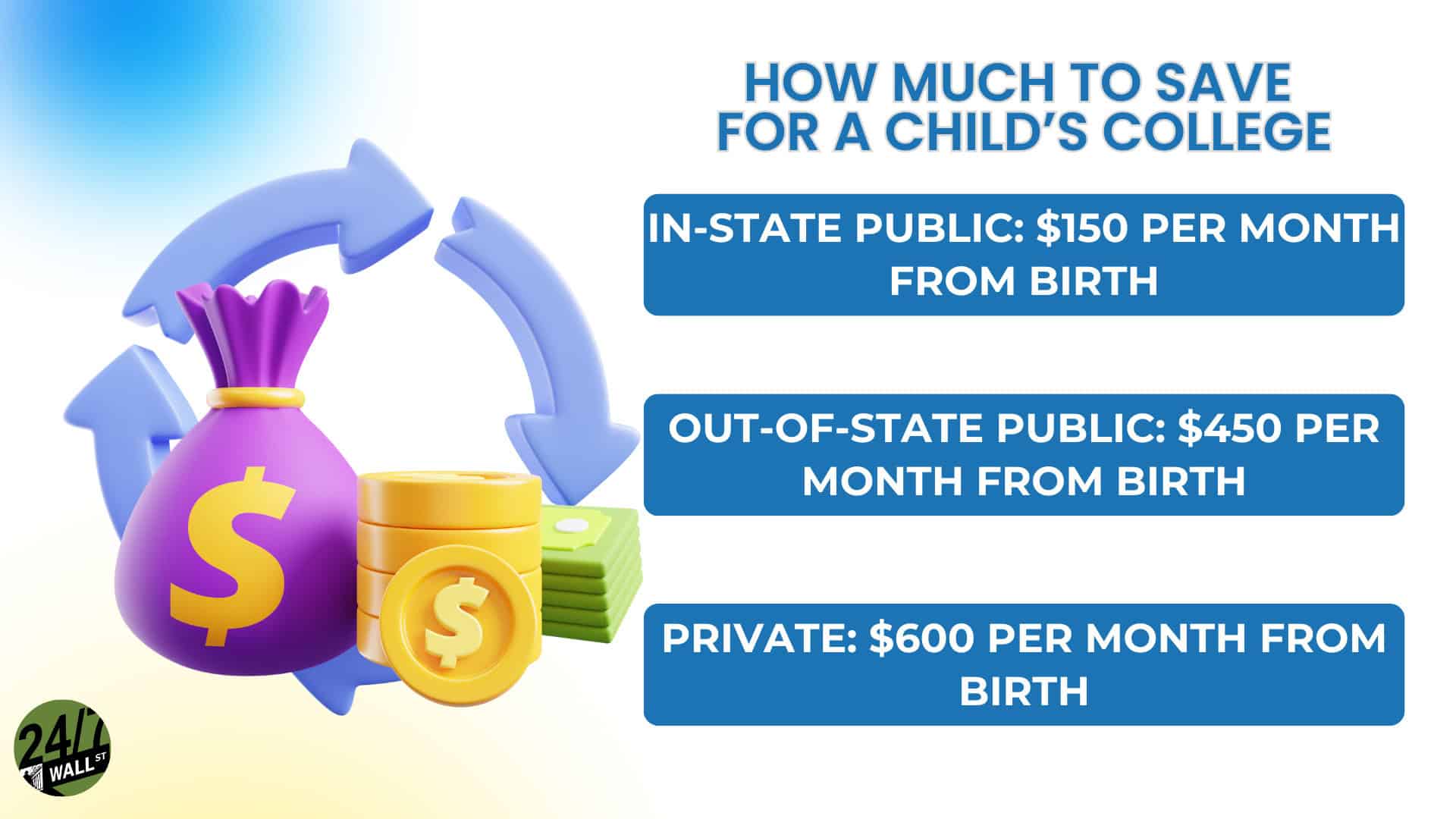

When planning for college for your children, there is always a question of how much is enough. While the answer can vary based on public or private universities, there is little argument among parents that the expense of college all but requires you to start saving early.

This is the scenario with our Redditor in r/ChubbyFIRE, who is considering setting aside $280K per child. While we don’t know the exact age of each child, we know that they appear to have already finished middle school and are in high school, so this Redditor’s plan needs to be finalized fast.

I love this post because it forces these parents to decide how to best help their children without feeling like they are just giving them money. There’s even a question of having them take a loan to cover anything beyond what they provide to boost how seriously school is taken.

What we know from this Redditor is pretty straightforward: they plan to set aside $350,000 per child across various needs. The primary focus is on 529s for college, totaling $280,000 each.

In addition, we’re also looking at the Redditor adding $20,000 for a car, $50,000 for help with a house down payment, or this money can be used for a wedding. In total, we’re looking at around $350,000 per child across the board.

Things get a little more interesting when the parent considers having the kids take out loans for 20% of whatever balance remains over $280,000. They mention they will help the kids repay the loan if they appear on the right path. We can interpret this to mean they want them to complete their degree, etc.

With one child planning to study medicine (though not medical school), there is a solid belief that the $280,000 would cover both undergrad and grad school. The middle child looks to be pursuing a PhD and is likely to be at an “Ivy or Ivy-like” school, which means that tuition would certainly be over $280,000. The youngest child doesn’t appear to have picked a college path, so how much they would need remains uncertain.

What’s interesting about this whole Reddit thread is we never really know what makes this Redditor a member of the FIRE club. We get one post in the comments where he talks about a net worth between $4.1 and $4.5 million, but it’s unclear if that’s all the family has.

Regardless, I’d say the whole recommendation is probably sandwiched between being on track and being too low. As of 2024, the average tuition cost for a four-year private university varies substantially, but you could look as low as $27,000 or close to $100,000 per year. As the Redditor is talking about one child potentially going Ivy League, there’s a good chance we’ll be closer to the latter number.

The result here is that there is a potential that the Redditor isn’t thinking broadly enough and needs to add more money. Whether or not they can swing it is unknown, but when you add tuition, room and board, books, and miscellaneous expenses, the dollars add up quickly.

Ultimately, without being a financial planner, I recommend setting aside more money for college and taking back anything that isn’t used. Separately, forget the whole loan situation for the children. This Redditor is talking about how responsible they are now, so why burden them with something you will help pay back anyway?

I like where this Redditor is thinking, and I’m so glad we have parents who understand the burden college tuition can place on children. If you have the means to help and the desire to do so, parents should dig deep into their pockets.

I can promise my children this is precisely what I hope to be able to do for them. I say this as someone who had to take out loans for graduate school and understand the heavy burden that weighs on paying nothing but interest for over a decade.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.